Shaun le Roux, Fund Manager at PSG Asset Management

The JSE’s strong performance over the past five years has been at odds with general investor expectations

With much fanfare, the FTSE/JSE All Share Index (ALSI) reached the milestone of 100 000 index points in July. While the strong performance of the S&P 500 Index over the past five years (primarily driven by a narrowing group of tech giants amidst growing excitement around the impact of artificial intelligence (AI)) has received a lot of attention, surprisingly, the ALSI kept pace over this period. Both delivered around 16.5% p.a. in rands over five years to June 2025. These strong returns from the JSE have come despite headwinds. Persistent foreign selling and aggressive reallocation by local investors away from SA equities to global equities and domestic income securities amidst a stagnating SA economy, all contribute to the challenges.

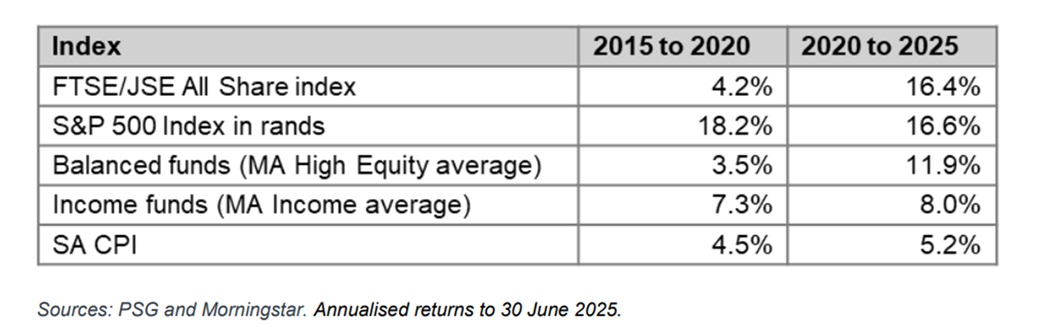

To illustrate, ASISA statistics show that the local equity unit trust sector saw outflows for each of the past five years while the global equity and income sectors received very strong net inflows over this period. Investors tend to extrapolate recent experience, hence domestic investors’ preference for offshore equities and domestic income funds over local equity funds is largely a result of the preceding poor returns from the JSE. Notably, domestic equity funds and even balanced funds failed to match inflation between 2015 and 2020. By contrast, foreign equities were very strong over the period, while income unit trusts, on average, generated real returns of almost 3%. In periods when equity returns fail to match those of income funds, we inevitably witness a switch from equities to income. Why take equity risk when a lower-risk asset class is generating attractive (and better) returns?

Five-year performance from 2015 to 2020 and 2020 to 2025

However, the most recent five years (2020 to 2025) have seen local equities significantly outperform income funds, despite income funds once again delivering attractive real returns. Additionally, global equities have continued to deliver despite high starting valuations as a result of robust profit growth over the period. Positioning suggests a strong ongoing client preference for global over locally listed equities indicating complacency about the sustainability of returns from global equities, following their extended exceptional performance. We notice that domestic investors remain relatively cautious in their domestic asset allocation, with a high allocation to fixed income. So, good recent real returns from fixed income have encouraged lower risk appetite in domestic asset classes.

Poor sentiment towards local equity funds is likely influenced by the negative headlines on the state of the local economy and local politics. Despite the formation of a government of national unity (GNU), the economy continues to stagnate, structural reform progress is glacial and political dysfunction widespread.

Yet, we think JSE-listed equities have an important and underappreciated role to play in growing capital for local investors, and investors and fund managers are likely not taking on enough risk. Probably more importantly, we think equity risk is being taken in the wrong areas, and this positioning means expectations are unlikely to be met over the next five to ten years. Why? There are six main reasons for suggesting that current assumptions about equity allocation need to be reconsidered:

1. A new era in global macro supports a change in the investment regime

Global debt levels are extremely high, yet fiscal deficits persist – especially in the US, UK and France. We think recent policy developments in the US point to a strategy of managing debt levels by generating high nominal growth while trying to keep borrowing costs anchored. At the same time, China and Germany are stimulating their economies and the vast majority of global central banks are in a rate-cutting cycle. We think the disinflationary cycle of the past four decades is well and truly behind us, and we should prepare for volatile but higher global inflation in future. We also see clear incentives for global investors to lighten their very heavy US exposure over the years ahead, with a cycle of dollar weakness likely to start. These factors all support a new investment regime that favours a weaker dollar, higher levels of nominal global growth and exposure to assets that do well in times of higher inflation – including emerging markets, commodities and value stocks. The JSE should broadly be a beneficiary of the new global investment regime.

2. The JSE is not the local economy

The JSE’s performance does not rely solely on the performance of the domestic economy, as the local equity market maintains a healthy exposure to commodity producers as well as rand hedge industrials, many of which are dual listed. These include BHP, Glencore, Anglo American, AngloGold, Prosus, Richemont, British American Tobacco, AB InBev and Bidcorp. We estimate that just 42% of the ALSI comprises stocks mainly focused on the domestic economy with the balance being rand hedges.

Domestic stocks (SA Inc) experienced a tough decade on average – ratings have declined and the economy has not been supportive. However, there have been some notable structural winners that have shrugged off the economic malaise and become sizable components of the market, including Capitec, Shoprite, Clicks, Discovery, Sanlam and Outsurance. Furthermore, SA Inc could surpass expectations, mainly due to the low expectations embedded in valuations, with these stocks generally trading at crisis valuation levels. We have often observed that returns are excellent when sentiment goes from terrible to bad, like it did locally in H2 of 2024. Also, the changing macro environment as described above has historically been supportive for commodity producers like SA and is associated with flows into emerging markets.

Illustrating how cheap SA Inc is, and the underpin from healthy dividend yields, Absa Bank currently trades on a PE ratio of 7 times and a dividend yield of 8.2%. The dividend alone compares favourably with the current yields from fixed income funds and, notably, the SA 10-year sovereign bond yields 9.6%, the lowest level in over three years. Despite a strong domestic bond rally over the last few months, domestic equities have not rerated. If SA Inc stocks manage to grow profits in real terms over the years ahead, expected returns should be excellent. For example, if Absa grows dividends by 8% p.a. over the next five years, shareholders can lock in 16.2% annual returns without any kind of rerating, matching the excellent market returns over the past five years.

3. In a commodity bull market, you don’t want to be underweight the SA index

Commodities are very influential in the economy and commodity stocks currently comprise 25% of the ALSI. Most investors have been bearish on commodities in recent years given the underperformance over much of the past decade – another reason why demand for SA equity funds has been lacklustre. PSG has a positive outlook on several commodities (including gold, PGMs, copper and coal), all of which are well represented in our market. And worth remembering is that, in previous bull markets, resource stocks comprised in excess of 50% of the ALSI (in the 1970s and early 2000s). In the event of a new commodity bull market (which we think is quite likely over the next five years given the low level of additions to commodity capacity over the past decade) it is reasonable to expect strong relative performance from the JSE.

4. There are very wide divergences in valuations in global stock markets and the JSE is particularly cheap

Empirical data shows that starting valuations have a material impact on subsequent returns – buying on a low valuation increases the odds of higher future long-term returns, and vice versa. The good news is that the JSE is unequivocally cheap. SA stocks are cheap within the emerging market (EM) universe and EMs are very cheap relative to developed markets (DMs). In contrast, the US has only been this expensive during times of extreme market exuberance, like 1999 and 1929. The divergence between the US and other markets, and between growth and value stocks, is on some measures the widest it has ever been. This is a good environment for stock pickers to generate good future returns, and the JSE looks like a particularly fertile ground for ideas.

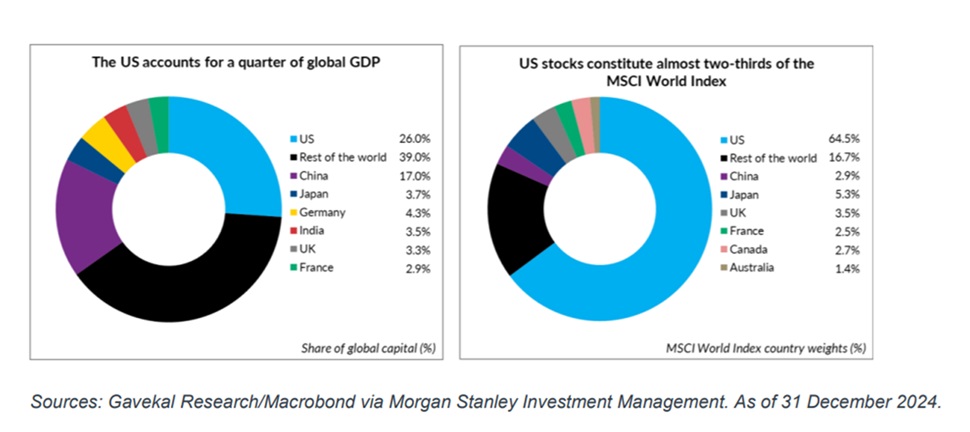

5. Extreme concentration makes market cap-based index investing a risky proposition

Equity markets have recently been characterised by extreme levels of concentration, notably with the increase in exposure to the US in global indices, and the increase in concentration within the US equity market. The US now represents two-thirds of the global market cap, significantly exceeding its economic share. And the US stock market has become extremely concentrated: the largest two stocks comprise 15% of the S&P 500 Index, the top ten 38% and the top 50 make up 76% of market value. This is due to various factors including US economic outperformance, the rise of passive investing, outperformance by larger growth stocks and the emergence of dominant global players in the technology arena (recently boosted by AI-hype). All these factors are cyclical in nature and, with concentration at dangerous levels, blindly investing in an index seems a risky proposition while allocating capital based on market capitalisation looks like a poor strategy. When capital starts to rotate away from the US and its mega caps, the impact could be pronounced if just a small slice of this found its way onto the JSE.

6. SA equities have produced 7% real returns over 125 years and in times of high inflation, equities are essential to grow capital in real terms

UBS’s analysis of 125-year returns across various markets shows that SA equities have compounded returns at on average 7% p.a. above inflation over more than a century, making it one of the best performing global stock markets. We see no reason that this feature of equities as an asset class should change. It is healthy to remind ourselves that equities produced these results despite world wars, apartheid, sanctions, political upheaval and many other challenges. Vital to enjoying this feature of the JSE is the investor’s ability to withstand shorter-term volatility and drawdowns. We view shorter-term equity market volatility as the cost of the ticket to superior long-run outcomes.

Real yields in SA are high, helping to protect fixed income investments from periodic spikes in inflation. And the SA Reserve Bank is attempting to anchor future inflation expectations to a 3% base. Accordingly, we have a favourable view on the opportunity in domestic fixed income securities including sovereign bonds and inflation-linkers. However, a long-term view of asset class performance reveals that fixed income battles to grow capital in real terms when inflation is sustainably elevated. A spike in domestic inflation is not our base case but it is worth remembering that SA is a small open economy where external supply shocks can result in currency weakness and inflationary pressure. So, if inflation were to become a problem in the future, history has shown that equities are the best way to grow capital in real terms. This is because equities have pricing power and are able to pass on higher prices to their customers.

We worry that domestic investors remain overly cautious in their allocation to domestic equity funds. They may be underappreciating the role of equities in uncertain and inflationary macro environments. Furthermore, the composition of our index favours superior future relative performance against both over owned US equities and domestic fixed income. Long-term investors should consider whether they are taking on enough equity risk, and taking on risk in the right geographies.

Yes, shorter-term volatility is to be expected, but we believe the long-run prize will more than compensate investors.

ENDS

Ed’s Note: This article was first published by Glacier Research, in their Funds on Friday edition of 5 September 2025