Dirk Jooste, Fund Manager at PSG Asset Management

Compared to equity markets, fixed income markets tend to be seen as being more placid and predictable (and even, dare we say it, rational). However, fixed income markets are currently undergoing some pivotal changes that will have material implications for how investors’ portfolios are constructed.

More conservative investors tend to be more reliant on the fixed income assets in their portfolios to help secure the required long-term objectives, including income generation and capital preservation. However, fund managers cannot be complacent and assume fixed income assets will always achieve these goals. As prices change, fund managers must carefully assess the available returns and associated risks, ensuring their clients are being adequately rewarded for these risks, and that overall risks are appropriate.

For PSG Asset Management, not overpaying for assets is a key driver of not only managing risk, but also delivering the returns that help investors achieve their required long-term outcomes. We therefore adopt a dynamic approach in our portfolios, adjusting our preference for assets as prices and risk/return characteristics shift.

Below we explore how shifting market dynamics have led us to adjust allocations in the PSG Stable Fund over time, to our investors’ benefit – firstly looking at situations that lead us to lean into market weakness (and buy), and secondly situations that we believe signal over-priced assets (hence prompting sales, or leading to us avoiding investment).

Buying at the right price: Finding value in different areas as market drivers change

Prior to the disastrous Nenegate scandal (when President Jacob Zuma replaced the then Finance Minister Nhlanhla Nene with short-lived appointee Des van Rooyen in December 2015), South African bonds were delivering low real yields. As a consequence, we held relatively little duration in our funds, with minimal exposure to longer-dated bonds. Following van Rooyen’s “Weekend Special”, however, fears around South Africa’s fiscal future intensified. In our view, many of these fears were overblown, pricing in a full-blown default while there was little evidence to suggest that South Africa’s fiscal position would reach such a dire state, even in the medium term. While debt sustainability could be impacted by weakened governance and higher required yields in the long term (all else being equal), the steepening yield curve implied a debt spiral was a foregone conclusion and would occur imminently.

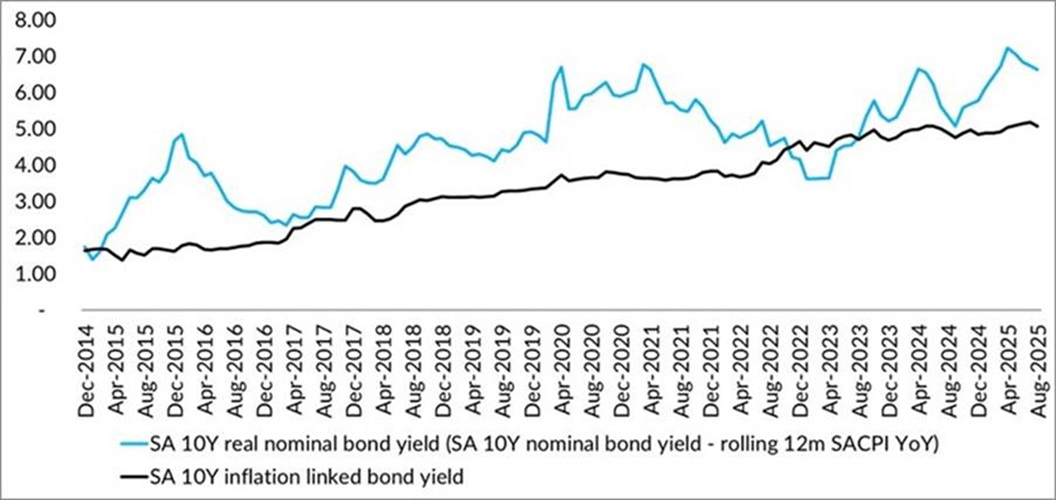

Given our assessment of the situation and what we considered to be low immediate risks to client capital, we started taking on more duration in our funds in early 2016. In the period leading up to Nenegate the South African nominal 10-year yield was below 8% while inflation averaged 6%, meaning bonds offered 2% real yields. In early 2016, real yields available on South African 10-year nominal bonds exceeded 4%, and they have subsequently averaged 4.8% p.a., making them an attractive asset despite concerns about South Africa’s fiscal position.

SA real yields: nominal and inflation-linked bonds

Source: PSG Asset Management and Bloomberg

Today, the 10-year yield is above 9% with current inflation at around 3.3%, and 5-year Bureau of Economic Research (BER) inflation expectations at 3.6%. While yields on 10-year bonds have retreated from highs associated with election uncertainty last year, the real yields on offer today are still attractive considering how much inflation expectations have moderated. For a low-equity funds, the portfolio contribution of an asset delivering a predictable 5% real return is incredibly valuable.

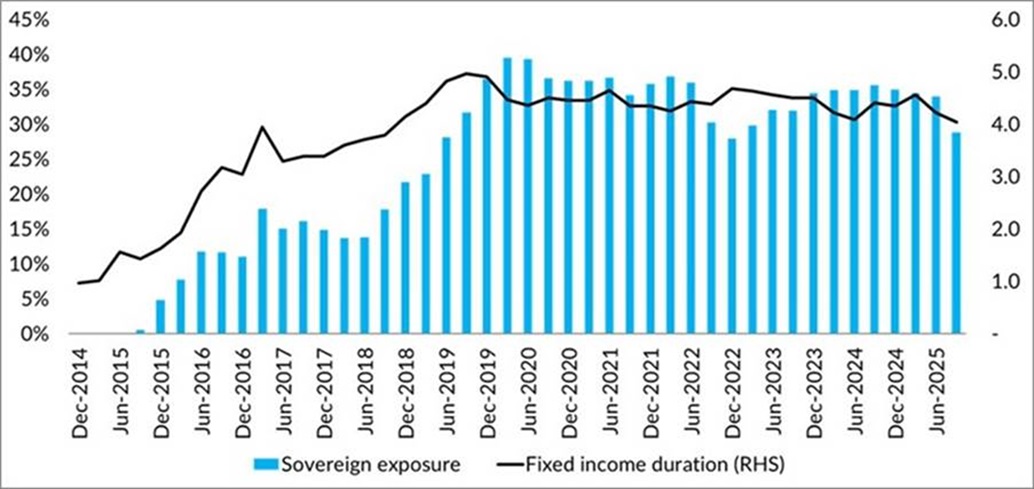

PSG Stable Fund sovereign exposure and duration

Source: PSG Asset Management

Returns in markets are never static, ever shifting in response to market dynamics. Since 2019, we have seen inflation-linked bonds become more attractive and we added these to our portfolios. If they can be bought at an attractive price, inflation-linkers secure a return that is immune to inflation, credit and interest rate risk. Thus, they provide an attractive pathway to securing a guaranteed real return for clients. However, as with all things, the price at which these assets are bought is critical.

Shying away from expensive assets that do not adequately reward investors for the risk taken

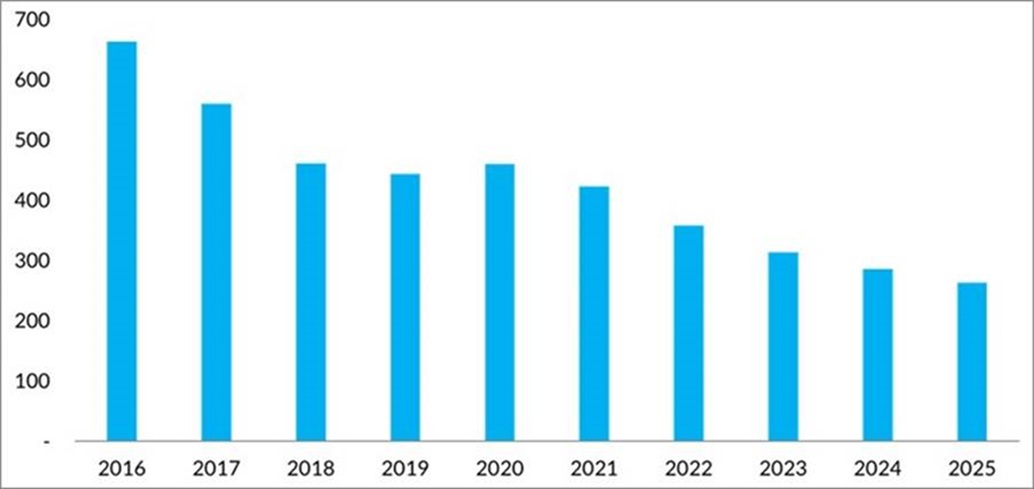

We currently see an interesting dynamic at play in the market for additional tier 1 (AT1) securities. These assets are at the highest end of the credit risk spectrum, and are issued by banks in the post-Global Financial Crisis (GFC) era so that bank regulators can ‘bail in’ these bonds. This bail in entails the regulators writing off the bank’s obligation to creditors (the bondholders) in the event that a bank is in distress, instead of using taxpayers’ money to bail out the bank (read more here). These assets are highly technical, and while they repriced globally after the Credit Suisse crisis (when CHF16billion of Credit Suisse AT1 assets were written off by the Swiss Financial Market Supervisory Authority (FINMA) in March 2023), they have not substantially repriced in South Africa. We believe this is symptomatic of a lack of supply of, and excess demand for, high-yielding fixed income assets in South Africa.

When we compare the spread of AT1 instruments to the price-to-earnings ratios (PEs) of bank shares, it is apparent that risk is being priced completely differently in fixed income markets relative to equity markets. While AT1s seem to be considered an attractive fixed income asset with asset managers bidding them up, banks themselves are trading at crisis equity valuations. In our view, the risks in AT1 assets are being underestimated, while bank shares are looking significantly more attractive by comparison.

South African Big 4 Banks

Rolling One-Year Forward P/E Ratio

Sources: PSG Asset Management and Bloomberg

SA Big 4 Banks Average AT1 issue spreads by year

Sources: PSG Asset Management and JSE

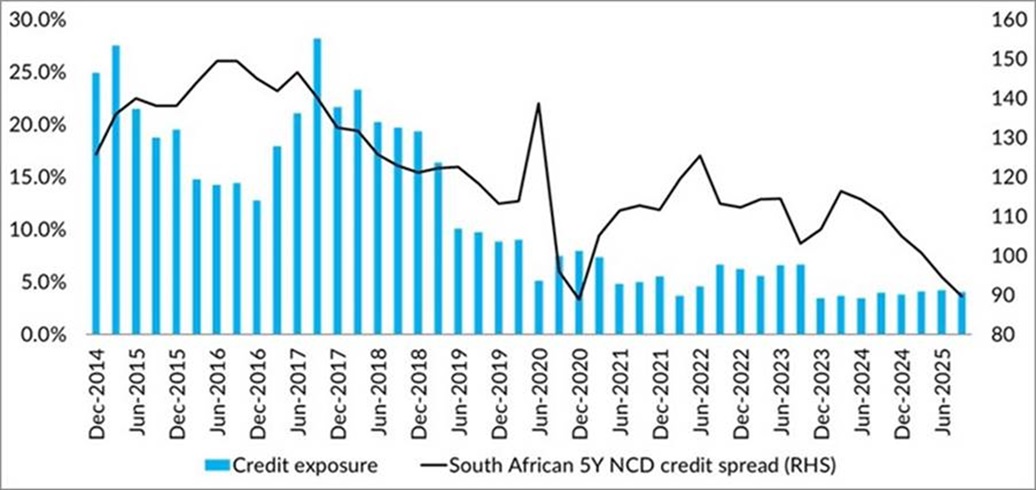

We see a similar trend across South African credit markets, with substantial demand for these instruments even at yields that we don’t believe fully compensate investors for the credit risk. With credit expensively priced, in our view, we have much less credit today than we have historically held. The decline in credit holdings in PSG Stable Fund as credit becomes less attractive (illustrated by the 5-year NCD credit spread) is evident in the chart below.

PSG Stable Fund Credit Exposure

Source: PSG Asset Management and Bloomberg

Looking forward: the importance of adopting a dynamic approach

The examples above highlight that fixed income markets shift on an ongoing basis. In order to extract maximum value for investors, it is necessary to be conscious of the price paid, and to ensure investors are adequately compensated for the risks they take on. To our minds, the environment that lies ahead is likely to be one marked by volatility and high levels of uncertainty – something to which fixed income markets are also not immune. Therefore, investors are well advised to partner with investment managers who can adopt a dynamic approach to portfolio management and adjust portfolios by leaning into areas of pricing weakness while continuing to ensure investors are well rewarded for the risks they take on.

ENDS