Kyle Hulett, Co-Head: Investments at Sygnia

Markets reached new highs in August, bolstered by easing tensions as US President Trump reduced pressure on Russian President Putin. Significant headwinds are approaching the US consumer, however, driven primarily by rising inflation linked to tariffs. US companies have absorbed most of the costs from Trump’s tariffs until now, but this burden is increasingly being shifted to consumers, which is expected to push inflation higher. Goldman Sachs forecasts that the Fed’s preferred inflation gauge, core personal consumption expenditures (PCE), will rise to 3.2% by December 2025 on tariff related cost pressures.

The impact of tariffs is tangible and measurable: customs collections surged to $27 billion in June – four times the 2024 monthly average – confirming that tariffs are being paid without significant avoidance or reduction in import volumes. US firms have absorbed approximately 64% of the tariff costs thus far by managing inventories, but this is expected to drop sharply to 8% as companies pass costs directly to customers. This expectation is supported by corporate earnings guidance that reflects improved margins and by the July US producer price index (PPI), which jumped 0.9%, marking its largest monthly increase since June 2022. The primary services component of the PPI – a proxy for US corporate profit margins – remains elevated, suggesting tariffs will likely be reflected in higher consumer prices, sustaining headline inflation.

Foreign exporters have absorbed little of the tariff costs to date, with steady import prices reflecting no significant discounts. While exporters may take on a slightly larger share (rising from 14% to 25% according to Goldman Sachs) if import volumes decline sharply, the brunt will fall on US consumers, who absorbed only 22% of tariff costs through June but are expected to see their share surge to 67% by October as companies transfer the burden downstream.

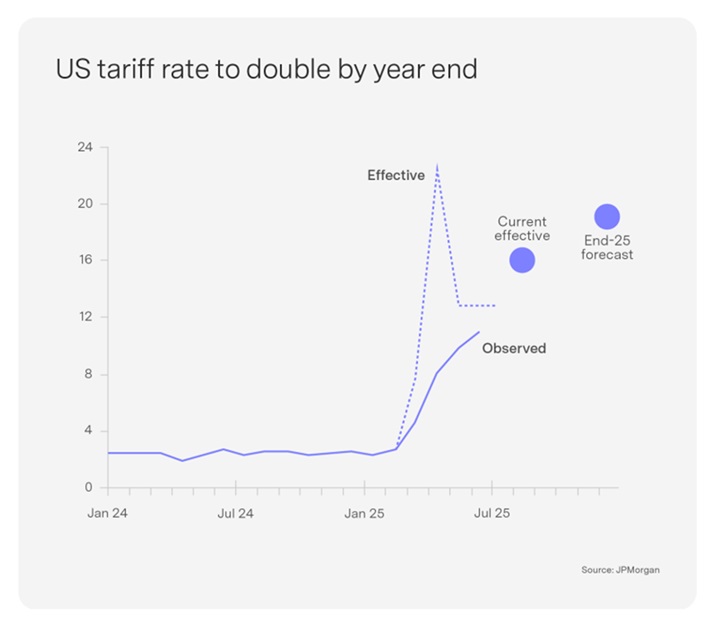

JP Morgan estimates that core measures of underlying inflation remain elevated at around 3% or higher, and the effective tariff rate is projected to nearly double to 20% by year-end, magnifying the tariff impact on consumers sixfold. This increasing pass-through of costs to consumers suggests inflation may rise beyond current market expectations.

The resulting inflationary pressures could unsettle markets in the near term and may dampen consumer spending over the longer term.

ENDS