Archie Hart and Varun Laijawalla, Emerging market equities portfolio managers, at Ninety One

Earlier this year, we highlighted the shift in volatility regime in debt markets – characterised by a blurring of lines between the behaviour of emerging and developed markets (DM). Emerging Market Equities Portfolio Managers Archie Hart and Varun Laijawalla argue that this shift extends beyond bond markets.

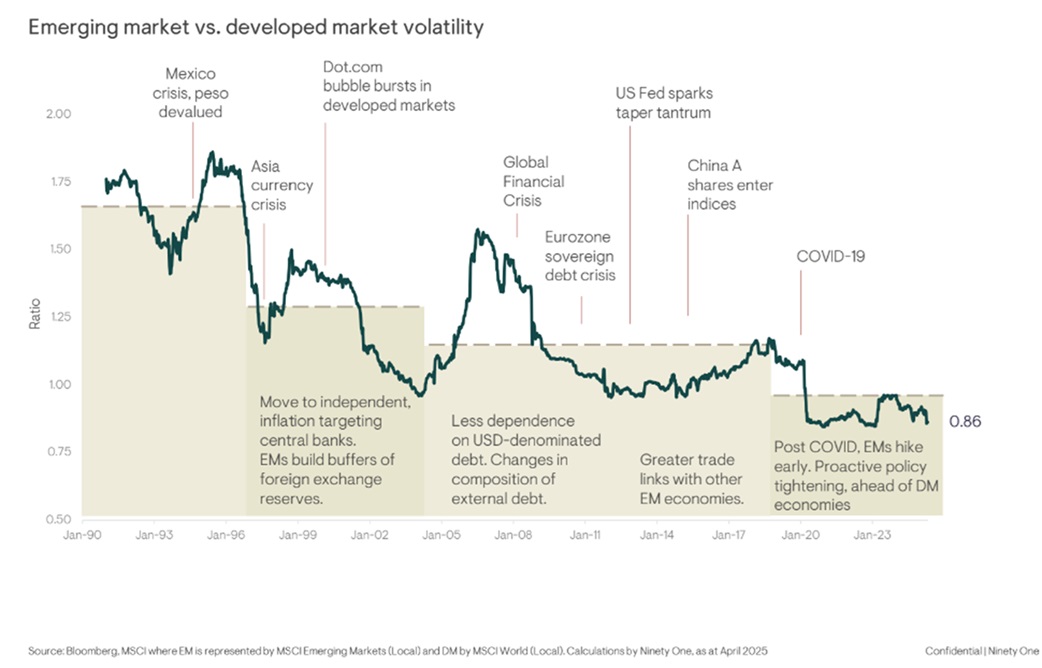

Ten years ago, equity market volatility in emerging markets (EM) was 1.5 to 2 times higher than in developed markets (DM). That difference has gradually fallen as volatility has converged (see chart). While part of this trend is due to shifts in index composition, it also reflects a relative strengthening of EM fundamentals and a broader move to orthodox policymaking in many EM economies over recent years. These are important considerations in the context of global equity portfolios today, which are typically underweight EM.

Over the past few decades, various developments have transformed EM equities into a higher-quality asset class that is more resilient to external shocks.

Key among these developments are meaningful reforms in emerging market economies, which have improved macroeconomic frameworks, fiscal discipline and strength of institutions. Archie Hart, Co-Portfolio Manager, Emerging Markets Equity: “For example, Brazil’s Novo Mercado, introduced in 2000 and revised since, established stricter corporate governance and disclosure standards for listed companies, increasing investor confidence. Similarly, South Korea introduced comprehensive corporate governance reforms following the 2008 financial crisis, improving transparency and investor protection. In 2014, India’s Securities and Exchange Board (SEBI) mandated stronger disclosure requirements and governance rules, enhancing market integrity. These and several other targeted policy reforms have steadily helped lower volatility in emerging equity markets, aligning them more closely and sometimes favourably with developed market levels.”

At a corporate level, companies across emerging markets have raised their operational standards, governance and transparency, increasingly aligning themselves with international best practices. This corporate evolution has strengthened investor confidence, contributing to the stability of emerging equity markets. Taken together, these reforms have narrowed the gap between emerging and developed markets, reshaping perceptions of risk and opportunity.

Recent global shocks have underscored the growing resilience of emerging markets. During the COVID crisis of March 2020, US equity volatility notably surpassed that of emerging markets. The MSCI Emerging Markets index exhibited substantially lower volatility than DM[1]. More recently, the first half of 2025 has been volatile, with a radical resetting of US trade policy (“Liberation Day”) and armed conflict in the Middle East. Varun Laijawalla, Co-Portfolio Manager, Emerging Markets Equity: “Yet, emerging market equities have remained robust. While policy uncertainty in the US has intensified, within emerging markets, policy clarity and consistency are much greater. China has confirmed the importance of the private sector in its economy, India is pouring more concrete than it ever has, most of the Middle East is focused on economic progress, and Asia retains its strong economic competitiveness, particularly with technology.”

Economic, fiscal and monetary policies in emerging markets have become generally more pragmatic and conservative, with their direction better understood and accepted by markets. “In the context of tariffs, while trade is important, it is c35% of revenues in the emerging market equity asset class, and only 13% of revenues are driven by exports to the US. This, and a deeply discounted valuation, helps to explain why emerging markets have performed so well despite a surfeit of what could be described as bad news in H1,” said Hart.

Today, investors can access a more diverse and higher-quality asset class through EM equities. While careful stock selection remains essential in such a wide-ranging market, the asset class offers exposure to powerful growth stories and companies increasingly shaping global progress. Improvements in corporate governance, operational standards, and economic policymaking have laid a more stable foundation for long-term returns. Laijawalla concluded: “Crucially, these structural shifts have helped reduce volatility in EM equities, once seen as inherently riskier, to levels now comparable with, and at times even lower than, developed markets. As this transformation continues, so does the case for a strategic rethink of emerging markets within equity portfolio allocations.”

[1] Source: Bloomberg, MSCI where EM is represented by MSCI Emerging Markets (Local) and DM by MSCI World (Local). Calculations by Ninety One, as at June 2025

ENDS