Stefan Cloete, Junior Research & Investment Analyst at Glacier by Sanlam

The importance of compounding interest can never be underestimated, and it’s frequently hailed as a potent force that can turn small investments into large fortunes. Given its significant influence on both investors and borrowers, Albert Einstein is widely given credit for saying compound interest is the “eighth wonder of the world”.

What compounding means

Compounding returns can be explained as earning returns on both your original investment as well as on its subsequent returns. In a world of immediate gratification, investors need to develop and strengthen their patience. It takes discipline and patience to achieve your financial goals and long-term financial success, and we have the evidence to back this thinking.

The numbers don’t lie

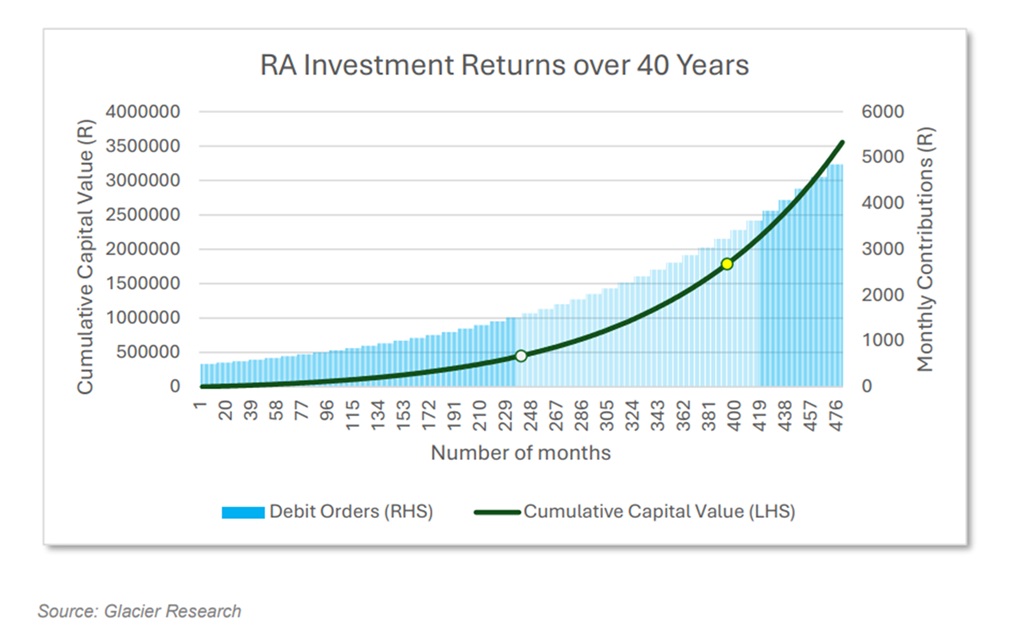

Let’s look at how a retirement investment grows over 40 years. Let’s assume the investment starts with a R500 monthly debit order that increases by 6% per year over a 40-year period. The investment also grows at 8% per year over a 40-year period.

It may surprise you to learn that halfway through the 40-year investment period, you would only have accumulated only around 12.6% of the final investment value. Interestingly, you only reach half of your final cumulative investment value in year 33 of 40 (or 82% of the predicted period).

This means that you get most of your investment growth in your final years of investment. In fact, you accumulate 50% of your final investment value in the last seven years or just 18% of the total period.

This really highlights the power of compound growth and supports the statement that it is the 8th wonder of the world. Like everything in life though, there is always a ‘but’.

In the case of compounding growth, three things are true:

- It is important to maintain objectivity.

- Time is your best friend in investing.

- The longer you invest, the more profound the compounding effect becomes.

Emotion has no place in investing

Patience is the key to investing. When looking at the following set of data, it also shows that you need to take emotion out of decision-making.

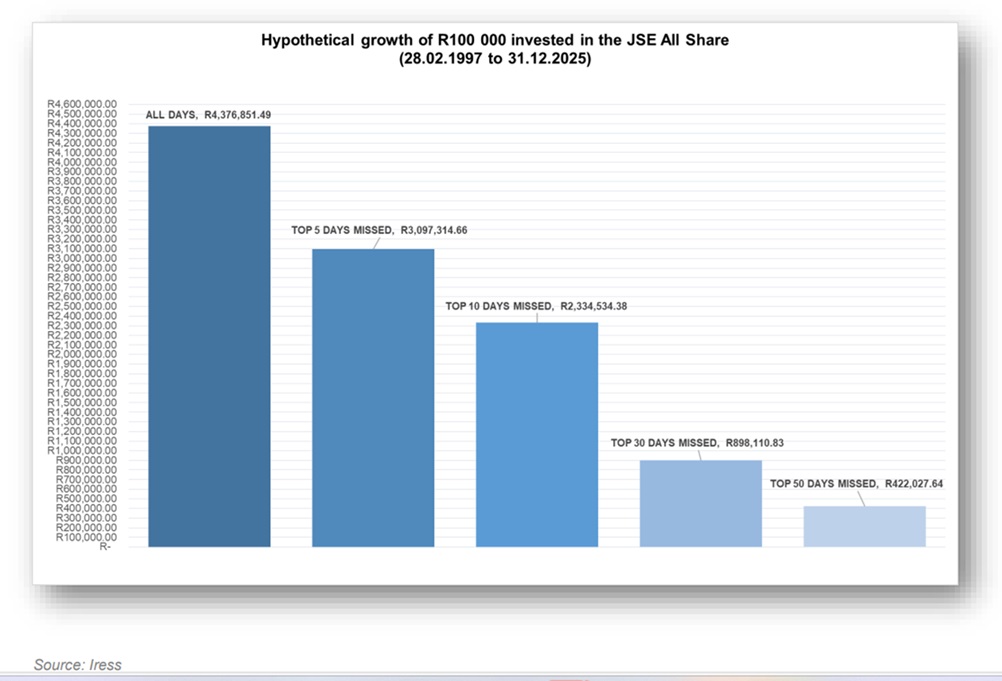

The following graph shows the investment returns of the JSE All Share Index from 1997 to the present, and how trying to time the market can have significant negative effects on your investment returns.

A hypothetical investment of R100 000, with no sales or withdrawals over the roughly 28-year period, would be worth R4 376 000 today. Now, imagine if you were a fairly active investor that regularly switched investments and/or sold out/bought into the market, and you missed the JSE All Share’s top five performance days. Missing just those days, would leave you with R1 279 000 (almost 30%) less at the end of the period, than if you had remained patient and fully invested. Further illustrating the point, imagine you had missed the top 10 performance days or top 30 performance days.

The above graph ends the debate. An investor should not be trying to time the market, but rather spend as much time as they can being invested in the market.

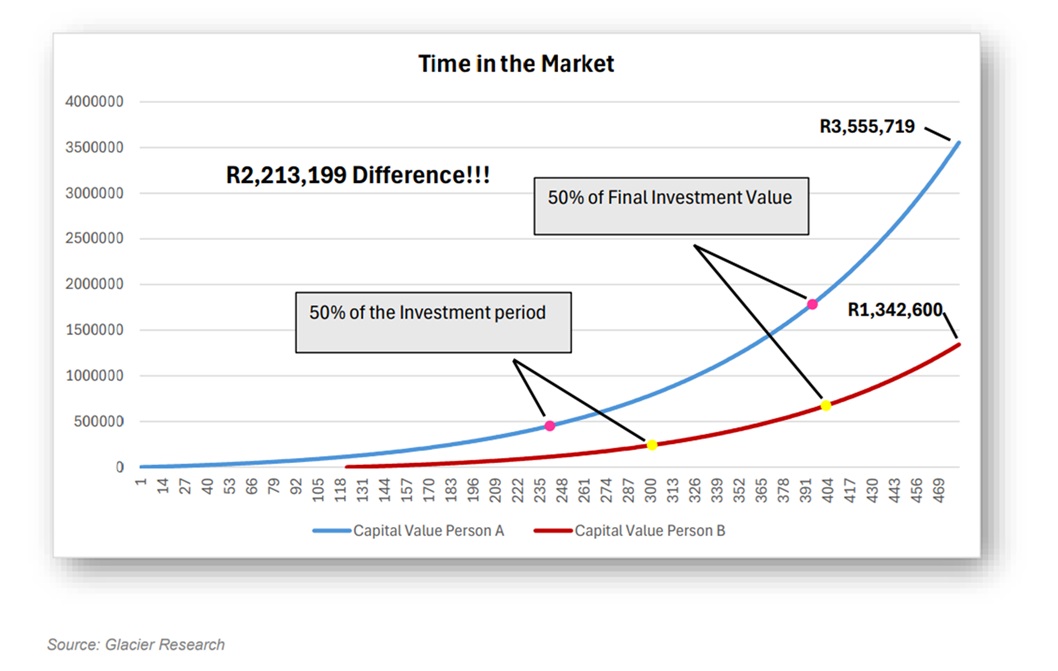

In the graph above we can see two people’s retirement journeys. Person A, has a retirement investment starting with a R500 monthly contribution that increases by 6% annually and the investment is growing at 8% per year over a 40-year period. Person B, has the exact same metrics, only Person B starts investing 10 years later than Person A. We can see that just the 10-year difference in investment horizons has a massive impact on the final value of investment, with Person A accumulating R3 555 719 – R1 342 600 = R2 213 119 more than Person B. Most of the investment growth occurs in the final years of the investment period, highlighting the power of compounding growth. It might surprise you to know that 50% of the investment growth occurs in the last 7 years, by halfway through the investment horizon, Person A has only accumulated roughly 13% of his final investment value.

While many investors believe that investing in the stock market can be likened to gambling. In fact, the opposite is true. Long-term investing in the stock market is not gambling. While the odds with a sports betting book, slot machine or blackjack table turn increasingly against the player the longer you play; the stock market historically rewards patience.

Over the last 96 years, through to the end of 2023, 94% of all 10-year periods have delivered a positive return for the S&P 500. Those odds are unlikely in the gambling world (Public.com). History has shown the longer the holding period, the greater the chances of a positive return/outcome.

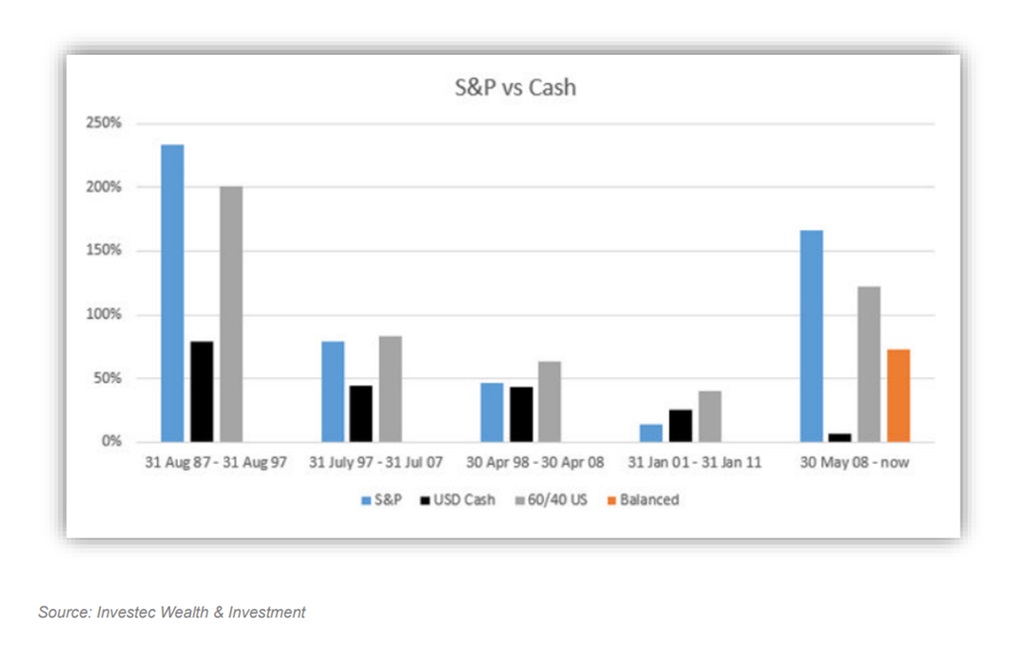

Have you ever considered what might have occurred if you had invested right at the peak before each of the last five major market crashes? The outcome may surprise you.

When comparing three indices—the JSE, the S&P 500, and the MSCI World Index—an investment in a balanced portfolio with 60% stocks and 40% bonds at the top of each market cycle performed significantly better than cash over the following ten years in every instance, apart from the JSE for the period 1987–1997, attributed to political instability at the time.

This demonstrates that timing does not matter when you invest, but that investing your cash over the long term is essential for generating returns.

The key to successful investing lies in patience and long-term thinking. Patience and discipline are essential for achieving long-term financial success. Timing the market or making hasty decisions often leads to unnecessary losses. As Peter Lynch wisely put it, “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” By maintaining a disciplined, patient approach, investors can avoid the pitfalls of short-term speculation and instead position themselves for enduring financial growth.

ENDS