Adam Furlan, Portfolio Manager, and Jason Borbora-Sheen, Portfolio Manager, at Ninety One

Global markets have been turbulent this year, amid escalating tariff tensions and concerns around inflation and growth. Risk assets, particularly equities, have experienced sharp declines as investors grapple with policy uncertainty. Even traditionally stable developed bond markets – which have historically offered shelter during volatile periods – have exhibited unexpected price swings. We’ve seen an aggressive sell-off in longer-dated bonds, reflecting deeper structural shifts and changing fiscal dynamics in developed economies.

April vividly illustrated this unusual market behaviour as traditional correlations expected during risk-off episodes broke down. Equities fell sharply, yet the US dollar weakened against the euro, and the 10-year US Treasury yield rose, clearly diverging from typical risk-off dynamics.

This complex backdrop presents distinct challenges for fixed income investors, with sentiment globally having taken a knock. Conservative investors – especially those holding substantial positions in dollar cash – may instinctively favour caution, choosing to remain on the sidelines until clearer signals emerge. However, this perceived safety could mask hidden risks.

The tariff measures introduced by US President Trump are effectively inflationary – raising prices of imported goods – but crucially, their indirect impacts dampen economic growth. Although some of these tariffs – including key ones involving China – have recently been reduced as trade negotiations resume, several remain in effect.

The outlook for the US could be different than many other countries impacted by tariffs, with the US facing possible higher inflation followed by slower growth – essentially “stagflation”. Conversely, other countries and regions, including Europe, the UK and New Zealand, might experience deflationary pressures due to currency strength and exposure to reduced global trade.

Market dynamics are shifting as global economies enter late-cycle territory and policymakers grapple with how best to respond to tariffs. With countries and regions diverging in interest rate responses and economic outlooks, diversification across markets is more important than ever.

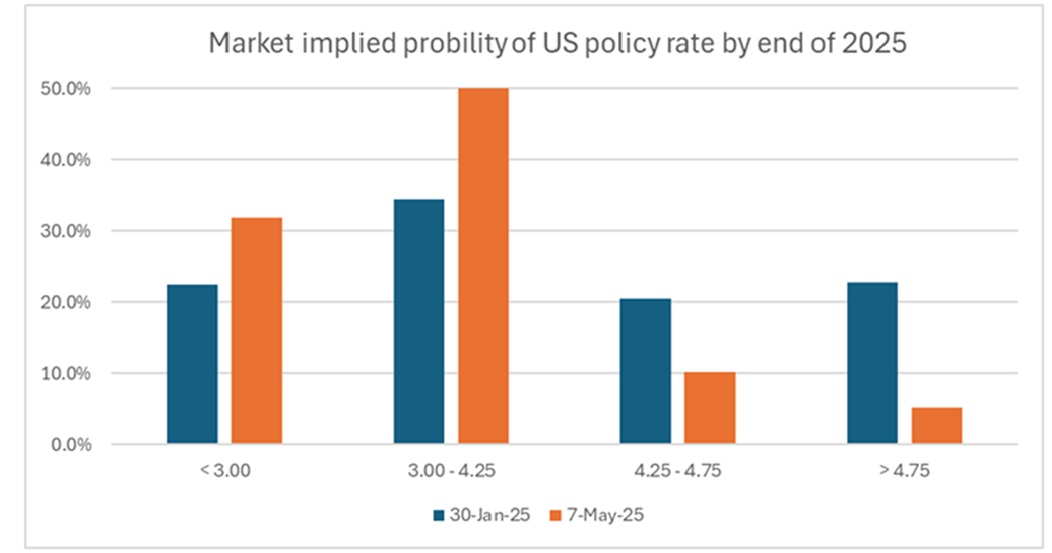

This turbulence has led market expectations on rates to turn significantly more dovish, and the probability of rates being cut further in 2025 in the US (implied by the option markets) has increased from 50% to 80%.

Source: Bloomberg and Ninety One.

As markets price in further interest rate cuts, cash investors will be exposed to both eroding purchasing power and the likelihood of much lower yields when reinvesting. Locking in current attractive yields through diversified fixed income instruments mitigates these risks and helps secure a stable income stream.

While US rate cuts are likely to be more gradual due to persistent inflation, we anticipate more aggressive cuts in markets like the UK, Canada and New Zealand. These countries currently have relatively restrictive monetary policies, positioning them for deeper rate reductions than markets currently anticipate. Our proactive stance in these regions aims to lock in yields at attractive levels, which could also provide potential capital gains as interest rates decline.

Our cautious stance extends to credit markets, where we maintain a strong preference for shorter-duration high-quality, investment-grade corporate bonds. This approach has minimised the portfolio’s exposure to recent volatility in credit spreads. We distinguish between temporary market dislocations and deeper systemic issues through rigorous analysis, choosing assets resilient to economic stress. Additionally, structured credit products like mortgage-backed securities (MBSs) and collateralised loan obligations (CLOs) further diversify and enhance the portfolio’s yield.

Currency strategy is another important component of our approach. While predominantly holding US dollars, we dynamically manage currency exposure – for example, recently taking positions in the yen to mitigate volatility. This enables us to swiftly adjust to changing market conditions and bolster portfolio resilience.

Ultimately, our Global Diversified Income Fund aims to provide conservative investors with an attractive alternative to holding dollar cash, carefully balancing risk and return. Amid ongoing market uncertainty, prudent diversification, flexibility and active management remain crucial in today’s challenging global fixed income landscape.

ENDS