Alan Wood, Head: Investment Consulting at Simeka Consultants and Actuaries

A retirement fund is a long-term investment vehicle. Most defined contribution retirement funds in South Africa use lifestage investment strategies.

Lifestage strategies ensure that you are invested appropriately throughout your retirement fund journey by:

- Growing your retirement fund savings when you are further away from retirement, and

- Protecting your retirement fund savings as you approach retirement.

To achieve this, retirement fund savings for members who are more than about seven years from retirement are typically invested in a high-growth investment portfolio, targeting CPI+5% to 6%. As members near retirement, retirement fund savings are gradually transitioned, either into a more conservative portfolio that often targets a return of CPI+3%, or to a strategy that targets income replacement goals.

The growth portfolio often invests over 70% of its assets in local and offshore equities to achieve CPI+5% to 6%. While equities perform well long term, they can experience short-term volatility.

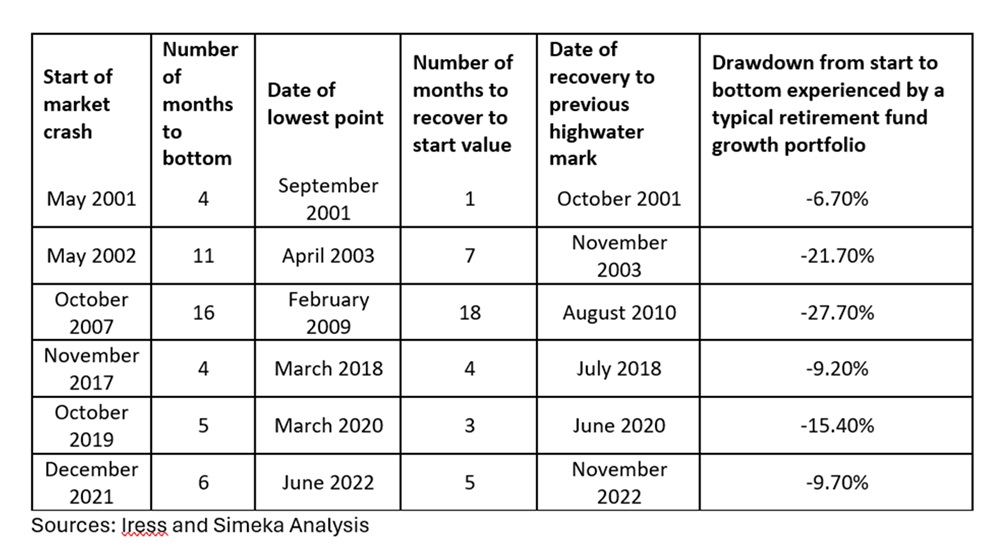

There have been a few periods of sharp sell-offs in equity markets in the last 25 years. The table below is a reminder of how these sell-offs would have impacted the value of assets invested in a typical South African retirement fund growth portfolio (with 70% in equities):

We are currently experiencing a broad sell-off in global equity markets, which is affecting members retirement savings. It is important to focus on the long-term benefits of equity investing. Historically, despite short-term uncertainty, equity markets have outperformed other asset classes over time, even after economic downturns, trade disruptions or political uncertainty.

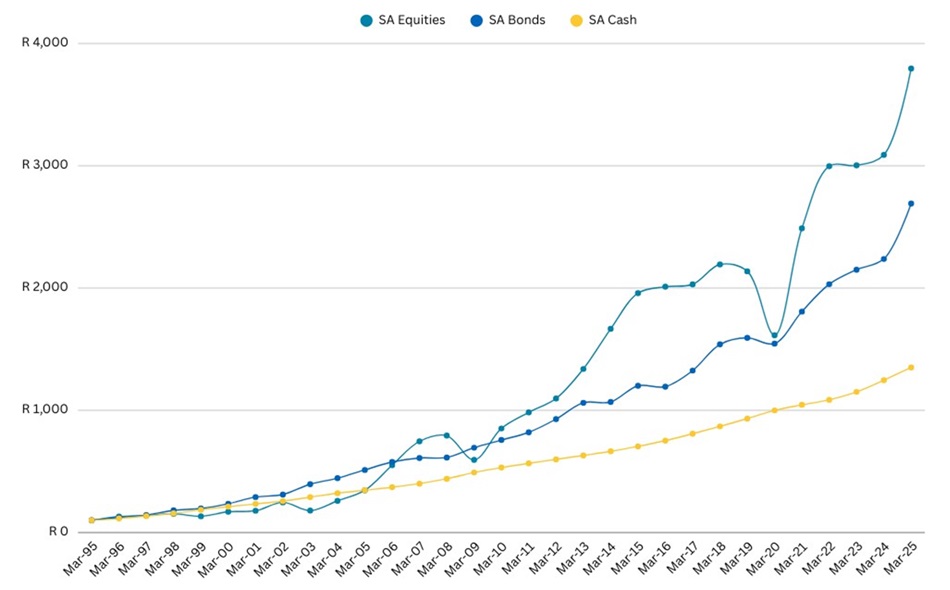

Graph 1 illustrates the performance of the local equity market, bond market and cash over the past 30 years. Despite several sell-offs, the local equity market, along with global markets, has recovered and delivered strong performance.

Graph 1 – 30-year Local Asset Class growth of R100

Source: Iress

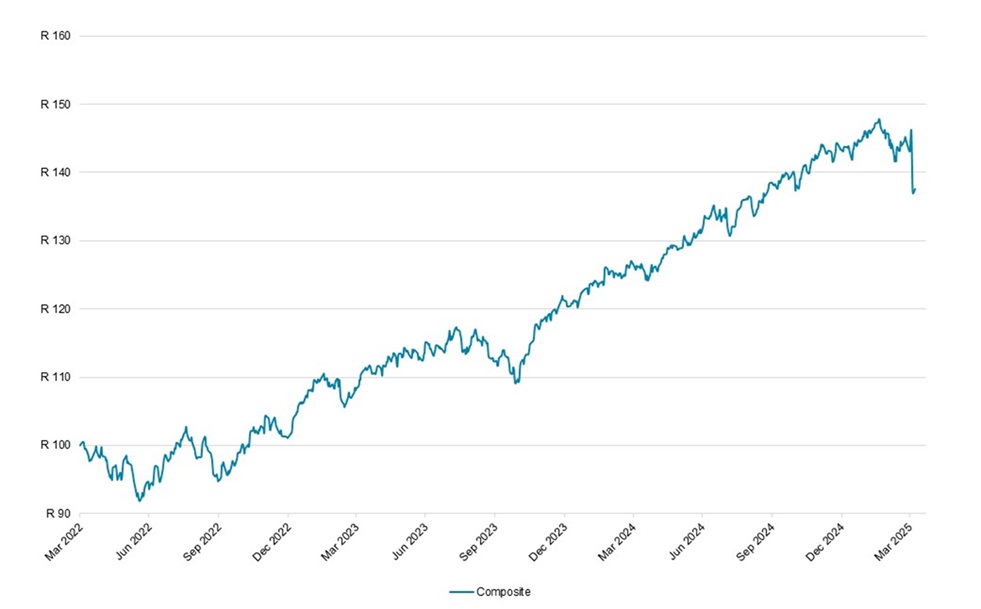

In graph 2, we have also shown how the retirement savings of a member invested in a typical growth portfolio would have performed over the last 36 months. Despite the sharp reduction in value in the last week, members invested in a typical retirement fund growth portfolio (with 70% in equities) would have achieved very strong investment performance over the last three years.

Graph 2 – Value of R100 invested in average retirement basket on 1 January 2025

Sources: Iress and Simeka Analysis

Factors that caused the recent sell-off

Global equity markets began to sell off earlier this year due to uncertainty from US President Donald Trump’s trade tariff policies. Initially, tariff implementation was limited to a few countries and industries. On 2 April 2025, President Trump announced widespread tariff increases impacting many countries. These hikes were more significant than expected and triggered investor panic. Investors fear these tariffs could significantly reduce global trade, potentially leading to a global recession or at least a recession in the US.

Economic commentators believe there is a 40% to 50% chance that the US will enter a recession in 2025. Other countries, including the UK, many European countries and South Africa, are also vulnerable, while growth in China and India may be lower than expected. Tariffs could raise prices globally, especially if other countries impose retaliatory tariffs on the US.

There is a risk of a phenomenon known as stagflation, where we experience high inflation and a recession at the same time. Stagflation is a serious problem, rendering the tools available to governments and central banks to boost economic growth less effective. These tools – government spending and lowering interest rates – may cause higher inflation, so there are limits to how these tools can be used in times of stagflation.

While these factors have triggered short-term fluctuations, they do not change the long-term potential of equity markets to generate wealth. Historically, markets have recovered from corrections, reaching new highs over time.

The power of long-term investing

Equities have consistently outperformed other asset classes such as bonds and cash over extended periods, as shown in Graph 1. While short-term movements can be unpredictable, the long-term trend has been one of growth. Key reasons why staying invested remains a sound strategy include:

- Markets reward patience – Over decades, equity markets have proven resilient, overcoming recessions, financial crises and geopolitical events. Investors who stay the course have historically seen strong long-term returns.

- Compounding growth – Time in the market, rather than timing the market, is what builds wealth. Long-term investors benefit from reinvested dividends, earnings growth and market recoveries.

- Current valuations present opportunities – While some equities were previously overvalued, recent market declines have created opportunities for long-term investors to buy quality assets at more attractive prices.

We have experienced a long period, especially in global equity markets, where passive investment strategies have outperformed active managers. In turbulent times, active managers typically outperform.

In summary

- Stay committed to your investment strategy – A retirement fund designed with a long-term perspective ensures a diversified approach to managing risks while capturing growth opportunities.

- Place trust in diversification – Retirement funds will provide resilience over time when structured to spread risk across different asset classes, sectors and regions.

- Avoid reacting to short-term volatility – Selling in response to temporary market declines could result in locking in losses and missing future recoveries.

While short-term market movements can be unsettling, history has shown that patience and discipline in equity investing lead to superior long-term outcomes.

ENDS