Leon Greyling, COO at the ICTS Group of Companies

When I was asked by my colleagues to write this column on the institutional investment performance surveys in South Africa, I thought “sure, no problem, how difficult could it be?” I remembered that back in the “good, old nineties” investment surveys were 2 pages long, covered balanced mandates only, and consisted of about 15 or so investment managers!

Now I appreciate that surveys have progressed since then as the industry has developed – new mandates, new styles, specialisation and more… But I must confess, I haven’t looked at an industry performance survey in well over 6 years. But hey, how difficult can it be, right?

So, what are investment performance surveys really?

An investment performance survey is a systematic assessment that evaluates the performance of investment portfolios or investment managers over a specific period. It typically collects data on various metrics, such as returns, risk-adjusted performance, fees, and benchmarks. The survey aims to gather insights from investors, managers, and financial professionals to understand investment strategies, market conditions, and overall performance trends. Results from such surveys can help inform decision-making, enhance transparency, and improve investment practices.

Investment performance surveys offer several benefits:

Performance Benchmarking: They allow investors to compare their returns against industry standards and peers, helping assess whether their investments are meeting expectations.

Informed Decision-Making: By providing insights into market trends and performance metrics, these surveys help investors make more informed decisions about asset allocation and strategy adjustments.

Identifying Best Practices: Surveys often reveal successful investment strategies and practices, enabling investors to adopt approaches that have proven effective.

Transparency: Regular performance evaluations increase transparency, fostering trust between investors and fund managers or financial advisors.

Feedback for Improvement: They provide valuable feedback to asset managers about how their funds are performing relative to others, prompting potential improvements in management strategies.

Risk Assessment: By analysing performance in relation to risk, investors can better understand the risk-return profile of their investments.

Market Insights: Surveys can highlight shifts in market sentiment or emerging investment trends, helping investors stay ahead of changes.

Overall, they are a valuable tool for optimising investment performance and enhancing strategic planning.

Ok, so we have that all cleared up (and thanks to ChatGPT for some assistance). The question now is….do they achieve that?

Well…yes they do….but, no they don’t!

I mean no disrespect to the companies or individuals who work tirelessly to produce these surveys every month. They do a magnificent job and I’ve seen the effort that goes into it. But perhaps, over time, that which was meant to sort through the “clutter”, has become the clutter itself. Let me explain myself…

It was David Lewis who said, “Information overload is a symptom of our desire to not miss a thing.” I can assure you that the surveys aren’t missing much at all. The first one I opened, not even Harry Potter in his prime could read the print it was so small. After finding the zoom function, I set about consuming the data. One month, 3 months, year to-date, 12 months, 3 years, 5 years, 10 years…active return, absolute return…rankings…categories with sub-categories…Large, All, SA only, Global, BEE, Balanced, Specialist…Equities, Bonds, Money Market, Property, Absolute, Hedge……performance, risk (volatility, active return, tracking error, Sharpe ratio), scatter plots……..

They used to be just 2 pages!!

I was immediately overwhelmed and thankful that I am not the trustee of a retirement fund. What was meant to help provide some sort of clarity, be a guide, create the opportunity for understanding through discussion and questioning, now needs more explanation than ever. Have we forgotten the initial purpose or is it just impossible to create clarity from the excess of clutter that exists today?

I think it’s a bit of both to be fair, and again, this is not meant to be a criticism, but rather a “call for help” on behalf of all those we serve (trustees and members). How can we find ways of getting back to the basics – not 2 pages – but rather develop the ability to steer them through it all, make it pertinent or relevant? There must be ways. We must find ways. Because the decisions that stem from this analysis are simply too important.

“Out of clutter, find simplicity.” — Albert Einstein

I must concede that it is clear to me that the surveys can be beneficial to multi-manager analysts and investment consultants in conducting due diligence on investment managers, when used correctly. The old adage that “past performance is not an indicator of future performance” comes to mind here. We are all human (analyst, consultant, trustee or member) and past performance is the shiny apple on the tree! When looking at the surveys, no one result over any particular period is good for much without consideration of the circumstances/context, the approach of the parties involved, and their positioning relative to their peers (across multiple factors).

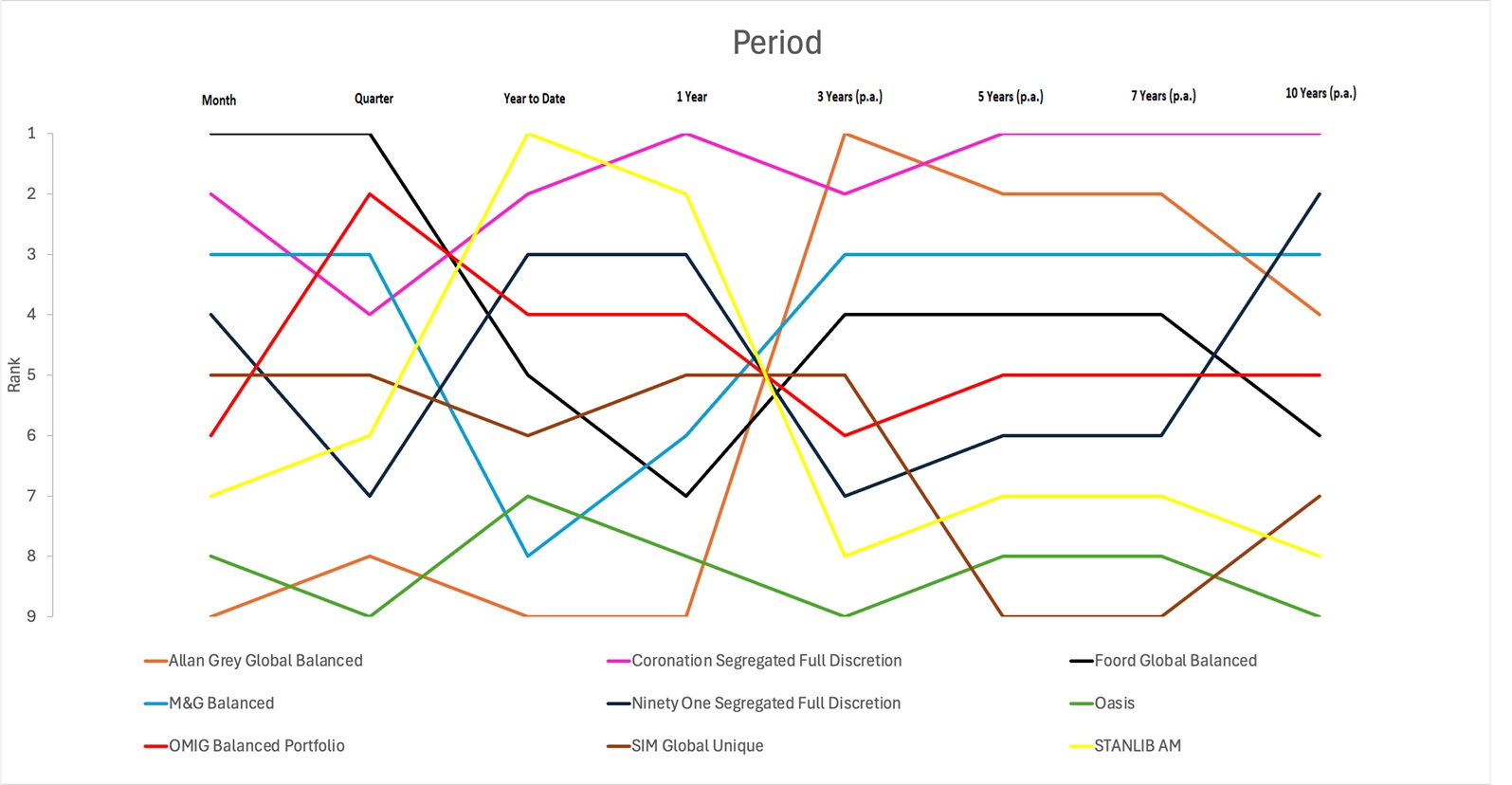

Look at the following analysis of the larger balanced mandate (including global assets) managers over the various time periods depicted in the survey. It’s interesting, but very limited in any kind of clear conclusion. I suppose one can point out the consistency of Coronation and Oasis but beyond that it’s fair to say that managers’ rankings jump around a lot over anything less than 3 years, so beware of the apple!

Bring into that, that the difference in return between the best and worst over 3 and 5 years is 3,05% per annum and 3,84% per annum respectively. Who ever said manager selection wasn’t important?! That’s a lot of difference in Rands and cents!!

I will be putting fingers to keyboard monthly from now on. Why? To help unpack some of what is in the surveys and highlight the bits that may help. I also hope to obtain comment and articles from various market participants, to help decipher what the surveys are telling us.

Let’s use this opportunity to enhance understanding across the board.

ENDS