Mpho Molopyane, Chief Economist at Alexforbes

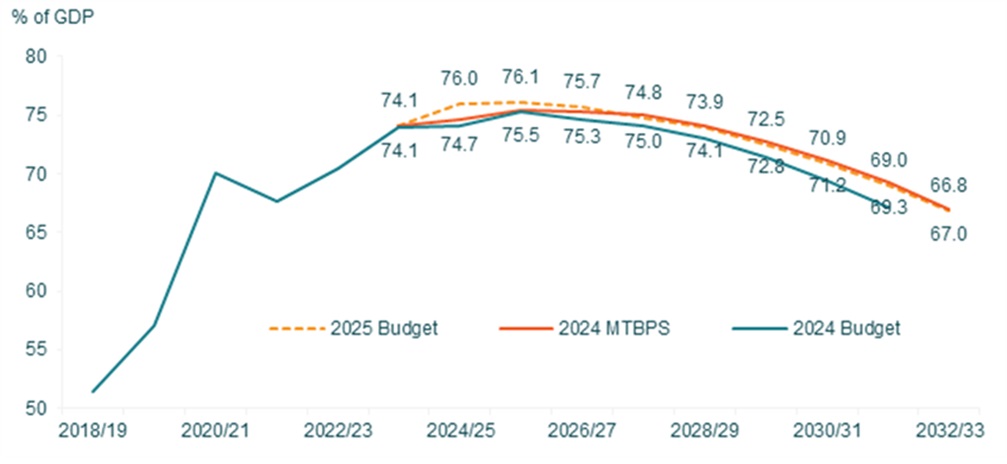

The postponement of the 2025 Budget continues to dominate headlines. While the focus has been on the 2 percentage point (ppt) VAT rate increase to 17%, the bigger issue is that the fiscal outlook was little changed despite the substantial tax increase. Instead, the debt-to-GDP ratio was projected to stabilise at 76.1% – slightly higher than the 75.5% projected at the 2024 Medium Term Budget Policy Statement (MTBPS).

Figure 1: Budget versus MTBPS debt-to-GDP outlook

Sources: National Treasury and Alexander Forbes Investments

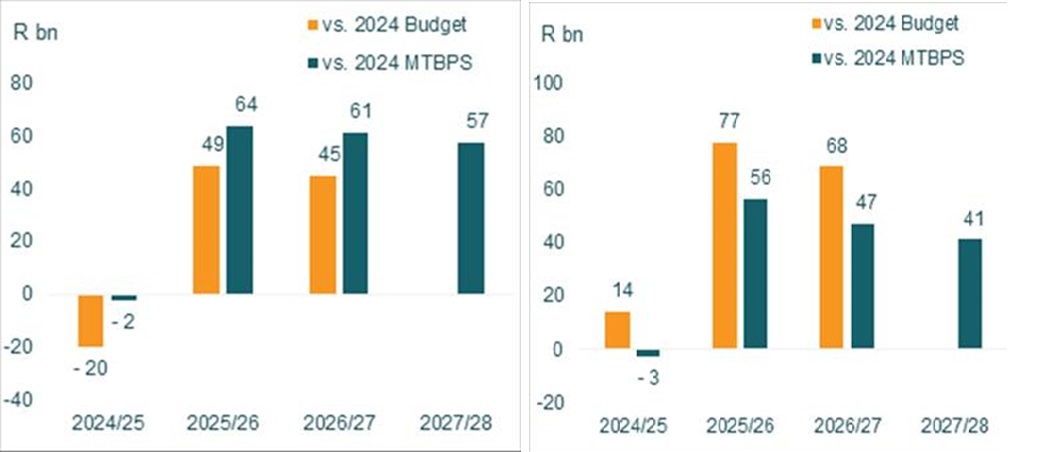

The additional revenue to be raised from the VAT increase would go towards funding above-inflation increases in social grants, infrastructure spending, the public wage bill, and frontline services. Over the 2025/26 to 2027/28 financial years, the main budget revenue was projected to be higher by R182 billion and expenditure by R145 billion relative to the 2024 MTBPS. This would have resulted in a slight improvement in the main budget deficit, which was now projected to narrow to 3.2% of GDP in the 2027/28 financial versus the 3.4% MTBPS estimate.

Figure 2a: 2025 Budget vs 2024 MTBPS and Figure 2b: 2025 Budget vs 2024 MTBPS and

Budget revenue Budget expenditure

Sources: National Treasury and Alexander Forbes Investments

However, substantial risks to this outlook remain, as recently emerged spending pressures – such as the High Court judgment on the Social Relief of Distress (SRD) grant ruling that both the number of recipients and the grant amount need to be increased – were not adequately addressed. This suggests that National Treasury (NT) would have to find over R100 billion in additional revenue per annum to fund this. While indications are that NT will appeal the judgement, over the medium- to long-term social spending pressures remain given South Africa’s high unemployment rate. There are also concerns that higher education funding for the poor and the missing-middle remains inadequate, with more funding also likely to be required for the National Health Insurance (NHI). Additional funds will also be required should United States Agency for International Development (USAID) funding for President’s Emergency Plan for AIDS Relief (PEPFAR) be permanently suspended.

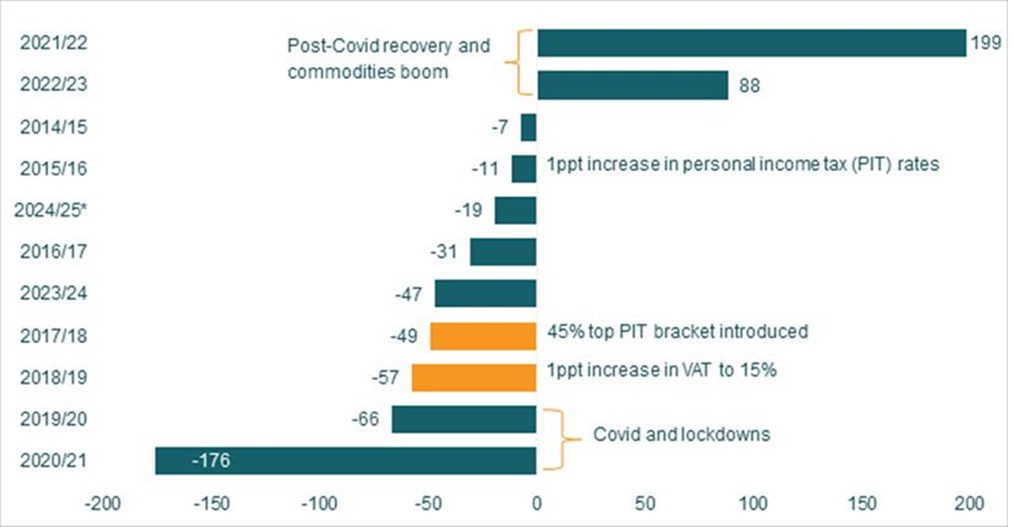

Fiscal slippage risks are likely to be exacerbated by revenue shortfalls. Barring 2021/22 and 2022/23 (during the post-Covid commodities boom), revenue outcomes have generally come in lower than initially projected over the past 10 years. More concerning is that the revenue shortfall tends to be larger during periods where there are substantial tax increases, like in the 2017/18 financial year when NT introduced the 45% top income bracket and in the 2018/19 financial year when the VAT rate was increased by 1ppt to 15%. Overall, this points to overestimation bias and raises concerns over fiscal consolidation credibility.

Figure 3: Total tax revenue projections versus outcomes

Sources: National Treasury and Alexander Forbes Investments

Beyond this, the immediate concern for most is the implication of the postponement

One of the questions we received following the announcement of the postponement was whether a government shutdown was imminent. With the budget rescheduled to 12 March, this allows for sufficient time for a new budget to be tabled, debated and passed by parliament towards the end of June or July. Section 29 of the Public Financial Management Act allows government to fund its operations in the first four months of the fiscal year, with up to 45% of the total amount appropriated in the previous budget.

The other question we received was about the possible makeup of the revised budget. At this stage it remains unclear what the revenue and expenditure mix of the revised budget will look like. However, we expect the overall focus to remain on fiscal consolidation. This is because NT has over the past several years consistently highlighted that elevated debt levels lead to higher debt service costs that crowd out social and infrastructure spending. It is unclear how they will walk back some of the proposed spending such as higher wages and additional funding for front-line departments aimed at building a capable state or how they will raise additional revenue as a VAT increase seems unpalatable. This puts the NT in a realm of difficult choices.

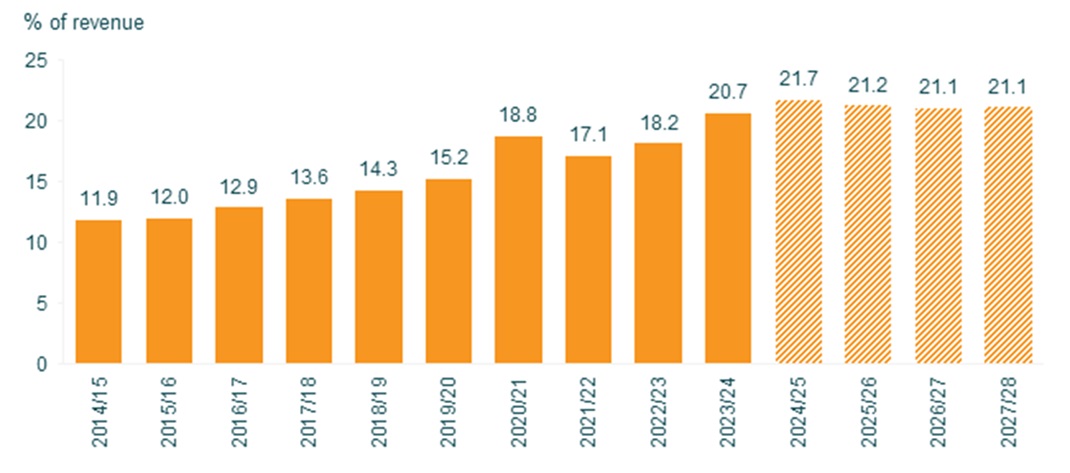

Figure 4: Debt-service costs as a share of main budget revenue

Sources: National Treasury and Alexander Forbes Investments

Lastly, there are also concerns that the latest developments could lead to further frictions within the Government of National Unity (GNU). While the postponement of the budget is unprecedented for South Africa, it is not unique. Several countries with coalition governments have faced challenges in passing government budgets. The reaction from several GNU parties suggests that they remain committed to the coalition and eager to play a greater role in how government is run.

The postponement can also be seen in a positive light. The optimism around the GNU following last year’s election was in part premised on the notion that there will now be increased oversight and accountability in how the state is governed. The delay in tabling the 2025 Budget is perhaps a reckoning that South Africa is no longer a one-party state and that the way things were done in the past needs to change. It would be prudent for the GNU to review current programmes to ensure there is alignment with the goals and objectives of the new government.

ENDS