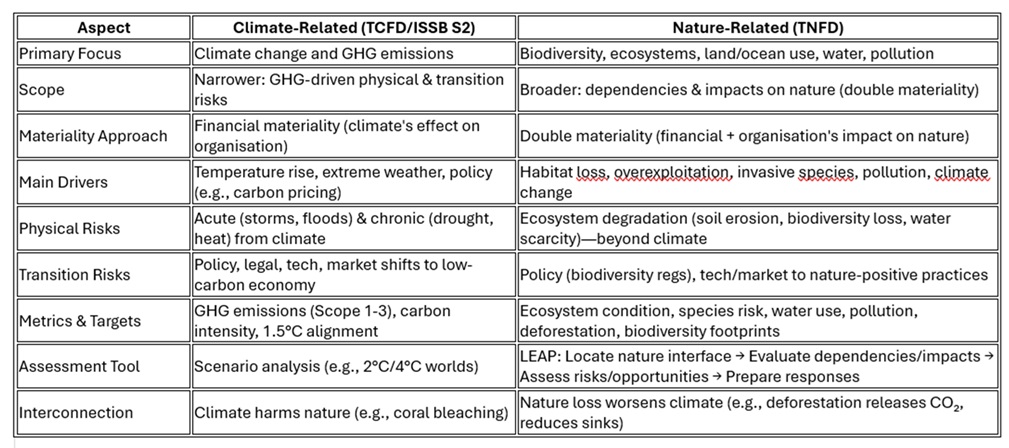

Nature-related and climate-related issues represent interconnected yet distinct environmental risks, opportunities, dependencies, and impacts that organisations – particularly businesses and financial institutions – must assess and disclose.

Climate-related issues focus on climate change, driven by greenhouse gas (GHG) emissions, global warming, and effects like rising temperatures, extreme weather, sea-level rise, and altered precipitation.

Nature-related issues cover broader biodiversity and ecosystems, including species diversity, soil health, water cycles, forests, oceans, and ecosystem services (e.g., pollination, water purification, carbon sequestration, raw materials).

The Task Force on Climate-related Financial Disclosures (TCFD), now part of ISSB standards, targets climate risks exclusively. The Taskforce on Nature-related Financial Disclosures (TNFD) addresses nature-related ones, promoting integrated reporting on the climate-nature nexus.

Key differences

Why the distinction matters

Climate change drives much nature loss, but nature issues stem from non-climate factors like agricultural expansion, plastic pollution, and overfishing. Healthy ecosystems regulate climate (e.g., forests as carbon absorbers). Ignoring one undermines the other, so TNFD advocates integrated disclosures.

In practice:

– A company faces climate risk from heatwaves disrupting operations.

– It faces nature risk from freshwater depletion due to upstream deforestation, unrelated to its emissions.

Both frameworks integrate environmental factors into financial decisions, but nature adds complexity: local variability and harder-to-measure biodiversity vs. standardised GHG metrics.

For guidance, visit TFND Global (nature) and IFRS (climate). Many organisations report under both for comprehensive exposure.

The United Nations’ SDGs

The UN Sustainable Development Goals (SDGs) are 17 interconnected goals adopted in 2015 under the 2030 Agenda, tackling poverty, inequality, climate change, environmental degradation, and more. They are holistic: progress in one (e.g., SDG 15 biodiversity) supports others (e.g., SDG 2 food security, SDG 13 climate resilience).

TNFD supports SDGs by integrating environmental sustainability into finance, redirecting flows to nature-positive outcomes and addressing intertwined nature-climate risks.

Key relations

- Alignment with Global Biodiversity Framework (GBF): TNFD links to the Kunming-Montreal GBF (COP15, 2022), especially Target 15, mandating biodiversity assessments and disclosures for large entities. Endorsed by 190+ governments, it halts nature loss by 2030, advancing multiple SDGs.

- Direct Support for Core SDGs:

- SDG 14 (Life Below Water) & SDG 15 (Life on Land): TNFD’s biodiversity focus aids management of ocean/forest impacts, disclosing habitat loss, pollution, and overexploitation to drive protection.

- SDG 13 (Climate Action): Ecosystems as carbon sinks buffer climate; TNFD builds on TCFD for “climate-nature nexus” reporting.

- Broader Links:

- SDG 6 (Clean Water): Water risk assessments.

- SDG 2 (Zero Hunger): Agricultural nature impacts on food.

- SDG 12 (Responsible Consumption): Reducing negative supply chains.

- SDG 8 & 9 (Growth & Innovation): Nature-positive investments.

- Sustainable Finance Impact: TNFD translates nature risks financially, supporting UN capital shifts (500+ adopters, $17.7T assets). Complements ISSB and GRI for actionable SDG progress.

SDGs blueprint sustainability; TNFD operationalises it in finance, bridging environmental-economic gaps for holistic 2030 achievement.

The ASSA Climate Index

The ASSA Climate Index, developed by the Actuarial Society of South Africa (ASSA) and launched in October 2025, is a free, open-access tool that tracks the frequency and intensity of extreme weather events across South Africa relative to a 1991-2020 baseline. It provides quarterly updates on climate indicators, helping users quantify trends in extremes like heatwaves, heavy rainfall, droughts, and cold snaps at national, provincial, and municipal levels.

In the context of the TNFD framework, climate-nature interconnections, and UN SDGs discussed earlier, the ASSA Climate Index can help by delivering localised, data-driven insights to support risk assessment, strategy development, and disclosures. Here’s how it contributes:

1. Enhancing Risk and Impact Management (TNFD Pillar)

- The index’s metrics (e.g., extreme maximum/minimum temperatures, precipitation, drought, and a composite average) are expressed in standard deviations from historical norms, making it easier to identify physical climate risks that drive nature loss – such as droughts degrading ecosystems or extreme precipitation causing soil erosion and biodiversity decline.

- Organisations can integrate this data into TNFD’s LEAP approach: Evaluate nature dependencies/impacts influenced by climate (e.g., water scarcity in Gauteng affecting agricultural supply chains), Assess related financial risks/opportunities, and Prepare disclosures or mitigation strategies.

- It bridges the climate-nature nexus by providing evidence of how climate extremes exacerbate nature-related issues, complementing TCFD/ISSB climate disclosures for a more integrated view.

2. Supporting metrics and targets (TNFD Pillar)

- Users can download datasets (e.g., from sources like AgERA5) for custom analysis, enabling the development of nature-positive targets aligned with TNFD recommendations. For instance, track drought indices to set metrics for ecosystem resilience or water use efficiency.

- This aids in double materiality assessments: quantifying how climate-driven events financially impact the organisation while also measuring the organisation’s contributions to nature degradation via climate stressors.

3. Advancing UN SDGs

- Directly supports SDG 13 (Climate Action) by offering tools for monitoring and adapting to climate variability, informing national policies and corporate strategies.

- Indirectly bolsters nature-focused SDGs like SDG 14 (Life Below Water) and SDG 15 (Life on Land) through data on events that harm marine/coastal ecosystems (e.g., extreme precipitation leading to runoff pollution) or terrestrial biodiversity (e.g., heat extremes threatening species in provinces like Limpopo or Western Cape).

- Contributes to SDG 11 (Sustainable Cities and Communities) in urban areas like Pretoria, where the index can highlight localised risks for infrastructure planning.

4. Practical applications in key sectors

- Insurance and Finance: Actuaries and insurers use it to model catastrophe risks, price policies, and assess long-term liabilities – e.g., linking extreme weather data to increased claims from floods or fires, which tie into nature-related financial exposures.

- Policy and Regulation: Policymakers leverage it for evidence-based decisions on disaster preparedness, aligning with global frameworks like the Global Biodiversity Framework (which TNFD supports).

- Business and Research: Companies in agriculture, energy, or manufacturing can incorporate index insights into sustainability reporting, while researchers analyse trends for broader environmental studies.

- Retirement Funds and Asset Management: Guides investment strategies by quantifying climate risks to portfolios, as highlighted in ASSA’s guidance on retirement and mortality/morbidity.

Access ASSA’s Climate Index here for interactive dashboards, analysis tools, and downloads

ENDS