Kyle Hulett, Co-Head: Investments at Sygnia

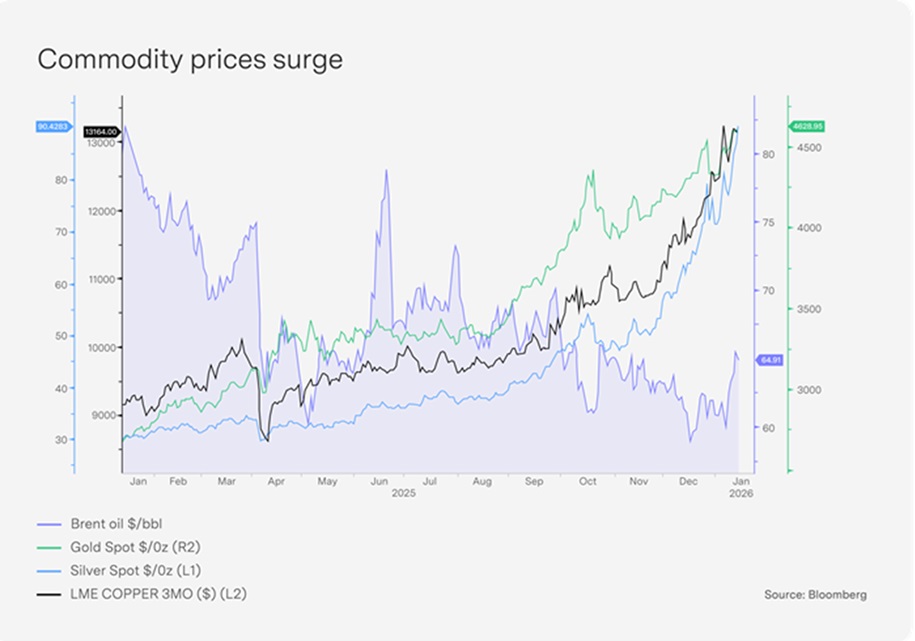

Metal and energy prices surged in January as investors navigated multiple global crises. Gold, silver, platinum, copper and tin reached new highs, while oil rebounded sharply. The rally stems from attacks on Federal Reserve (Fed) independence, tariff threats and escalating geopolitical tensions.

Fed under pressure: The Trump administration challenged the Federal Reserve’s independence, prompting a weaker dollar and a flight to commodities. Fed Chair Jerome Powell faces potential crim[1]inal charges about a headquarters renovation project. Former Fed chairs Janet Yellen, Ben Bernanke and Alan Greenspan condemned this as an “unprecedented attempt to use prosecutorial attacks to undermine [Fed] independence” and warned it could trigger inflation and economic instability. Separately, media reports indicate that the Supreme Court justices are sceptical of Trump’s arguments against Lisa Cook, suggesting she may remain on the Federal Open Market Committee and easing some concerns about Fed independence.

Oil rallies on Iranian crisis: Brent crude climbed above $70 per barrel amid Middle East supply fears. Mass protests have erupted across Iran. Trump suggested “very strong options”, including military action, and he announced a 25% tariff on any nation trading with Iran, directly affecting China and India – Iran’s top trading partners. Risks of a US strike on Iran are likely to sustain risk premia on oil prices after the arrival of the US aircraft carrier USS Abraham Lincoln and three warships in the Middle East.

Resource control disputes: Two separate conflicts have highlighted the growing importance of resource control.

- Greenland: Greenland holds strategic rare-earth deposits and military base locations. After threats to buy, annex or invade Greenland, Trump backed down on using force and retreated on proposed tariffs against European nations who opposed him. Trump still wants Greenland and claimed a “framework of a future deal”, but the Danes said the Greenland issue is not up for debate.

- Venezuela: Following the US’s capture of Nicolás Maduro, Venezuelan leader María Corina Rodríguez gave her Nobel Peace Prize to Trump while negotiating exclusive US oil access. Access to Venezuelan oil would enable President Trump to substitute Canadian heavy crude imports with a comparable alternative, while enforcing his proposed 100% tariffs on Canada. Challenges remain, however, as Maduro loyalists retain influence and reviving output to pre-2019 levels of about 2 million barrels/day would require major Western investment – unlikely given the political uncertainty. The action also risks escalating US-China tensions, as China is South America’s top trading partner

The combination of geopolitical instability, trade policy uncertainty and challenges to central bank independence has created an unusu[1]ally volatile environment for the dollar and commodity markets. Notably, though, the liquid bond market is not showing material signs of inflation from either the commodity price increases or fiscal largesse associated with the debasement trade, suggesting that most of January’s events were sabre rattling and distractions – if that is the case, the less liquid commodity markets should expect a pullback.

ENDS