Izak Odendaal, Investment Strategist at Old Mutual Wealth

On the 9th of February 1969, the Boeing 747 took its maiden flight. It entered full commercial service the following year. Although Boeing no longer produces the 747, upgraded versions of the “Queen of Skies” remain in use to this day, much to the delight of plane enthusiasts everywhere. It is remarkable to think that the distance between its launch date and today – 57 years precisely – is similar to the time between the launch date and the first ever powered flight by the Wright brothers in 1904. In other words, between 1903 and 1969, there were incredibly rapid technological advancements (1969 was of course also the year humans stepped on the moon for the first time). From 1969 to today, there have been many incremental improvements to jet airplanes, but the basic concept and architecture remain the same. Someone from the 1970s would not feel completely out of place in a modern airplane, nor would someone from today feel lost on a 1970s PanAm flight (aside perhaps from people smoking on board).

However, that same time traveller from the past would find the internet, ecommerce, laptops, and digital displays everywhere bewildering. They will wonder why everyone is constantly bent over, swiping away on small devices clutched in their hands. They would read about how drones have completely changed the nature of warfare in Ukraine, allowing the much smaller army to hold off mighty Russian tanks and warships. And when it comes to AI chatbots, it will blow their minds.

All of this is to say that technological progress is uneven and unpredictable. This makes it advisable to apply a pinch of salt whenever a new technology is hyped. A few years ago, the economist Robert Gordon went further, proposing a thought experiment along the following lines: if you had to choose, would you rather go without indoor plumbing or video streaming? Would you rather go without electricity in your home, or a smartphone in your pocket? Would you rather have a car, or a laptop? Would you rather have antibiotics, or AI? In many cases, people would probably choose the technology from the first half of the 20th century over much more modern versions. Luckily, we get to have the old and the new technologies. But remember that earlier generations also experienced rapid technological change.

Slow take off

A further point is that it normally takes time for people to figure out how to use technologies. The writer Morgan Housel notes that after the Wright brothers’ historic flight at Kitty Hawk, almost no-one thought that a revolution was at hand. Only a handful of newspapers reported on the event, and it took several years and a world war for the public to pay serious attention to the idea of manned flights. It took another world war to cement the full military, logistical and commercial potential of airplanes. Today, air travel is indispensable for business and leisure, and the industry continues to grow. To name just two examples, Dubai is spending $35 billion on a giant new airport, expected to be the largest in the world, while a $12 billion project has just kicked off in Ethiopia to build Africa’s largest airport.

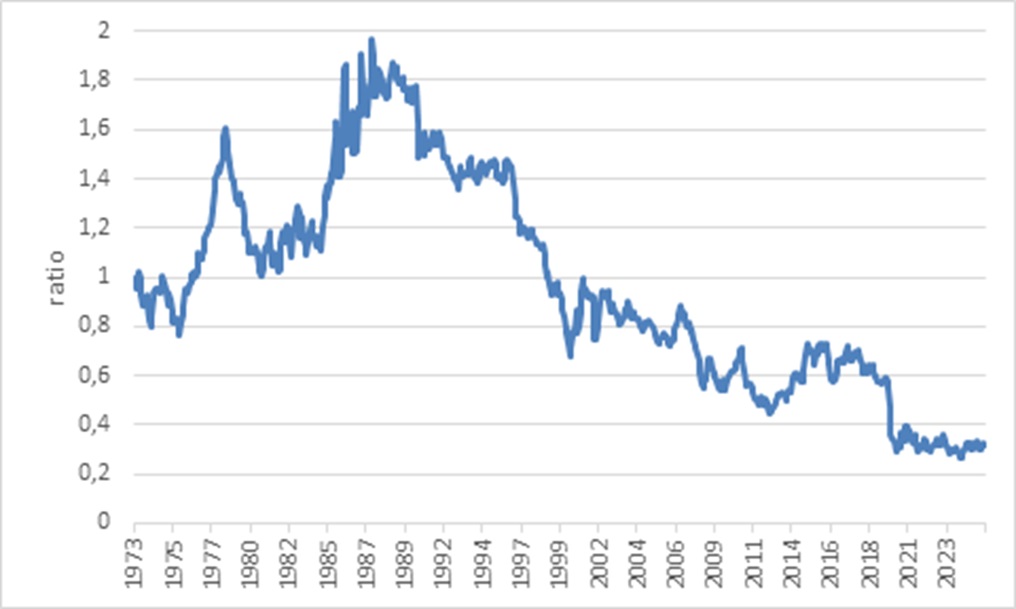

Did this make air travel a sure thing from an investment point of view? Not according to legendary investor Warren Buffett, who famously remarked that if a “farsighted capitalist” was present at Kitty Hawk all those years ago, they would have shot down that first flight given that the cumulative net return to airline shareholders since then was negative. There are profitable airlines, but there have been many bankruptcies in a sector subject to high fixed costs, volatile fuel prices, competition from subsidised state-owned entities, economic cycles, wars and, in 2020, a global pandemic. Listed airlines have collectively far underperformed global equities, as chart 1 shows.

Chart 1: Datastream World Airline index relative to Datastream World Equity Index, US dollars

Source: LSEG Datastream

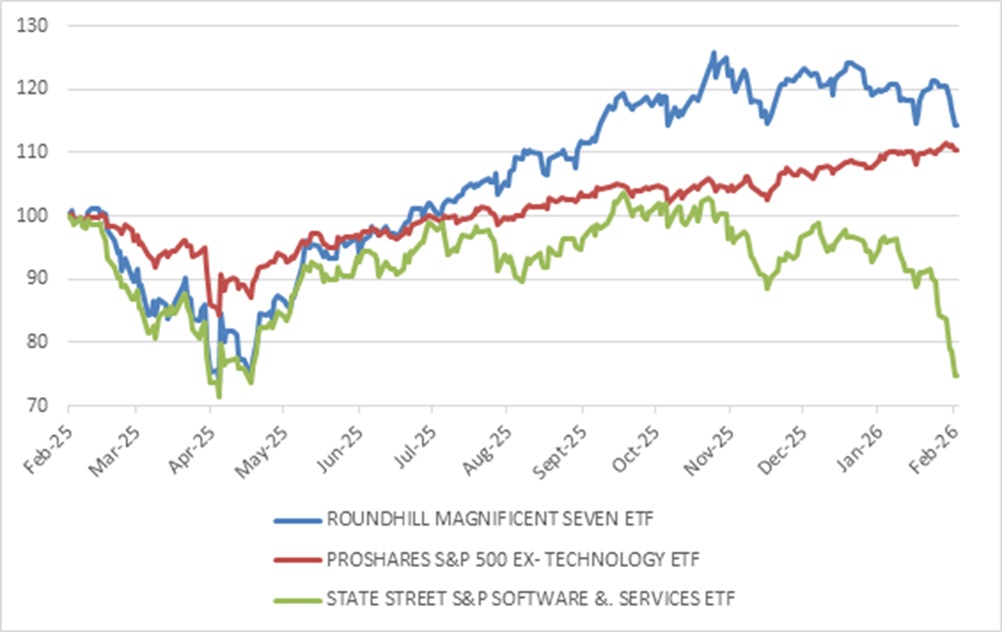

This is a roundabout way of getting to the more recent developments with AI, a breakthrough technology that nonetheless leaves many questions unanswered. One of these questions is about who the winners and losers among companies will be. A big sell-off in software and related shares suggested an answer to that question. New AI tools threaten to undercut their business models, as some customers will wonder why they pay for expensive software subscriptions when they could build their own solutions with AI.

Chart 2: US equity EFTs over the past year

Source: LSEG Datastream

One of the advantages of software and other tech companies is that they were “asset light”. Once a piece of software was produced, it could be sold millions of times without having to add staff numbers or production facilities, and with each new copy costing a fraction of the original. They can grow rapidly. In contrast, producing cars, for instance, requires massive factories, large workforces, and complex systems. Expanding production is difficult, so growth tends to be slow.

With AI, however, tech is no longer so asset light. Reporting earnings over the past two weeks, the biggest of the listed tech giants, Amazon, Alphabet, Meta, and Microsoft, raised guidance on their capital expenditure plans to a staggering $660 billion for next year, most of it going towards new data centres. And this is only four companies. Compare this with the cost of the brand-new giant airports mentioned above, or the $30 billion dollars Airbus reportedly spent on developing the A380, its 747 competitor. The AI buildout dwarfs that, and its scale is difficult to wrap one’s head around.

Airbus made the last and 251st A380 in 2021and never made a profit on this model despite producing a technological marvel. The R&D costs were simply too high, and demand shifted to smaller planes. There is a similar possibility that all this AI-capex will not be profitable even if they give us wonderful products. It ultimately depends on who is prepared to pay what for AI products, and fierce competition could drive those prices below breakeven levels. There will be winners and losers among the leading AI companies too.

With these data centres there is a corresponding increase in demand for physical resources, like steel, aluminium, copper and more. Alongside rising defence spending and the green transition, this is starting to look like a global capex upswing.

Over the past decade or so, investors threw money at tech companies, pushing their valuations higher. They starved the materials companies of capital, and these firms traded on depressed multiples. Financial discipline was the order of the day, limiting exploration and expansion plans. It means this global capex boom has kicked off with limited supply of many crucial physical resources, notably copper. It would be ironic but entirely plausible if the big winners in terms of stock market returns over the next year are from the unloved old economy sectors, who have a demand tailwind and relatively cheap starting valuations.

Chart 3: MSCI Materials Index relative to MSCI World Index, US dollars

Source: LSEG Datastream

In similar vein, electricity supply, as old economy as it comes, is crucial. A large AI data centre uses around 100MW of electricity, enough for thousands of homes. The limiting factor is often the grid capacity to take electricity from its source to its users. Some of these data centres are therefore built right next to a power plant, but expansion of the grid is also necessary. One kilometre of a typical high voltage transmission line requires about 4 tonnes of aluminium.

Many analysts and industry insiders like Nvidia boss Jensen Huang have argued that China has the edge here, given its ability to quickly expand power plants and build transmission lines. It is ramping up renewable energy capacity at a time when President Trump is deliberately trying to halt solar and wind plants. Bloomberg reported last week that, since 2021, China has added more power capacity than the US did in its entire history. This includes 543 gigawatts in 2025 alone. That’s adding about 10 Eskoms in one year. It plans to add another 68 over the next five years.

Speaking of Eskom, it is a good example of where the value is captured in the supply of a crucial technology. Electricity is critical to modern economies and will become even more important as the world tries to move away from fossil fuels. As we’ve unfortunately seen, the South African economy would ground to a halt without Eskom. However, based on last year’s profit and trading at a 10x PE multiple, it would barely make the top ten shares on the JSE. Electricity is essential, but most of the value accrues to its users, not the supplier. Therefore, AI can be a foundational technology, but if it becomes commodified, its suppliers won’t necessarily be the most valuable companies. Again, this is uncertain.

The productivity enhancing potential of AI is obvious, and this will be good for the profitability of a broad range of companies across sectors. It is still early days in terms of seeing this impact, since it will take time for firms to adapt and adjust their processes. There is one important individual who seems ready to bet big on a productivity boom, however. Newly nominated Federal Reserve chair Kevin Warsh has argued that as AI results in significant productivity gains, it will boost overall supply in the economy and therefore lower inflation. Something similar happened in the late 1990s, and the then Fed Chair Alan Greenspan held back on raising interest rates despite strong economic growth because he believed productivity would rise. He was proven right (though he subsequently kept rates too low, leading to a housing bubble). Warsh is therefore eager to lower interest rates, though he might be jumping the gun a bit.

Downside

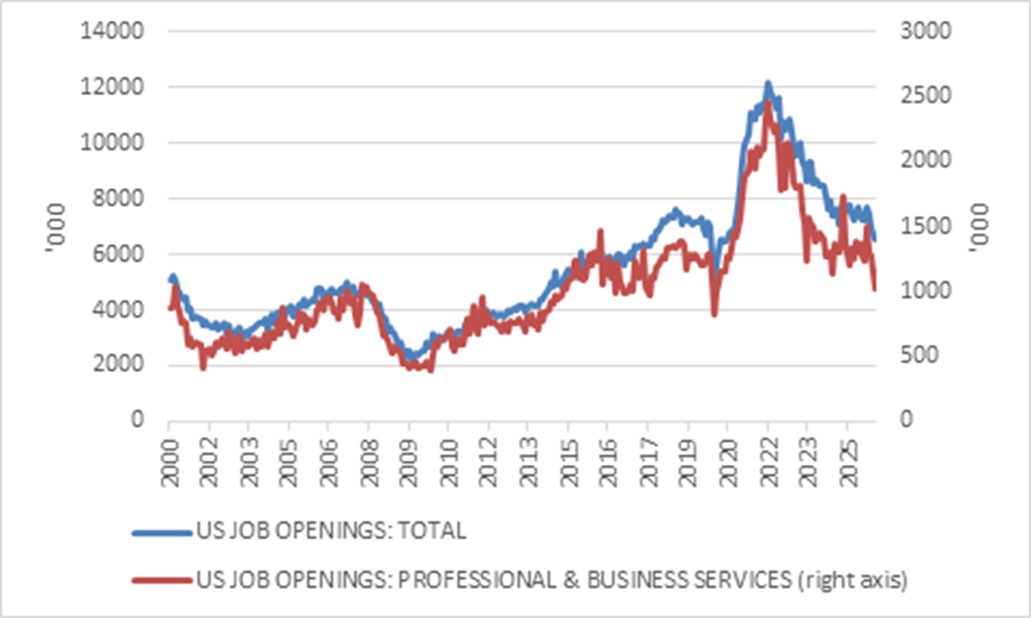

The downside of productivity is of course that fewer workers are needed, and at worse, there might be job losses. So far, the evidence is inconclusive, but it makes sense that companies might scale back hiring while they experiment with AI. This might not lead to widespread layoffs, but hiring has slowed already. In the US, the categories of professional and business services have seen a notable decline in job openings, precisely the types of workers who might be replaced by computers.

Chart 4: US job openings

Source: LSEG Datastream

The evidence from history is that technological revolutions do not result in headline unemployment, since new industries will emerge that absorb workers. Productivity leads to economic growth over time, which in turn creates work, instead of destroying it. However, beneath the surface, companies and even entire industries disappear. Many individuals who lose their jobs might never find employment again or will have to accept other work at lower pay. There is much room for unhappiness in a transition from today’s world to one where AI is deeply embedded everywhere.

Skills at risk

Notably, it is skilled workers like software engineers who seem most at risk, not necessarily blue-collar workers. This recalls the original Luddites, groups of workers who destroyed the machinery they blamed for taking their jobs in England between 1811 and 1816. They were mostly skilled artisans, the software engineers of their day.

Unfortunately, it also chimes with the “elite overproduction” theory of mathematician Peter Turchin, who argues that societies that historically produced too many elites (like today’s university graduates) relative to available high-status positions were destabilised by a surplus of frustrated, overqualified individuals competing intensely with one another. This led to conflict and rebellion. While this might be an extreme outcome, there could clearly be political implications to AI adoption, especially if voters keep seeing the billionaire owners of AI firms getting richer.

Even assuming that there won’t be widespread unemployment, there will be broader societal implications. When social media was invented, it was hailed as a means of bringing people together, and there was optimism that it could spread democracy, such as during the Arab Spring uprisings in 2011. Today, social media is widely seen as one of the biggest sources of division, creating echo chambers where everything that challenges preconceived views is “fake news.” With AI, creating fake news, including video footage, and distributing it widely is easy. The scope for manipulation is massive. Ditto for criminal activity. This cannot be good for trust levels. Trust, as it happens, is an important ingredient for economic success. In low-trust societies, every agreement must be a watertight contract, followed by ongoing monitoring and spending on security. All this is effectively a tax. High-trust societies have lower transaction costs and are therefore richer and more innovative.

This merely scratches the surface and the potential for commercial, environmental, economic, political, social and psychological disruption is real. Look long enough into the future, and there is a range of possibilities, including a “singularity” or where AI can improve itself better than humans can, and we’ve lost all control. There is a non-zero probability of total extinction. However, sunnier scenarios are more likely.

Seatbelts fastened

In the meantime, however, lets reiterate the point that things are uncertain. For investors, AI remains too big a bet to miss out on, but also too uncertain to go all in. The best approach is to retain broad equity exposure, so that your portfolio includes the winners, even if it will also contain some losers. It will also require patience, as markets will continually recalibrate expectations, leading to volatility. And remember that while technology changes rapidly, human nature doesn’t. Fear and greed will remain important drivers of market sentiment, and it is best to keep those emotions in check. Tried and testing investment principles remain applicable and as airline captains like to remind us, it is always a good idea to keep your seatbelt fastened in case of turbulence.

ENDS