Alexander Engelhard, Portfolio Manager, and Karl Engelhard, Portfolio Manager at Skybound Capital

Private credit has entered the financial spotlight, often hailed as an emerging asset class which is on the cusp of reshaping financial markets. While the growth in private credit has been significant in recent years, what we are witnessing is not the birth of a new financial instrument, but rather an evolution of a time-tested concept; credit. At its core, credit involves the process of evaluating risk, pricing capital, structuring transactions and managing repayment structures. While on a fundamental basis, private and public credit are very similar, there are nuanced differences in pricing mechanics, liquidity and information flow, which investors need to be aware of. These distinctions are crucial to understanding the strategic and complementary role private credit can play in an investment portfolio.

Understanding credit risk

Risk assessment in credit investing primarily focuses on two core elements: Default Risk (or Probability of Default), representing the likelihood of a borrower failing to meet payment obligations, and Loss Given Default (LGD), reflecting the potential loss incurred in default scenarios. Together, these factors form the basis of the Expected Credit Loss (ECL), a key metric in credit risk analysis. It is important to note that perceived ECL intensifies with factors such as transaction complexity, economic/market sentiment, borrower specifics, and liquidity conditions. Credit spreads reflect these risks. Simply put, one can break down credit spreads into the following formula:

𝐶𝑟𝑒𝑑𝑖𝑡 𝑆𝑝𝑟𝑒𝑎𝑑 = 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐶𝑟𝑒𝑑𝑖𝑡 𝐿𝑜𝑠𝑠 (𝐸𝐶𝐿)+ 𝑅𝑖𝑠𝑘 𝑃𝑟𝑒𝑚𝑖𝑢𝑚𝑠 + 𝐿𝑖𝑞𝑢𝑖𝑑𝑖𝑡𝑦 𝑃𝑟𝑒𝑚𝑖𝑢𝑚𝑠

The ECL represents the fundamental credit risk of the borrower, while the risk premiums are influenced by a range factors, such as transaction complexity, economic/market sentiment, and broader investor psychology. Liquidity premiums reflect the ease or challenge of exiting positions without incurring substantial discounts on valuation and are a key tenet in private market investing. Naturally, debt instruments which are perceived as carrying higher levels of risk should deliver higher levels of return to compensate for those risks.

Performance: Private vs Public Credit

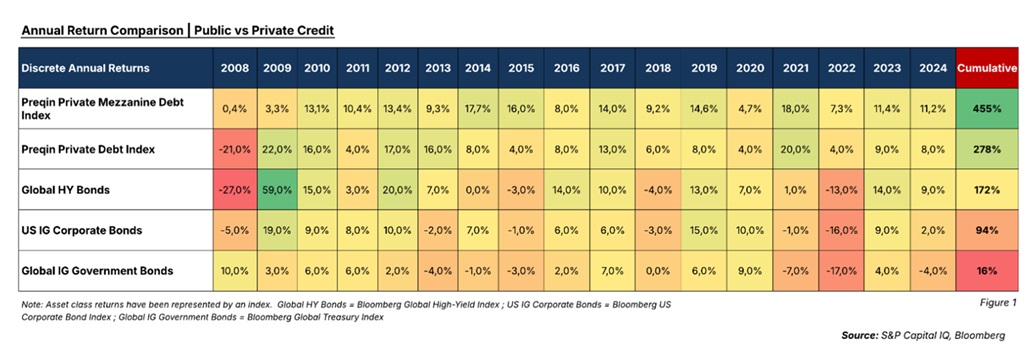

Figure 1 below shows the historical annual returns for Public and Private Credit Asset classes.

It is evident that, over the long term, private credit has consistently delivered superior returns, even relative to high-yield bonds. However, does this outperformance inherently suggest a higher risk of default or capital loss? Not necessarily. The primary driver behind private credit’s enhanced returns is often attributable to the liquidity premium (compensation investors receive for accepting reduced liquidity) and the increased risk premium associated with specialised, intricate financing arrangements typically absent in public markets.

While private credit enables investors to enhance their fixed income returns by capturing risk premiums, generally inaccessible through public bonds, it is essential to understand the unique characteristics and key distinctions between private and public credit markets.

Public vs. Private Credit: Unpacking the nuances

If both private and public credit are ultimately driven by the same asset class, credit, why then is private credit frequently segregated from its public counterpart? This differentiation is principally driven by three key structural differences in pricing, liquidity and transparency:

Pricing and valuation

Unlike their publicly traded counterparts, private credit instruments do not undergo daily mark-to-market valuations, resulting in the appearance of lower volatility. This characteristic largely stems from the limited or absent secondary markets for these assets. Furthermore, the customised and often intricate nature of private credit structures pose additional challenges, making direct valuation comparisons with public bonds impractical.

Despite ongoing debates surrounding valuation, the growing implementation of independent audits, strengthened governance frameworks, and increased reliance on third-party valuation specialists have enhanced control mechanisms and continue to bolster investor confidence in the integrity of private credit valuations.

Liquidity

Liquidity in private credit markets is inherently a double-edged sword. On one hand, limited liquidity is precisely what generates the attractive yield premiums sought by investors. On the other hand, the absence of a deep secondary market significantly constrains active portfolio management for both private credit managers and investors. The adage, “In private markets, there is no eraser at the back of the pencil,” illustrates this point. Unlike public markets, where active trading allows for adjustments, corrections, or even reversals, decisions within private credit (and private markets more broadly) carry lasting implications. Capital committed today generally remains invested for extended periods, offering few viable exit strategies should investments deteriorate.

However, this illiquidity also provides benefits in terms of stability and alignment. The long-term nature of private credit commitments cultivates genuine, enduring partnerships between private credit managers and the companies to which they lend. For borrowers, this sustained engagement delivers stability, allowing them to confidently pursue strategic initiatives with ongoing lender support, an alignment and continuity that public market financing often struggles to replicate.

Transparency

Private credit managers typically provide less transparency regarding underlying holdings compared to public markets. It’s important to distinguish between two distinct informational layers in private credit investing: the borrower-to-manager layer and the manager-to-investor layer. In the borrower-to-manager layer, information exchange is generally extensive and detailed. Due to the confidential nature of the due diligence process, private credit managers often access far deeper and more nuanced insights than are typically available in public markets. This granular information significantly enhances the decision-making process, supports greater investment confidence, and facilitates more effective risk mitigation. Nevertheless, the intrinsic illiquidity of private markets restricts the flexibility to reverse investment decisions once commitments have been made.

Conversely, the manager-to-investor information layer is more constrained. While managers often share aggregated portfolio-level metrics, confidentiality requirements typically prevent detailed disclosure of specific underlying transactions, thereby limiting the depth and granularity of information private credit managers can make available to investors.

Conclusion

Private credit is not a revolutionary construct, but rather the natural evolution of credit markets in response to shifting investor demands and market dynamics. Its unique characteristics (such as enhanced risk premiums, liquidity constraints, and nuanced information flows) make it a valuable complement to traditional fixed income exposures within an investment portfolio. By understanding these subtleties, investors can better appreciate private credit’s potential to deliver attractive, risk-adjusted returns while navigating the trade-offs it entails.

As the asset class continues to mature, it will likely cement its role as an integral component of diversified portfolios, particularly for those with patient capital seeking yield, diversification, and deeper borrower relationships. For investors who approach it with a pragmatic mindset and robust risk management, private credit offers not just opportunity but resilience in an ever-evolving financial landscape.

ENDS

This article was first published in Funds on Friday, by Glacier Research on Friday, 18 July 2025.