John Anderson, Managing Executive at Sanlam Corporate: Investments

Now may be your moment to slay the ‘retirement’ dragon and claim your treasure.

Retirement fund members nearing retirement want one thing above all: income that lasts for life. Yet, the path has many obstacles – much like a dragon guarding your hard-earned treasure. With South Africa currently in a period of strong investment returns, this may be the moment to ‘slay’ that retirement dragon by opting for a guaranteed annuity.

Recent analysis shows that typical balanced portfolios – the mainstay for many pre- and post-retirement investors – have delivered performance well ahead of the cost of securing a guaranteed annuity. The bottom-line? This could be your time to ‘strike’.

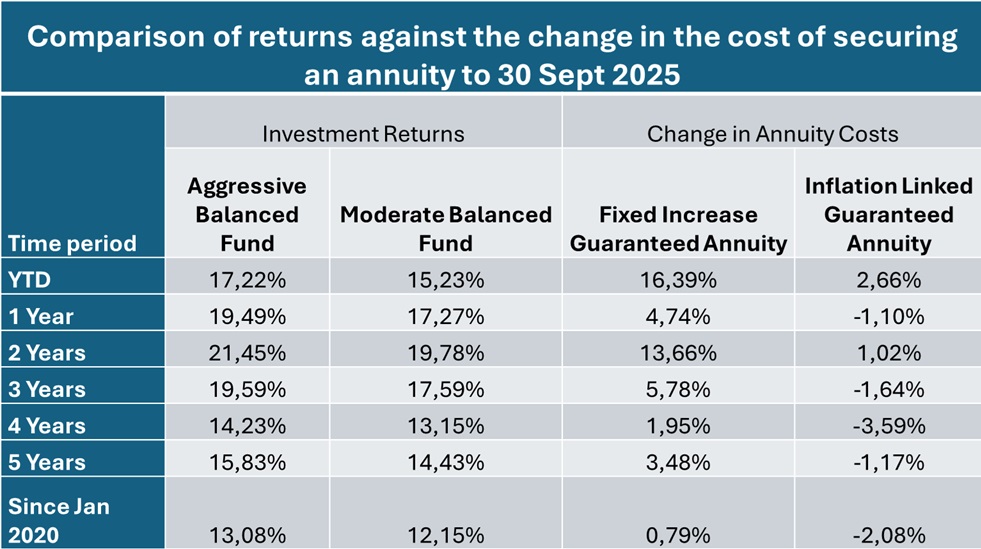

The table above illustrates that the cost of securing a guaranteed annuity (together with inflation over that period) has increased by 4.74% over the last year to 30 September 2025. Investment returns over this time were between 17.27% and 19.49% depending on whether you were invested in an aggressive or moderate balanced portfolio.

In 2023, when interest rates were higher, guaranteed annuity rates were extremely attractive, many advisors and individuals bought guaranteed annuities either at retirement or by switching their living annuities into guaranteed annuities. Although annuity rates have increased by 13.66% since, investment returns on retirement savings in an aggressive or moderate balanced portfolio have risen by 19.78% and 21.45%, respectively. Given the recent market run relative to the cost of securing an income, if you missed out and did not secure an annuity in 2023, now is as good a time to purchase an annuity!

This analysis shows that the general market view of purchasing a guaranteed annuity when interest rates are high is fundamentally flawed. Instead, one should look at how your retirement capital has increased relative to the cost of securing an income.

Our research shows that a blend of living and guaranteed life annuities usually offers a better balance of a lifetime income and flexibility. Strategically, your living annuity should have a sufficient blend between traditional asset classes (such as equities, bonds, cash), accompanied by a guaranteed annuity to provide an income for life.

Who should consider purchasing a Guaranteed Annuity?

1. Members approaching retirement

- Locking in income now provides certainty and protection against market downturns.

- Current annuity pricing offers better value per rand invested than in recent years.

2. Pensioners in living annuities

Our research shows that around 30% of living annuitants are drawing income at unsustainable levels. Another 30% of living annuitants are at risk of unsustainable drawdowns unless they proactively manage the various risks. For both groups, current market conditions provide an excellent opportunity to switch your living annuity into a guaranteed annuity to improve income sustainability and lifetime legacy.

Our modelling shows that for the average retiree, even a simple 50/50 split between a living and guaranteed annuity reduces the chance of running out of money from around 64% to just 2%. At the same time, this strategy reduces the chances of a negative legacy (i.e. where you owe your heirs a debt because of income support) from 48% to just 2%. This improvement in legacy is achieved by avoiding the catastrophic and very costly risk of depleting funds entirely at advanced ages.

A blended strategy can therefore improve long-term sustainability whilst at the same time improving legacy potential over a lifetime.

3. Risk-averse investors

- Guaranteed annuities offer peace of mind and predictable income: especially valuable in uncertain times.

- For those individuals still wanting to leave a legacy benefit behind for their heirs, guaranteed annuities can be purchased with a guaranteed term. This allows your heirs to receive an income for the remaining period or a lumpsum payment after you pass, within the guaranteed term.

It’s time to strike with a strategic shift toward income security

The decision to convert retirement capital into a guaranteed income stream has become more compelling than ever, providing a good opportunity to defeat the retirement income dragon. Based on current market levels and the fact that most retirees prefer peace of mind and income security, now is the time to reassess the role of guaranteed annuities in your retirement strategy.

ENDS