David Weil, Investment Committee Member at Motswedi Economic Transformation Specialists

In South Africa’s dynamic economy, small entrepreneurial firms play a vital role as drivers of growth, innovation, and employment. These small and medium enterprises (SMEs) provide jobs for between 50% and 60% of the workforce and contribute around 34% to the GDP. As key players in the business landscape, large corporations and SMEs can work together to overcome challenges and build stronger partnerships. By addressing issues like communication gaps and payment timelines, all businesses can contribute to a more inclusive economy, helping to tackle unemployment and inequality while promoting sustainable progress i.e. a bigger market for all to thrive.

Large corporations, which hold a significant share of the market – around 90% of the economic landscape – have the opportunity to view SMEs as valuable collaborators rather than just suppliers, or in some cases competitors. In negotiations and interactions, fostering mutual respect can lead to more equitable terms and productive relationships. This approach builds trust across the business community, enhancing confidence in South African companies overall. For entrepreneurs, clearer and more consistent engagement from larger partners can save time and resources, allowing them to focus on innovation. In a country where startups already face hurdles like regulatory processes, access to capital and infrastructure limitations, supportive attitudes from the “major” players, can help lower barriers and encourage growth for everyone involved.

This is particularly pertinent in the investment and retirement funding industry in South Africa where a few players are large and dominant with a long tail of sub-scale firms following them.

Timely payment of invoices is an area where improvements can make a real difference for all parties. Studies show that 91% of South African SMEs encounter delays in payments, with many invoices settled an average of 18 days beyond the 30-day mark. This can create cash flow challenges, especially when working with government entities or large private firms; for example, provincial governments like Eastern Cape and Gauteng had outstanding payments of over R4.5 billion and R2.7 billion respectively in the 2023/2024 financial year. Streamlining these processes allows small business owners to dedicate more time to their operations rather than follow-ups. For SMEs operating on tight margins, reliable cash flows enable them to meet obligations to suppliers and staff, supporting steady expansion and contributing to a healthier supply chain that benefits larger companies as well.

When SMEs thrive, the entire ecosystem benefits, though challenges can lead to higher failure rates – between 70% and 80% within the first five years, often linked to cash flow management. Reports indicate that 25% of small business setbacks relate to payment issues, with 24% facing significant cash flow concerns in the past year. By addressing these collaboratively, we can reduce attrition and help more ventures transition from startups to stable operations, fostering a diverse and resilient economy.

On a broader level, supporting SMEs strengthens South Africa’s economy by creating jobs and reducing inequality. With these firms employing up to 80% of the workforce, their success helps lower the 42.6% unemployment rate, particularly the 45% among youth. Healthy SMEs prevent job losses and support families, narrowing the inequality gap. Inefficiencies, such as those from energy issues, may cost R100–R300 billion in GDP annually, but collaborative efforts can mitigate this by formalising more businesses. In key provinces like Gauteng and KwaZulu-Natal, where industries like manufacturing and logistics are prominent, thriving SMEs can drive balanced regional development and social stability.

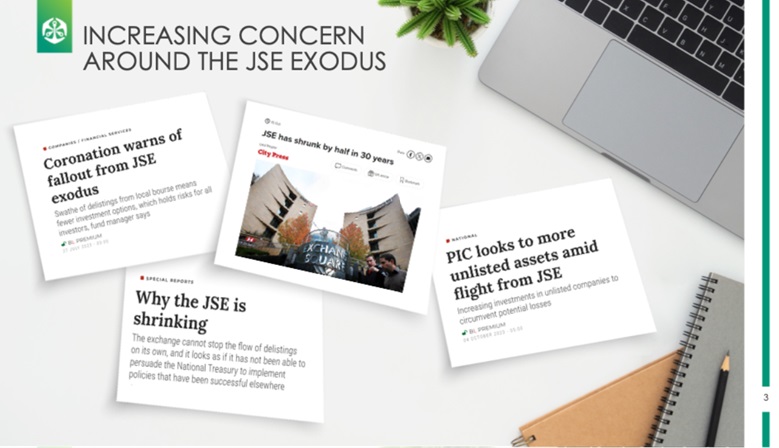

Growing SME’s also feed the public markets creating investment opportunities, which is not the current trend unfortunately.

Source: Old Mutual Alternative Investments

Importantly, large corporations stand to gain from nurturing SMEs, as it opens doors to new innovations, efficiencies, and market expansion. Per the African proverb – it takes a village to raise a child! By partnering with agile small firms, big businesses can access fresh ideas, specialised products, and cost-effective solutions that enhance their own competitiveness. Many successful companies began as small ventures, and investing in today’s entrepreneurs creates future allies for growth. In South Africa, where diversifying beyond sectors like mining and finance is crucial, this symbiosis promotes an adaptable ecosystem. As SMEs grow, they expand the consumer base, increasing demand for goods and services from all businesses and creating a cycle of shared success.

To build this collaborative future, large corporations can prioritise practices like prompt payments, clear communications, and authentic partnerships. Government support through regulations on timely settlements and incentives – such as tax benefits or procurement targets – can encourage these efforts. Entrepreneurs can also utilise resources like invoice financing and industry networks to enhance their resilience. By seeing small firms as essential partners, we pave the way for inclusive growth, job creation, and a thriving market that benefits businesses, employees, and communities alike in South Africa.

There are several ways in the retirement fund, advisory, insurance and investment industries whereby larger firms can support the growth of smaller firms. The first and most obvious is to see the benefits, like diversification of investments, rather than the risks of supporting smaller firms. Support through Enterprise and Supplier Development schemes are another. We’ve seen partnerships for retirement fund administration. All of this, albeit too limited at present, lends towards a healthier South Africa.

Ubuntu – “I am because we are” – collective responsibility and interconnectedness in society.

ENDS