Justin Floor, Head of Equities at PSG Asset Management

Multi-asset funds are an integral part of the investment landscape, both globally and locally. At their core the proposition is simple. They offer a diversified portfolio of securities including asset classes such as equities, real estate, bonds, cash and, in some cases, also exposure to more niche areas such as private assets or commodities. Globally, these types of portfolios are often exemplified by the 60/40 portfolio (60% equities, 40% bonds). By delivering this as an integrated portfolio, multi-asset funds also offer the benefit that the asset allocation can be adjusted by the portfolio manager if required as conditions change. This can help to manage investor behaviour and avoid emotional decision making, which has been shown to have detrimental impacts on the outcomes investors ultimately achieve.

However, many multi-asset funds are managed using a rigid set of methodologies and assumptions. While these assumptions have served the investment community well for several years, it is less clear whether they are suited to a rapidly changing and evolving environment, that may not look similar to that of the past. Below, we highlight some of these assumptions and explain why they could hinder achieving optimal investor outcomes into the future.

1. Not taking enough risk for the objective

Human behaviour tends to overweight short-term pain over long-term gain. Therefore, it should not come as a surprise that many growth-oriented multi-asset funds have been run too conservatively, prizing lower volatility over positioning for returns.

Considering that these funds are often a key component of many investors’ retirement savings, the importance of achieving enough long-term growth should be clear. Longevity and inflation are in many cases the primary risks for most investors, and those with sufficient long-term horizons are well served to incorporate exposure to growth assets. Financial advisers add huge value to their clients by helping them to achieve their long-term goals. They do this by ensuring the client’s risk profile is aligned with their needs and time horizon, and that their assets are invested accordingly. Importantly, they also ensure that the fund selected remains well positioned to achieve the client’s goals over time.

2. Embedding outdated assumptions as part of the investment process holds dangers

Strategic asset allocation (SAA) models underpin the portfolio construction processes of many investment managers. These often inherently assume that the post-Global Financial Crisis (post-GFC) period from 2009 to 2019 provided the normal baseline for how markets and asset classes behave. This period coincided with dramatic globalisation, low and stable inflation, monetary policy dominance, very low interest rates and negative bond/equity correlations. Zooming out it becomes clear that this may have been an anomalous period.

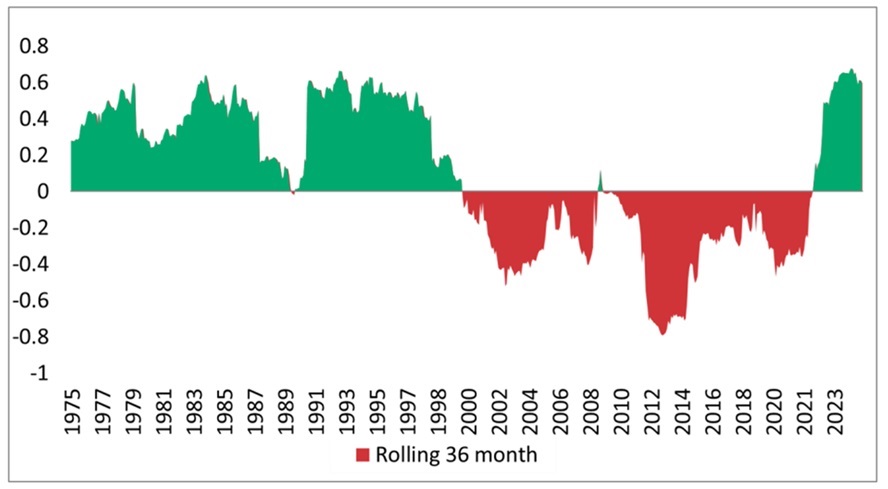

Today’s typical global 60/40 portfolio inherently assumes negative correlation between bonds and equities, and that the inevitable zigs in one asset class will be offset by zags in the other. However, historically this is only the case when inflation is stable and under control. Recently, bonds and equities have become much more correlated, with long duration bonds potentially amplifying equity risk instead of mitigating it. 2022 provides a key example of this risk amplification. Interestingly the 2022 and more recent performance correlation is consistent with the longer-term history, with the 2000 to 2019 period being the anomaly. We think bonds should be owned for their income and return credentials (in line with fundamental and economic risks), rather than for their portfolio hedging characteristics. Increasingly, investors need to look to alternatives that can fulfil the role of a portfolio diversifier: select commodities (especially gold), inflation-linked bonds and areas such as infrastructure, special situation equities and cash, can all play an important role in the future.

Rolling 36-month correlation between S&P 500 and US bond total returns

Sources: PSG Asset Management and Bloomberg

The reliance on data from the GFC period goes deeper than only the correlation between equities and bonds. Typically, the SAA process overlays its assumptions of long-term asset class returns and correlations with some optimisation technique, designed to inform a strategic mix of assets that can deliver on the fund’s long[1]term targeted outcomes (with smaller tactical asset allocation tilts to exploit market opportunities). These techniques embed and extrapolate historical asset class returns and correlations. Therefore, any large structural breaks in historic correlations and returns expectations (for example at market cycle extremes or inflections) could potentially leave investors unable to achieve their long-term goals.

3. Assuming that volatility is the same as risk

Many investors equate risk with volatility. This is understandable, as volatility is easy to calculate and elegant to manipulate into a variety of financial and statistical models. While sometimes helpful, an overemphasis of this approach has a number of shortcomings. Some of these include the fact that volatility is based on historical data and therefore is not always a reliable guide for the future (put differently: realised volatility can vary over time). Additionally, it does not distinguish between ‘good’ upside volatility and ‘bad’ downside volatility. Lastly, it is often used in models relying on normal distribution of returns, while the academic research (and this practitioner’s experience!) has clearly shown that the normal distribution is a poor proxy for the real-world distribution of outcomes.

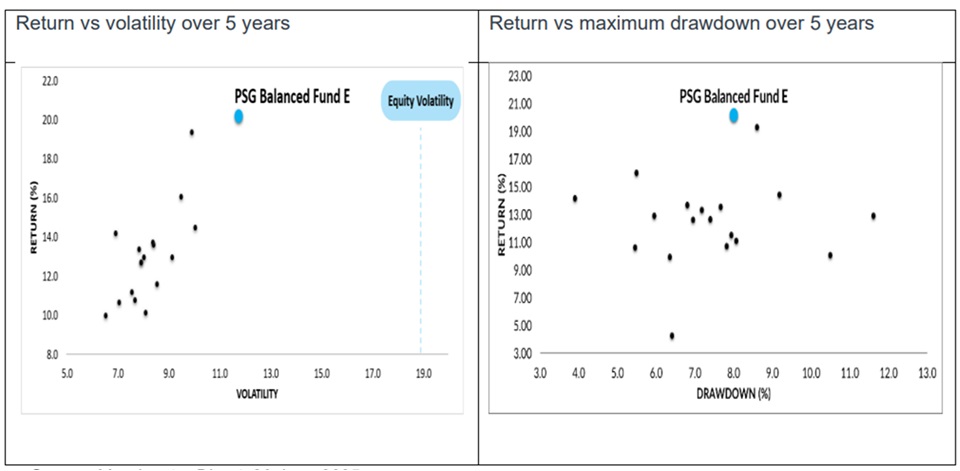

Consequently, at PSG we prefer to focus on more meaningful risk measures such as portfolio drawdown and time taken to recover. Focusing on maximum drawdown is a sensible alternative risk measure, in our view, given that it is the larger actual losses that inflict pain on investors. By focusing on risk managing overall losses, rather than on managing short-term volatility in the fund, we believe we are able to deliver better long-term returns for our clients at appropriate levels of risk. To understand why, let’s focus on the two graphs below, which show the PSG Balanced Fund relative to a number of other funds. Despite relatively higher volatility than peers (albeit still far lower than the equity market), the representation of pain (proxied here by the drawdown) has been very much in line with competitor funds.

Analysis of PSG Balanced Fund using different risk measures

Source: Morningstar Direct, 30 June 2025

Ensure your fund is able to meet challenges head on In 2025, it is becoming clearer that the future is likely to look very different and more chaotic than the relative calm of the preceding decades, which often anchor our expectations for investment outcomes and asset class behaviour. While the past can provide clues, there is no certainty about the future, and navigating an evolving and unpredictable environment successfully requires some humility, and an open mind. In this context there is an opportunity to challenge some widely-held assumptions that often underpin multi-asset portfolios and investment choices. Appreciating when these heuristics and techniques can be helpful and when they can be hazardous will increasingly be the difference between meeting investment goals or falling short of them.

ENDS