Nolwazi Hlophe, Senior Fintech Specialist at the FSCA

In today’s digital age, the pensions industry faces numerous security challenges, including the risk of fraud and cyberattacks. As pension funds manage vast amounts of sensitive data and financial assets, ensuring their security is paramount. Artificial Intelligence (AI) has emerged as a powerful tool in enhancing pension fund security and detecting fraudulent activities. This blog explores how AI is revolutionising the security landscape for pension funds in South Africa and includes case studies from various countries.

The Financial Sector Conduct Authority (FSCA) has emphasised the importance of cybersecurity and cyber resilience for financial institutions, issuing joint regulatory interventions with the Prudential Authority.

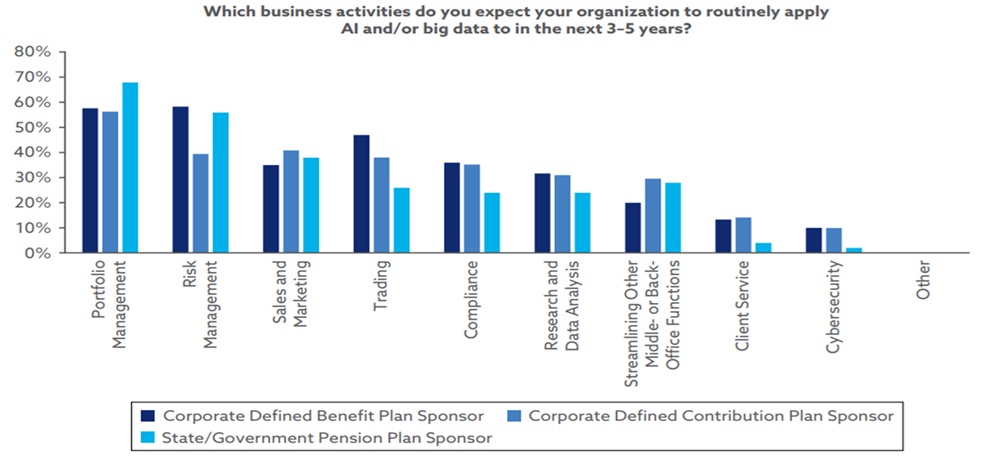

This June saw the implementation of Joint Standard 2 of 2024, which mandates the creation of a structured framework to address cyber risks, setting minimum security requirements and best-practice principles. Compliance is essential not only for regulatory purposes, but also to protect members from fraud, identity theft, and financial loss. Globally, cybersecurity in pensions is one of the focus areas for applying AI and/or big data (See Figure 1).

Figure 1: Pensions sector priorities

Understanding the security challenges in the pensions industry

Pension funds are attractive targets for cybercriminals due to the significant financial assets they hold and the sensitive personal information they manage[1]. Common security challenges include data breaches, where unauthorised access to sensitive data can lead to identity theft and financial loss. Pension funds are also vulnerable to various types of fraudulent activities, including phishing, account takeover, and insider threats[2]. Additionally, advanced cyber threats such as ransomware and malware can disrupt operations and compromise data integrity, posing significant risks to the security and stability of pension funds.

How AI enhances security measures

AI offers several advantages in enhancing security measures for pension funds. Here are some key ways in which AI contributes to improved security:

1. Real-time fraud detection

-

- AI algorithms can analyse vast amounts of data in real-time to identify suspicious patterns and anomalies. Machine learning models are trained to recognise indicators of fraud, such as unusual transaction behaviours or login attempts from unfamiliar locations.

- By continuously monitoring transactions and activities, AI systems can flag potential fraud before it causes significant damage, allowing for swift intervention.

2. Predictive analytics for risk management

-

- Predictive analytics powered by AI can forecast potential security threats based on historical data and emerging trends. This proactive approach enables pension funds to anticipate and mitigate risks before they materialise.

- AI-driven risk assessment models can evaluate the likelihood of fraud and cyberattacks, helping pension funds prioritise their security efforts and allocate resources effectively.

3. Enhanced cybersecurity measures

-

- AI enhances cybersecurity by automating threat detection and response. Machine learning algorithms can identify and neutralise malware, phishing attempts, and other cyber threats with greater accuracy and speed than traditional methods.

- AI-powered security systems can adapt to evolving threats, continuously learning from new data to improve their defenses.

4. Improved identity verification

-

- AI technologies such as biometric authentication and facial recognition can strengthen identity verification processes. These methods reduce the risk of unauthorised access and ensure that only legitimate users can interact with pension fund systems.

- AI can also detect anomalies in user behaviour, such as sudden changes in login patterns, which may indicate compromised accounts.

AI in action

Various countries have successfully integrated AI into their pension fund security frameworks, demonstrating its effectiveness in fraud detection and prevention:

- The Australian Prudential Regulation Authority (APRA), which oversees superannuation (pension) funds, emphasises robust operational risk management and resilience against scams, as outlined in its Prudential Standard CPS 230 Operational Risk Management. While not a specific “AI framework,” this standard implicitly encourages superannuation funds to deploy advanced technologies like AI to detect and prevent fraud, particularly concerning valuation accuracy and scam vulnerability. The Australian Securities and Investments Commission (ASIC) also maintains a focus on superannuation scam risks, with the industry itself adopting AI for tasks such as standardising valuation data for unlisted assets, thereby enhancing oversight and mitigating fraud risks.[3]

- Japan has embraced AI to enhance cybersecurity and mitigate risks in its pension systems. The Government Pension Investment Fund (GPIF) uses AI-driven predictive analytics to forecast potential cyber threats and improve identity verification processes. These AI tools have significantly strengthened the security framework, ensuring that only authorised users can access sensitive data and protect pension assets from cyber threats[4].

- United Kingdom: In the UK, The Pensions Regulator (TPR) and the Pension Scams Action Group (PSAG) have implemented AI-driven tools to combat pension fraud. These tools use machine learning algorithms to detect and remove fraudulent websites, significantly enhancing the security of pension funds. By analysing vast datasets, AI has enabled TPR and PSAG to identify high-risk sites and make referrals to partner agencies, thereby protecting pension savers from scams and cyber threats[5].

The future of AI in pension fund security

As AI technology continues to evolve, its role in enhancing pension fund security will become even more critical. Future advancements may include advanced anomaly detection, where AI systems will become more adept at identifying subtle anomalies and predicting complex fraud schemes. Additionally, integrating AI with blockchain technology can further enhance transparency and security in pension fund management. Automated compliance is another promising development, as AI can streamline regulatory compliance processes, ensuring pension funds adhere to security standards and regulations. These advancements will significantly bolster the security and integrity of pension funds, safeguarding them against emerging threats.

Conclusion

AI is transforming the pensions industry by providing robust security measures and effective fraud detection capabilities. By leveraging AI, pension funds can protect their assets, safeguard sensitive data, and ensure the financial well-being of retirees. As technology continues to advance, the integration of AI into security frameworks will be essential for maintaining trust and integrity in the pensions industry.

ENDS

[1] Knox, D., Pearce, G. and Shi, L. (2025). Chasing Brighter Futures: AI and Retirement Plans. Mercer. Available at: https://www.mercer.com/en-ch/insights/investments/market-outlook-and-trends/chasing-brighter-futures-ai-and-retirement-plans/ [Accessed 9 May 2025].

[2] Galloway, N. (2025). Cyber Resilience in Retirement Funds: Are We Ready for the New Era of Digital Threats? Prescient. Available at: https://www.prescient.co.za/news-and-resources/press-articles/cyber-resilience-in-retirement-funds-are-we-ready-for-the-new-era-of-digital-threats/ [Accessed 9 May 2025].

[3] McGarrity, C., Dixon, J. and Gallo, S. (2025) Superannuation funds must address scam vulnerabilities. Available at: https://www.bdo.com.au/en-au/insights/financial-services/superannuation-funds-must-address-scam-vulnerabilities (Accessed: 27 May 2025).

[4] Access Partnership (2023). Embracing AI and boosting cybersecurity in Japan with Google. Access Partnership. Available at: https://accesspartnership.com/embracing-ai-and-boosting-cybersecurity-in-japan-with-google/ [Accessed 9 May 2025].

[5] The Pensions Regulator (2025). Pension scam fighters stand united as artificial intelligence takes the fight to the fraudsters. The Pensions Regulator. Available at: https://www.thepensionsregulator.gov.uk/en/media-hub/press-releases/2025-press-releases/pension-scam-fighters-stand-united-as-artificial-intelligence-takes-the-fight-to-the-fraudsters [Accessed 9 May 2025].