Jason Becker, Head: Institutional Asset Consulting at Adviceworx

As investors continue to search for investment returns from alternative sources, Portable Alpha strategies could be a solution and play an integral part in your pension fund’s investment strategy.

Introduction

Portable alpha is an investment strategy that involves separating alpha and beta components of an investment portfolio. The alpha component is the portion of the portfolio that seeks to generate returns through active management, while the beta component is the portion that tracks a benchmark index. Portable alpha is an investment approach that provides target market exposure, while adding the potential for additional return through a separate investment strategy. Because the source of alpha is independent of the desired market exposure, it can theoretically be transported to any market exposure, hence the term “portable alpha.

Background

Portable alpha investment strategies were first implemented in the late 1980s and early 1990s. The strategy began to gain traction as institutional investors sought ways to achieve excess returns, independent of market-related risk exposures. The development of portable alpha was built on the theoretical foundation of the Capital Asset Pricing Model (CAPM), which differentiates between market-driven returns and returns from manager skill. As far back as the early 1980s PIMCO founder Bill Gross and Myron Scholes conceptualised combining S&P 500 index exposure with active fixed-income strategies to generate better returns.

Some advantages of Portable Alpha investment strategies include:

- Enhanced Returns:

Portable alpha strategies allow investors to capture both the market returns of a desired index and the additional excess returns generated by an alpha-seeking manager, providing an opportunity for greater overall performance.

- Diversification:

By isolating alpha from beta, investors can achieve greater diversification within their portfolios, as the alpha component is independent of the market exposure.

- Risk Management:

Investors can “port” alpha to their chosen market exposure, allowing for greater flexibility in tailoring both risk and return profiles to meet specific investment objectives.

- Performance Consistency:

These strategies can improve performance consistency, as the alpha component can be sourced independently of the market.

Implementation

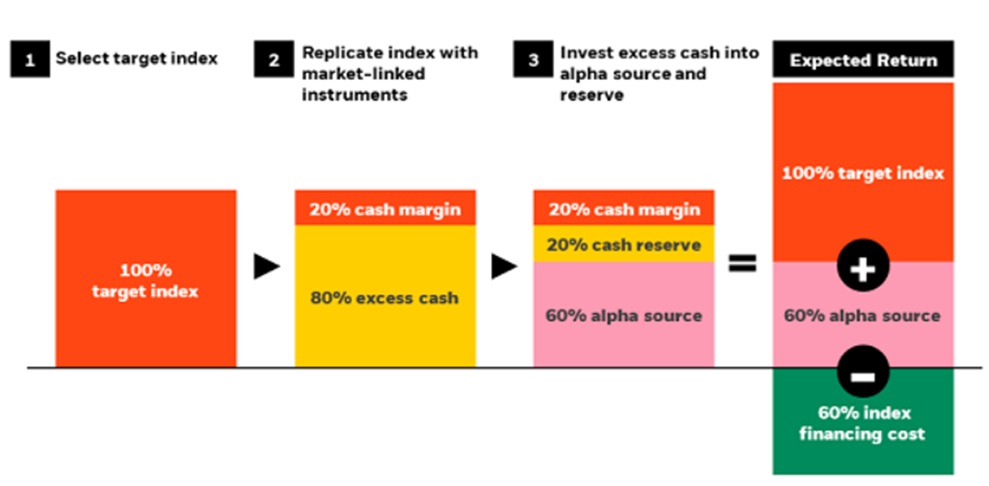

There are three key steps to implementing a portable alpha strategy. First, the investor chooses a target index for their beta exposure. Second, the target index is replicated using market-linked instruments. This part of the portfolio requires a small amount of cash in the form of a margin requirement to achieve the exposure but also comes with a cash financing cost. As a result, there is excess cash to allocate capital. The final step is to invest the remaining funds in an alpha seeking source and a cash reserve.

The below chart illustrates the practical implementation of a Portable Alpha strategy

Liquidity Requirements

A defined contribution pension scheme requires liquidity to meet future payments as and when they fall due. Portable Alpha strategies allow for liquidity in that a portion of the capital freed up from the beta component is strategically allocated to a cash reserve to meet the pension fund’s periodic liquidity needs, such as member benefit payments and withdrawals. . However, to access this liquidity, a three-month notice period can be required. To circumvent this notice requirement, it is possible to allocate a proportion of the overall portable alpha strategy to a cash reserve, or to reduce the portable alpha exposure and invest a portion in listed, highly liquid assets.

Pros and Cons

The positive aspects of a portable alpha strategy include enhanced returns, efficient capital deployment, improved diversification, and greater flexibility by combining passive market exposure with active management strategies. By using derivatives to gain market exposure, the strategy frees up capital to be invested in alpha-generating strategies, which can provide uncorrelated returns, stabilize the portfolio, and reduce reliance on traditional assets.

Pitfalls of portable alpha strategies include market risk exposure, potential underperformance of the alpha source relative to financing costs, complexity in managing derivative exposures, lack of genuinely uncorrelated and high-capacity alpha strategies, and risks associated with illiquid markets.

Closing remarks

Portable Alpha strategies can certainly play a part in seeking additional alpha sources and providing diversification. Regulation 28 of the pension funds act now allows pension funds to invest in a wide range of alternative type assets, yet the uptake of these assets has been slow. Perhaps it’s the complexity of these types of investments that creates uncertainty. Educating investors on the advantages of investing in alternative type investment strategies will go a long way to seeing Portable Alpha and other alternatives gain traction in the future.

ENDS