Alet Fick, Senior Multi-Asset Analyst at M&G Investments

Global markets appear to be in a seemingly happy place. Prices in several major equity markets are within touching distance of all-time highs, credit spreads are at or close to historic lows and most global currencies are stronger against the US dollar on a year-to-date basis. So, all should be well in the world, right?

Unfortunately, that’s not currently the case – we still sit with import tariff rates in the US at the highest level in almost a century, questions around central bank independence, government debt to GDP levels at the most elevated level in history and geopolitical conflicts that seem far from resolved. All these events create increased uncertainty in the world with considerable potential impact on asset prices.

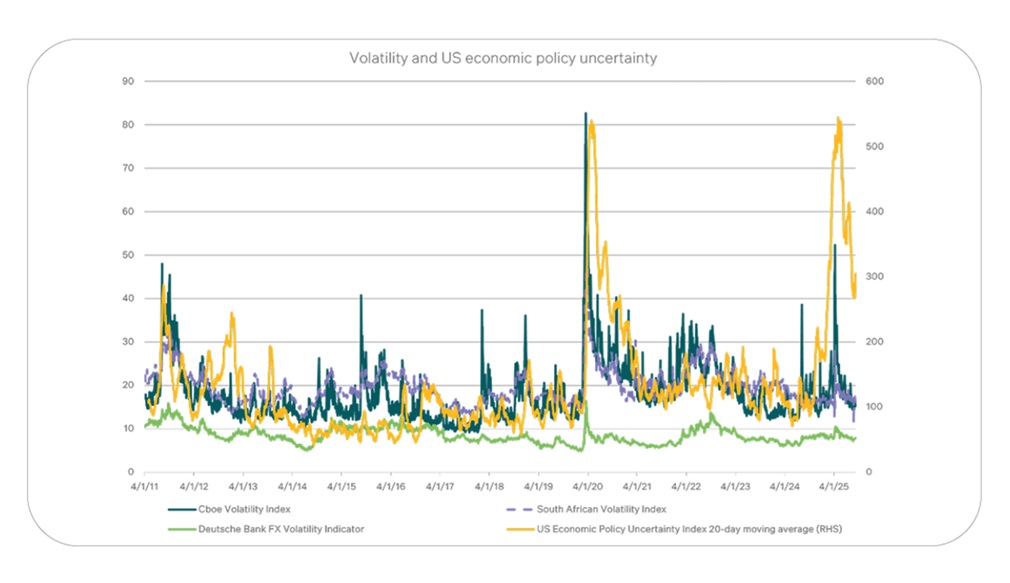

Some market indicators also suggest that all is not quite as robust as it seems. When looking at global bond yields in the developed world, countries such as the US, UK and some European markets have seen their bond yields rising gradually since the late 2022 global inflationary period, with yield curves steepening quite substantially in most regions, pointing to less confidence in the fiscal health of these economies. We have also witnessed the gold price rising significantly during the same period as market players look for safe haven assets away from US treasuries. In the US, the economic policy uncertainty index has pulled back from the highs after Liberation Day tariffs but remains at very high levels compared to history.

Volatility: Absent or just brief?

Historically, times like these would typically be reflected in sustained market volatility. This time, however, we have witnessed short-term sharp spikes of volatility in the market, with retracement happening very quickly and levels settling at very low levels after each move.

Current realised volatility in the US sits below 10% and even implied volatility, as measured by the VIX index, is trading around 15% compared to a 5-year average of around 20%. Similarly, in South Africa, implied volatility is sitting at the bottom of the range at around 15% currently. The same holds true for volatility in currency markets, where the local rand derivative market is trading at the lowest levels in at least 5 years.

This seems counterintuitive. We know there is a lot of uncertainty in the world, which could have big implications for global growth and inflation numbers, yet markets seem very complacent around the risks out there.

Local derivatives: A driver of low volatility?

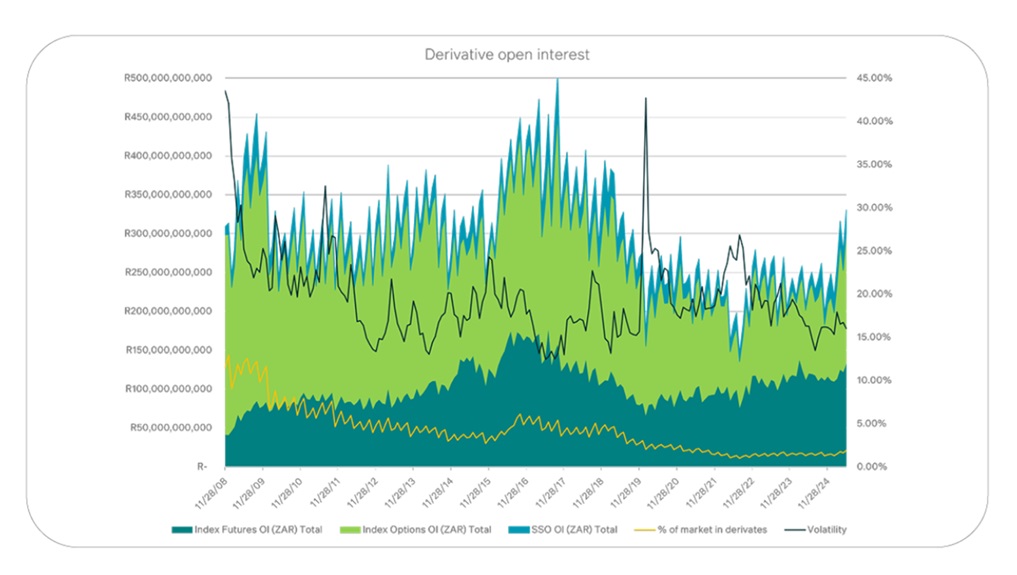

In the local South African market, this can be attributed to the decrease in volumes in our derivative market since the Global Financial Crisis. The market capitalisation for the All-Share index has grown by over 12% on an annualised basis since the end of 2008, yet the total open interest in the derivative market split across index futures, index options and single stock options is in fact down around 10% compared to 2008. Where derivative open interest used to be around 15% of the market, the level is currently sitting below 2% of market cap. The effect is that we see less volatility in the equity market, as there are fewer derivative positions in place to add to short-term and longer-term volatility compared to the past. Currently markets only react to events as they take place and then correct back to low levels very quickly, because the activity of the derivative market has become less pronounced in influencing price movements.

The US derivatives market: A different story

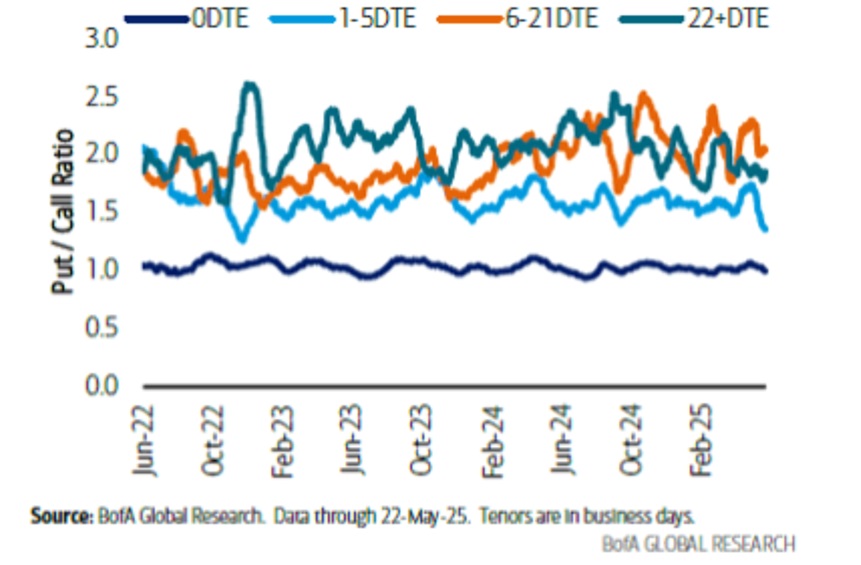

Comparing this phenomenon to the US shows us a different picture. The derivative market in the US is still very active, but what we have witnessed there is that the time to maturity for traded options has shorted significantly. Currently over half of the volume of options on the S&P500 is positioned in 0DTE (zero day to expiry) options. What’s surprising about these options is that the positioning for market players is actually very well balanced, which can be observed from the put/call ratio for the instruments trading consistently close to 1 (implying that the number of puts bought by participants are very close to the number of calls bought – for longer-dated expiry instruments this number tends to be higher). The outcome is that the impact of these instruments and the trading on the back of it is less extreme than one would expect, leading to smaller swings and fluctuations in volatility on the back of positioning.

Navigating the market waters

What are the implications of this? Either market participants are genuinely unbothered by the uncertainty lingering in the world at the moment, or the historical measures of uncertainty – such as volatility – no longer reflect the risks at hand due to changing market dynamics.

If it’s the former, we can all enjoy the positive price action seen so far this year and continue to ride the wave of record-high markets. If it’s the latter, the calm may simply be the prelude to a coming storm – one in which only a few opportunistic surfers would dare to venture into the waves while the rest watch cautiously from the safety of the shore.

ENDS