Izak Odendaal, Investment Strategist at Old Mutual Wealth

The first 19 days of January have produced enough topics for several newsletters, including Venezuela, Iran, Greenland, and the criminal probe into Federal Reserve Chair Jerome Powell. However, there will be plenty of time to unpack these topics in the weeks ahead – US President Donald Trump isn’t going anywhere anytime soon, after all. Instead, this week we’ll reflect on the exceptional returns that South African investors earned in 2025 and place them into historical context.

Last year saw a massive rise in global policy and geopolitical uncertainty as Trump tore the old rulebooks and hiked tariffs to levels last seen before World War II. This was a shock to all trade-dependent nations, but South Africa managed to find itself particularly exposed to Trump’s hostility. Against this backdrop, one might have reasonably expected 2025 to be a bad year for the rand and local markets. It was not.

Boom

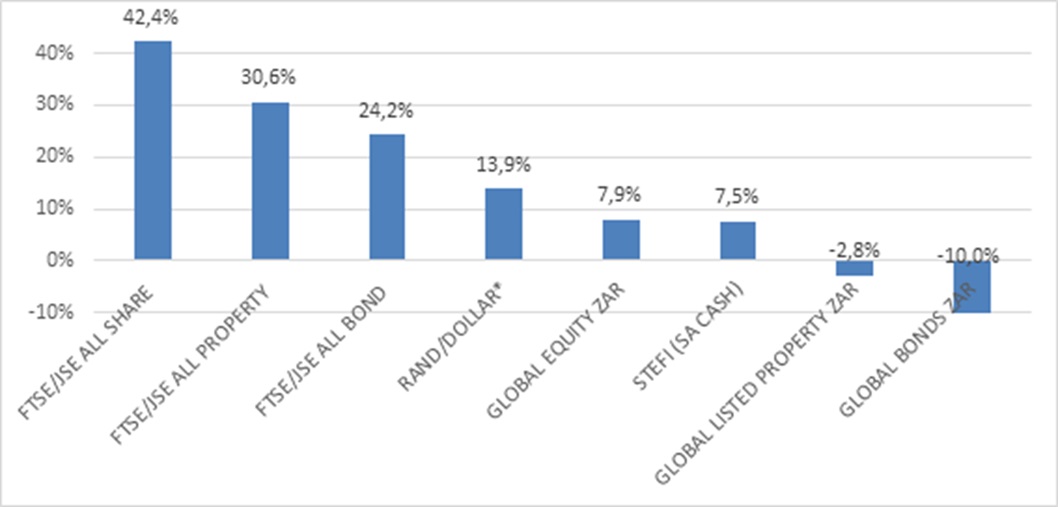

The FTSE/JSE All Share Index delivered a 42% return, while the All Bond Index returned a record 24%. Listed property also shone with a 30% return. The rand appreciated by almost 14% against the US dollar. This reduced offshore returns from the point of view of South African investors, but global equities were still positive in rand terms. All told, 2025 was a fantastic year for South African investors with broadly diversified portfolios, but clearly the domestic asset classes were the real stars.

Chart 1: 2025 Asset class returns in rand

Source: LSEG Datastream *positive number implies rand appreciation

The surge in SA equities last year can partly be explained by the blistering rally in precious metals prices, driven by elevated global uncertainty. The gold price was $2625 per ounce at the start of 2025 but $4324 at year-end. Platinum doubled from $914 to $2024. As a result, the resources sector on the JSE returned a staggering 144%, marking one of the best years on record for locally-listed mining shares.

However, the other two traditional sectors, financials and industrials, also performed solidly, returning 24% and 19% respectively. While the resources rally appears to be an outlier and should not be expected to repeat, there was broad-based strength across the JSE last year.

This reflects a combination of factors. The rally in precious metals prices not only lifted mining shares but also supported the rand, which in turn puts downward pressure on local inflation and interest rates – though it provided a headwind for the returns of rand-hedge shares on the JSE. Another international factor is that emerging market equities finally showed some life, beating developed markets in dollar terms for only the second time in a calendar year since 2017. A rising emerging market tide tends to lift South Africa’s boat, though there has not been any sign of significant net purchases by foreign investors, unlike South African bonds, where foreign investors have piled in.

Chart 2: South African interest rates

Source: LSEG Datastream

Bonds are back

The rally in South African bonds pulled the yield on the 10-year government bond from 10.6% to 8.50% (bond prices and yields move in opposite directions). Since other interest rate-sensitive investments like listed property and bank shares usually price off the government bond curve, this supported a rally in those assets.

Bonds ran due to progress in fiscal consolidation and a better growth outlook for South Africa, which gave rise to the first ratings upgrade in almost two decades. A 150 basis points reduction in the repo rate since late 2024 and the official shift to a lower inflation target also boosted bonds.

More than half of the 24% bond return last year came from price appreciation, by far the biggest contribution of capital gains in the bond market in the past 20 years. Typically, most of the return from bonds comes from interest income, not price movements, and in fact ten of the last 20 years have seen capital losses from bonds. However, only two of the last 20 calendar years, 2009 and 2015, saw negative total returns, largely because interest income has been so high, averaging 10% per year over this period. The annual average total return (price change plus income) was 9.2%. Assuming no defaults, the amount of interest income an investor will receive is mostly a function of the starting yield. This suggests that the outlook for bond returns has moderated, but current yields are still well above the 3% inflation target. We should not necessarily bank on further capital gains, though these might come if there is progress on lowering government’s debt ratio, economic growth accelerates and more ratings agencies announce upgrades.

In a nutshell, 2025 was a year for the record books, made more remarkable by the fact that local bonds, equity and property were negative on a year-to-date basis in early April. It is a reminder of how quickly markets can turn around, and how we shouldn’t panic when there is a correction. Nonetheless, investors should temper their expectations for 2026, not because there is any specific reason to worry – the global economy seems resilient while the local economic outlook has improved – but because markets never move in a straight line. The medium-term outlook for local asset classes is still attractive. Valuations on bonds, equities and property are no longer as cheap as they were, but are still priced to deliver positive real returns, especially since inflation should converge on the Reserve Bank’s 3% target over time.

Beating cash

If we widen the lens to look at longer-term return history, there are two issues worth addressing. The one is the fact that local investors were not always rewarded for taking on risk in recent years. For instance, the returns from aggressive balanced funds were close to those of income funds for a considerable period. The second is the argument that South African investors should abandon ship and increase foreign exposure at all costs.

Finance theory suggests that riskier investments, like equities, should usually generate a higher return than safe assets like cash. This doesn’t always happen. Interest rates are often quite high in South Africa across the yield curve. They still are today. Meanwhile South African equities were flat in real terms between 2014 and 2020 and again between 2021 and early 2024. However, 2025 saw the “correct” ranking of asset class returns, as equities beat cash handsomely with bonds in the middle.

Chart 3 shows the very long-term history of local equities against cash. Each point on the chart represents five years of returns, adjusted for inflation, with a positive number indicating equity outperformance. The relationship clearly follows big cycles, with a pronounced downcycle in relative equity performance starting in 2014. However, it has turned around decisively. Over the whole period since 1925, local equities beat cash in 80% of five-year periods. High interest rates in South Africa are a blessing for very conservative investors who seek income but no volatility. However, investors who have longer-term horizons should be careful of betting against equities by staying in cash. It should also be remembered that equity returns are lumpy, and one outstanding year, like 2025, is often why rolling 5-year returns look good. Missing out on one such good year can diminish long-term returns, which is another argument for staying invested.

Chart 3: SA equity minus cash – real returns over rolling 5-year periods

Source: Firer & McLeod, Iress, LSEG Datastream

Local is mostly lekker

What about South African versus global investments? It is a mistake to think in terms of either/or, since investors can and should diversify across local and global markets. Moreover, investors should distinguish between strategic and tactical allocations. A tactical allocation is based on current valuations and market conditions, and that will change over time. Cheap investments become expensive and vice versa, and tactical shifts make sense as risks and opportunities arise.

A strategic allocation, however, is when an investor who is already heavily exposed to South Africa through residential property and work or business, decides they don’t need much further exposure to local financial markets, and makes a long-term offshore allocation based on financial goals, rather than current market conditions. That makes perfect sense but will depend on an individual’s personal circumstances.

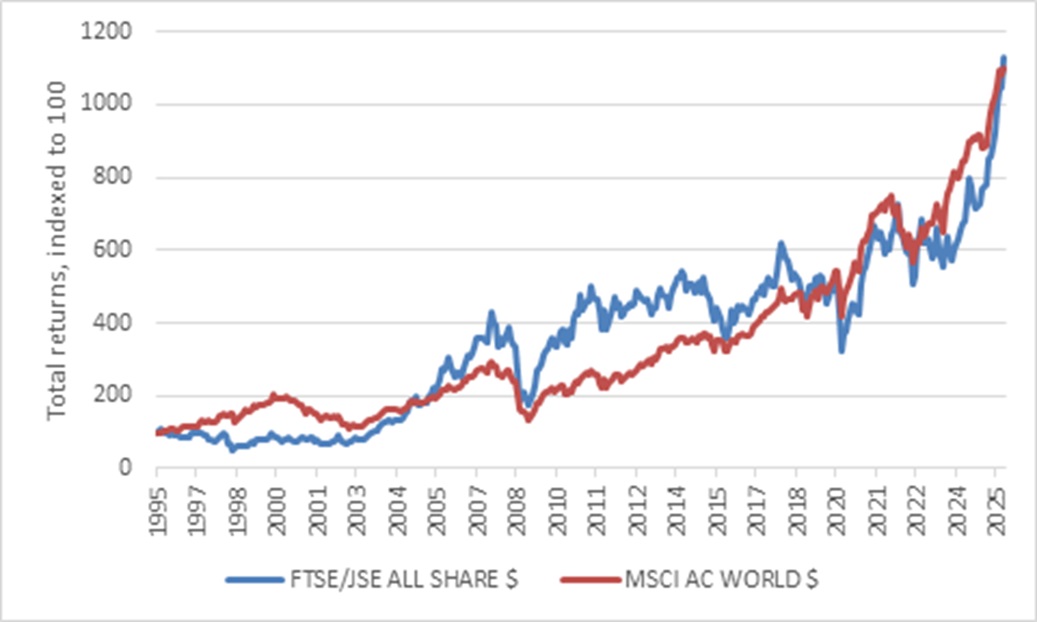

Chart 4 compares South African equities with global equities since the dawn of democracy. There were stretches of underperformance and outperformance, but over the full period, local equities kept pace in dollar terms. That is despite the rand falling from R3.6 per dollar to around R16.50 today. So yes, the global purchasing power of South Africans has fallen over this period as the currency lost value, but that is not the case if those hard-earned rands were invested on the JSE and left there to compound. It is the “leave it there” bit that is often difficult, because there have been so many negative headlines over the past 30-odd years, and there are bound to be many more.

Chart 4: South African and global equities in dollars

Source: LSEG Datastream

While the local market has kept pace with global equities in terms of returns, the same is not true of valuations. The MSCI All Country World Index and the FTSE/JSE All Share Index both traded at 13 times forward earnings as recently as early 2019. Since then, global multiples have expanded to 18, while locally there was a derating to around 11. There may be good reasons for local equities trading at such a discount, but it means a lot of good news has already been baked into global markets, leaving room for returns to disappoint over the medium term. Local equities still trade at reasonable valuations and are priced to outperform.

Again, the point is not that investors should pile into South African equities. There are strong arguments in favour of global exposure, and several risks to investing locally, from political uncertainty (though that seems to be a feature everywhere these days) to economic challenges. The biggest risk is perhaps simply that the gold price plunges from its record level. The JSE is also a concentrated market. As much as people fret about the US, where the top ten shares now account for almost 40% of market value, the picture has always been worse in South Africa. The top ten shares on the JSE account for half of the All Share Index’s market value.

The point is that the narrative that South Africa is somehow uninvestable is easily disproven by the data. Patient investors were rewarded last year and in the past. In the context of a diversified portfolio, where risks are spread and asset allocation is appropriate for the long-term goals of the investor, South African equities have a role to play and can still deliver solid real returns in future.

ENDS