Finalisation of the budget may take some time. While this has always been the case, prior to the GNU it was a rubber-stamping exercise that went unnoticed because of the ANC’s majority. Post the GNU a majority vote in favour of the fiscal framework is required, necessitating that the DA and ANC both vote to pass the budget. The DA has already stated that it rejects the latest budget, which was presented on 12 March, on the grounds that the party disagrees with the proposed VAT increase of 1% over two years (0.5% VAT increase from 1 May 2025, and a further 0.5% increase from 1 April 2026).

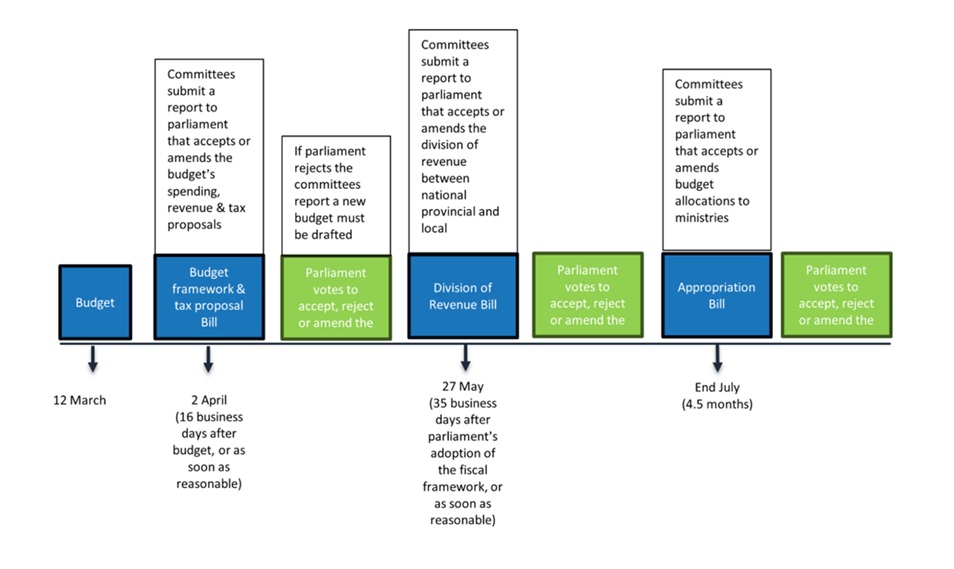

The process of signing a budget into law requires that four committees, each comprised of the full spectrum of political parties, accept or amend three ‘budget bills.” The committees draft reports on each bill and these are submitted to parliament within prescribed timeframes (Appendix A). Parliament then votes to accept, reject or amend the bills.

The first step is for finance committees to report to parliament on the Money Bill. Once the Money Bill is signed into law then the Division of Revenue and Appropriation Bills can be put before the National Assembly (Appendix A). The signing of the Money Bill into law requires that parliament vote on National Treasury’s fiscal framework i.e. levels of expenditure, revenue (including proposed taxes), borrowing and debt interest cost as set out in the budget and “ensure(s) that the cost of recurrent spending is not deferred to future generations”, among other things.

Voting on the Money Bill is expected to take place in parliament 16 days after the budget is tabled i.e. April 2nd or as soon as is reasonably possible. This year there is a risk that it will take longer than the prescribed 16 days for the ANC and DA to negotiate a fiscal framework, in which case the vote will be delayed. And, if the parties cannot come to an agreement, the Money Bill will be rejected by parliament and the National Treasury will need to go back to the drawing board and draft a new budget.

What does the DA want?

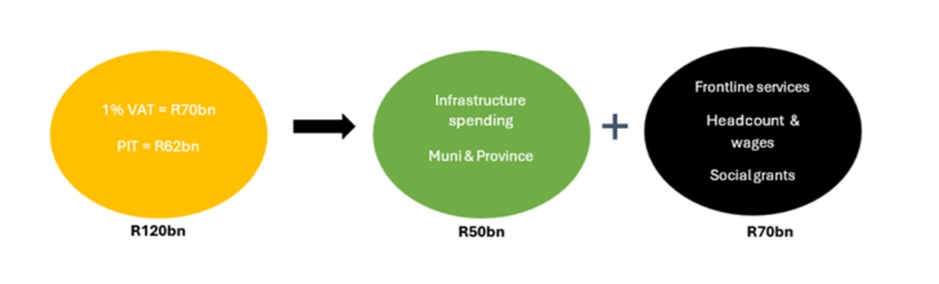

The March 12 budget proposes a 1% VAT increase to raise R70bn over three years and not adjusting PIT tax brackets by inflation to raise a further R62bn (Figure 1). This additional R120bn is to be spent on municipal and provincial infrastructure (R50n), essential frontline services, wages and social grants (Figure 1).

The DA argues that instead of raising VAT, the government should reduce wasteful spending. The party contends that South Africa does not have a shortage of tax revenue, it has “a shortage of scrutiny” (https://www.da.org.za/2025/02/budget-2025-growth-and-jobs-not-taxes). The DA wants a three-month comprehensive spending review, including an audit of ghost employees and reductions in spending on travel, catering and advertising, which it asserts could save at least R100bn. The DA proposes that the audit will allow R60bn to be reprioritised to fund essential services such as frontline healthcare workers, teachers, SAPS personnel, the wage agreement and increases in social grants.

Figure 1: Budget’s proposed tax hike to raise R120bn; R50bn for infrastructure and R70bn for consumption

Source: National Treasury, Matrix

Our view is that the DA will not accept a budget which does not accommodate a spending review, co-chaired with the ANC. No objection has been raised to increasing PIT revenue by not adjusting income tax brackets, and so we expect that this will remain in place. We also think there is a chance the DA will compromise on a 0.5% increase in VAT, but not the full 1.0% and that they will relinquish their demands with respect to the expropriation act, which they will seek to challenge through the courts.

If agreement can be reached on the Money Bill, then parliament and the appropriation committees can move ahead with the Division of Revenue bill. This requires agreement on the division of revenue between national, provincial and local government and is expected to be put before parliament 35 days after the Money Bill is concluded. The final bill is the Appropriation Bill, which allocates revenue to ministries and has 4.5 months to be finalised.

Legal dispute over the powers of the minister of finance

The power of the minister of finance to implement taxes unilaterally is subject to legal dispute and we expect the DA will take this to the courts. There is currently confusion over whether the budget’s proposed VAT increase can be rejected by parliament or if it remains in place for 12 months after being tabled by the minister of finance, regardless of parliament’s vote to accept, reject or amend it. This is because of conflicting legislation. The Taxation Laws Amendment Act, 2016 states that “the VAT rate … will be effective from a date determined by the Minister … and continues to apply for a period of 12 months from that date subject to Parliament passing legislation giving effect to that announcement within that period of 12 months.’’ However, when VAT was increased in 2018 the committee’s report upheld the minister’s announcement and stated that VAT “will continue to apply for a 12-month period from the date of the budget and will only lapse at the beginning of the next financial year.” We expect this ambiguity to be rectified and that it won’t delay the signing of the Money Bill into law.

South Africa’s small, concentrated tax base argues against increasing taxes

South Africa’s tax base may be too small to carry additional tax increases without affecting growth negatively. According to the latest tax statistics, the top ten corporate taxpayers (0.001% of registered corporations) paid 21% of the R314bn collected in 2023/24, and just over 0.1% (1,050) of all registered corporations accounted for 70% of the total corporate income tax collected. With respect to concentration risk we note that the top four CIT contributors are the banks.

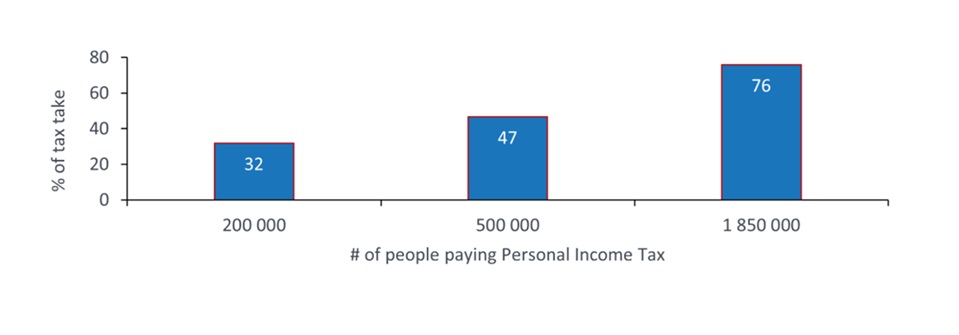

The personal income tax base is similarly concentrated, with 7% of taxpayers (500,000) paying almost 50% of PIT and 25% of taxpayers (1,850,000) paying 76% of PIT (Figure 2).

Raising PIT or CIT rates increases the burden on a small number of taxpayers, which limits the effectiveness of raising these taxes and raises the volatility of tax revenue collections. It also diminishes returns on investments, and reduces incentives for businesses to invest, impeding GDP growth.

Figure 2: The PIT tax base is small

Source: National Treasury, Matrix

Budget resolution will engender faith in the GNU, although challenges remain

If the ANC and DA succeed in negotiating a fiscal framework as we expect, this would be an immensely positive signal that the GNU is robust and functional with the potential to be enduring. If the compromise includes replacing a VAT increase with a spending review, which allows for the reprioritisation of R60bn from unproductive to productive spending, that would be an additional boon for sentiment, the growth outlook, the budget and the bond market. While we see it as unlikely, we concede that there is an outside chance that the parties fail to find a compromise both can live with, in which case bonds would weaken around 100bp.

Either way, challenges around debt sustainability remain. Without growth accelerating above 2% Matrix does not expect that debt will stabilise at 76% of GDP in 2025/26 as budgeted, even if spending is reprioritised in line with the DA’s spending review. However, the political economy is moving in the right direction, and if the GNU gains credibility it will reduce the cost of sovereign borrowing, resulting in a more virtuous circle.

Appendix A

ENDS