Dimpho Sekhaolelo, Quantitative Analyst, and Bastian Teichgreeber, Chief Investment Officer, at Prescient Investment Management

Roses are red, gold prices do not always stay green. Here is some insight on investing and what to do when things turn unseen.

Volatility, much like in relationships, is inevitable and at times causes investors to “fall out of love”. Doubt creeps in. Perhaps it was the wrong decision, perhaps the timing was off, or perhaps you are simply no longer into stocks. When markets are no longer rosy, people tend to make a number of costly mistakes on their investments, such as the following:

- Trying to time the market instead of staying invested.

Investors often wait for the perfect entry point or attempt to predict the bottom of a bear market. In reality, market turning points are notoriously difficult to identify, and waiting on the sidelines can result in missing the early stages of recovery. In addition, assets that performed well before a downturn may not necessarily lead the rebound.

- Panic selling during market drawdowns.

Once markets are already in decline, emotional selling rarely proves beneficial. Panic driven decisions lock in losses and increase the risk of missing the eventual recovery. Fear tends to cloud judgment, causing investors to exit long term investments at precisely the wrong time.

- Abandoning disciplined, evidence-based processes.

While downturns can present attractive opportunities, impulsive decisions and broad, unsystematic bets can increase risk. Not all sectors recover equally, making a structured approach essential.

- Ignoring investment horizon when making decisions.

Long term investors may overreact to short term volatility, while short term investors may remain too passive. It can be difficult to let go after investing significant time and capital, leading to blanket decisions across all assets. Both behaviours can be damaging when risk management is not aligned with time horizon and objectives.

- Incurring unnecessary transaction costs and locking in losses.

Frequent buying and selling in an attempt to de risk or time the market often results in higher transaction and execution costs. These costs compound over time and can materially erode returns, particularly when combined with selling assets at depressed prices.

None of this is new or profound. These insights are widely available, yet despite knowing better, investors still make the same mistakes. It’s like trying to convince a friend to leave a relationship they know is bad for them, their emotional attachment holds strongest.

The reality is that, as human beings, we cannot always rely on ourselves to act rationally. The real question then becomes, given who we are, how do we prevent ourselves from making these mistakes?

The solution is a systematic, rules-based investment approach. It’s like setting boundaries in a relationship. When emotions run high, in-the-moment decisions like heated words in an argument often lead to regret. It is therefore better to agree upfront on communication principles and stick to them. Likewise, systematic investing relies on predefined rules, data and consistent repeatable processes so decisions are made objectively, well-informed, timeously, and consistently, rather than by panic or overexcitement.

Such frameworks allow investors to incorporate large volumes of information, including market data and economic indicators, using robust models that help distinguish meaningful insight from noise, speculation, and headlines.

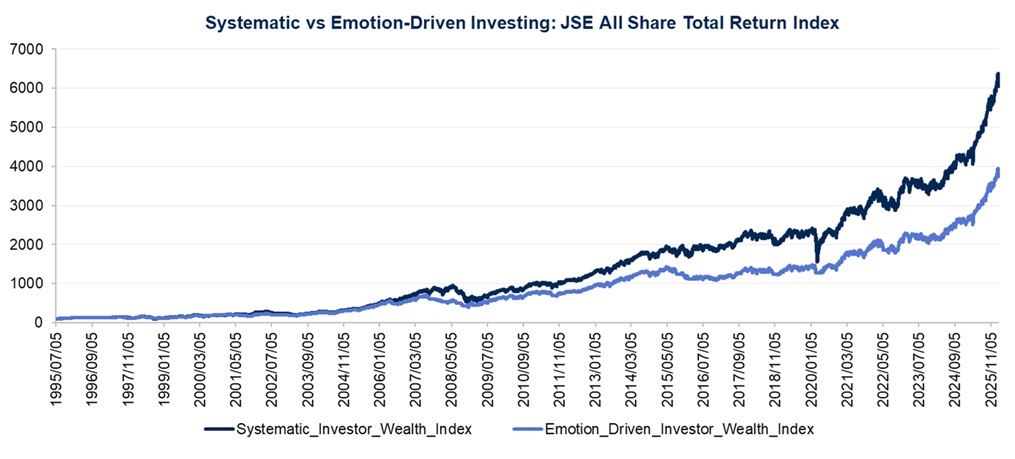

Sources: Prescient Investment Management, JSE (as at 09 Feb 2026)

The result is a portfolio that can be managed consistently across market cycles, at scale, and with far less exposure to the behavioural biases that often undermine long term outcomes as can be seen in the above chart.

So how can investors practically ensure they have a systematic approach when markets turn negative and emotions start to creep in?

1. Ensure the approach is truly systematic.

A single chart or signal does not constitute a system. A systematic approach draws on large amounts of data across different economic and market conditions, using robust mathematical and statistical models to process that information. These frameworks are designed to evaluate multiple factors simultaneously, filter out noise, and apply clearly defined rules consistently across different market environments, rather than relying on isolated indicators or discretionary judgement.

2. Introduce an objective layer into decision making.

Systematic investing often involves delegating decisions to an objective framework or independent party well before the downturns. Working with a trustworthy and independent financial entity that follows a rules-based strategy helps keep decisions aligned with long-term objectives rather than short-term market noise.

3. Design for consistency, not comfort, and commit to the process.

Systematic approaches are most valuable when they feel uncomfortable to follow. By defining evidence-based rules in advance and sticking to them during downturns, investors reduce the need to rely on intuition or confidence at precisely the wrong time. Trusting the process is what helps avoid costly emotional detours.

ENDS