Eugene Botha, Head: Research Hive at Momentum Investments

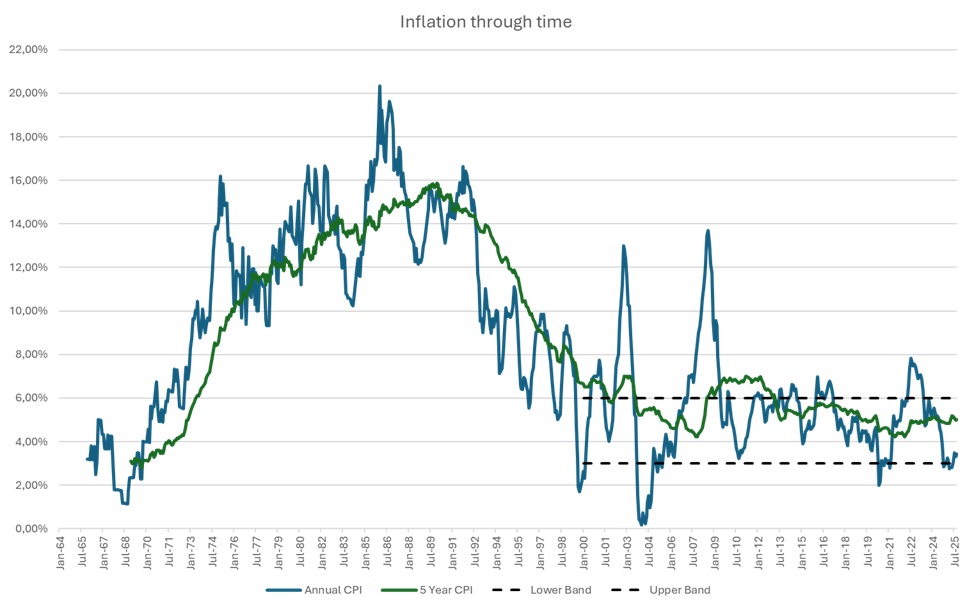

South Africa’s inflation-targeting regime, introduced in 2000, has been a cornerstone of monetary policy for 25 years. Moving away from an eclectic approach, the South African Reserve Bank (SARB) adopted a 3–6% target range for inflation, aiming to stabilise prices and anchor expectations.

Over the past 25 years, this framework has delivered notable success, with inflation volatility falling sharply and credibility improving. Yet, the midpoint of 4.5% remained high compared to global norms. Moving South Africa’s target to 3% aligns it with major trading partners, reduce inflation risk, and reshape the investment landscape.

Lower inflation reduces uncertainty, allowing for longer investment horizons and more effective capital allocation. It also narrows exchange rate volatility. SARB simulations suggest economic growth could rise by 0.25% within five years and 0.4% after a decade, driven by higher investment and fiscal savings from reduced debt-service costs.

Why does this matter? Inflation is not just a macroeconomic statistic – it influences every asset class. It affects discount rates, borrowing costs, and valuation multiples. Lower inflation may potentially compress country risk premia, reduce nominal yields, and alter the relative attractiveness of bonds, equities, cash, and real assets. For investors, understanding these dynamics is critical for both tactical positioning during the transition and strategic allocation in the new regime.

Historical perspective

Since 2000, inflation averaged 5.3%, with volatility falling sharply after 2010 – from 3.7% in the early years to just 1.2% in the last decade. The success rate of keeping inflation within the band stands at 78% over five-year periods, but inflation has tended to cluster near the upper bound, reflecting structural rigidities such as administered prices and fiscal deficits.

Source: Momentum Investments & Bloomberg

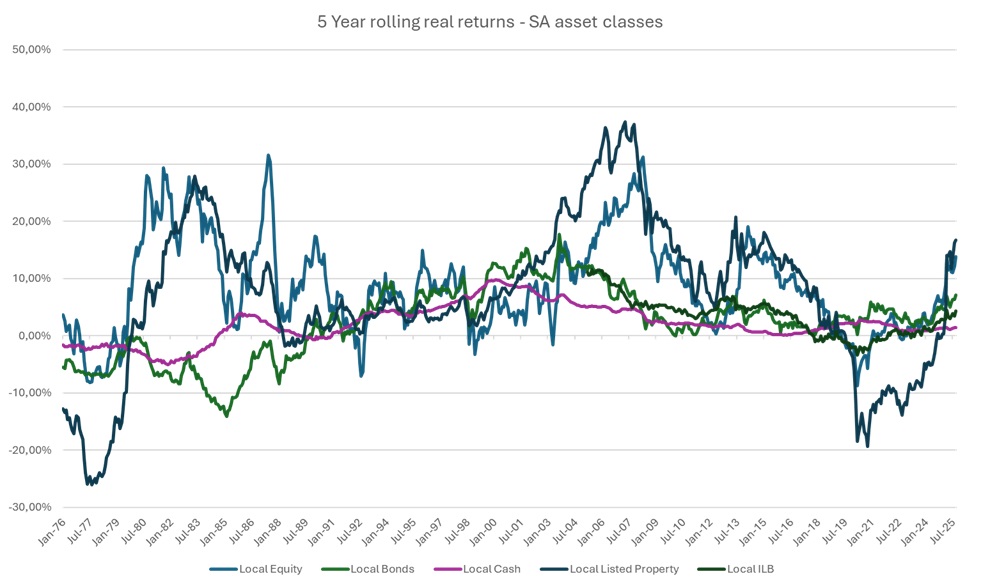

This stability of inflation coincided with profound changes in asset class performance. Local equities delivered strong long-term returns, but with sharp drawdowns during crises. Bonds, once plagued by negative real returns in the early years, became a reliable source of income as inflation stabilised. Cash, however, rarely outpaced inflation, offering persistently low real returns, while listed property moved between deep losses and spectacular gains, reflecting its sensitivity to macro shocks.

Periods of higher inflation compressed real returns across the board. Conversely, during times of moderate inflation (2010 to 2019), asset returns were robust: equities and bonds outperformed inflation, and volatility was subdued. This pattern underscores the link between inflation stability and asset performance: when inflation expectations are anchored, financing costs fall and real returns can improve.

Source: Momentum Investments & Bloomberg

Short-term effects

Markets don’t like surprises, but this won’t be one. As the target shifts to 3%, it will occur over time, not overnight, and as a result, it will not be a straight line. In the short term, monetary policy may tighten to anchor expectations, creating headwinds for growth-sensitive assets. Bonds might initially underperform if yields rise, but should rebound strongly as inflation falls and term premia compress. Cash will offer stability, and inflation-linked bonds should retain tactical appeal as hedges.

Property and real assets face mixed prospects. Lower inflation reduces nominal rental escalations and property price growth, but cheaper financing offsets some of this drag.

For tactical positioning, it offers us as investors opportunities to capitalise on. These are normal market dynamics, not reasons to worry.

Impact on long-term expected returns of asset classes

Once inflation stabilises near 3%, the risk-return profile shifts decisively. Over time, lower inflation may lead to adjusted return expectations across different asset classes. While there may be modest shifts in long-term risk premia assumptions, these are expected to be incremental and well within the bounds of our strategic frameworks.

While we don’t expect major changes to the asset class dynamics in a lower inflation environment, it’s worth noting how different asset classes may respond:

- Income-generating assets may become more attractive as their inflation-adjusted returns improve.

- Growth-oriented investments could experience valuation shifts, but their long-term potential remains supported by underlying economic and business fundamentals.

- Low-yielding instruments may continue to face challenges to deliver significant real returns unless interest rates adjust meaningfully to reflect the new inflation landscape.

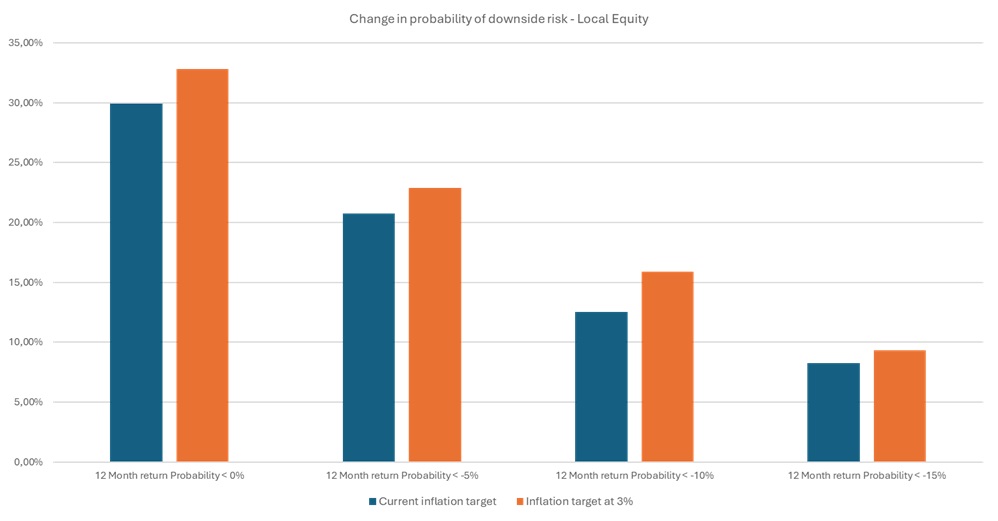

Impact on downside risk

If inflation reduces structurally, expected nominal returns across asset classes often decline (due to lower discount rates and growth assumptions). This means portfolios earn less nominal return while volatility remains similar, pushing more outcomes into negative territory.

When inflation therefore decreases to 3%, downside risk metrics for local equity, as an example, would worsen slightly.

Probabilities of negative returns rise across thresholds: for example, the chance of a 12-month return below 0% increases from ~30% to ~33%, and below -10% from 12.5% to 15.9%. This reflects that a lower inflation assumption amplifies relative downside risk, even though nominal market volatility remains unchanged. Normal market ups and downs feel riskier and therefore the chances of falling short – and the size of losses in bad scenarios – both potentially increase.

Despite these challenges, risk is actively managed through:

- Diversification across asset classes and geographies.

- Continuous monitoring of drawdown limits.

- Stress testing for severe market shocks and low-return environments.

- Dynamic asset allocation to keep risk within agreed tolerances.

- Liquidity buffers to ensure resilience under stress.

Strategic asset allocation: Stability amid change

Our long-term strategic asset allocation framework is designed to be robust and adaptive. The framework is built to withstand a range of macroeconomic scenarios, including shifts in inflation dynamics. As such:

- We do not anticipate significant changes to long-term asset allocations.

- Portfolios remain well-aligned to meet long-term investment objectives.

- Any future adjustments will be carefully considered and gradual, ensuring continuity and stability in portfolio construction.

For investors, the message is clear: prepare for a world where inflation risk is lower, interest rates are structurally lower, and real returns are more predictable. With inflation at 3%, the hurdle for beating inflation is lower, improving the likelihood of success for portfolios targeting real growth. This is particularly beneficial for long-term investors seeking to preserve and grow purchasing power.

While the path to lower inflation may be uneven, our strategic approach remains grounded in long-term fundamentals. History shows that when inflation falls and stays low, markets reward patience and discipline. Therefore, the best strategy is to stay the course, remain diversified, and think long-term.

ENDS