Annalise De Meillon Muller, Head of Technical Support and Palesa Mokoena, Technical Support Specialist for Glacier by Sanlam

1 September 2025 marks one year since the Two-Pot Retirement System came into effect. This regulatory reform, which has reshaped the retirement fund landscape, was implemented to balance the required long-term preservation of retirement benefits with the emergency short-term financial needs of retirement fund members.

Under the Two-Pot Retirement System, contributions to a retirement fund are now split, with one-third going into a savings component that can be accessed once per tax year and the remaining two-thirds going into a retirement component that will be preserved and used to purchase a compulsory annuity at retirement.

Increased retirement fund withdrawals

At the end of January 2025, the South African Revenue Services (SARS) reported that over 2.4 million valid Two-Pot withdrawal tax directives had been approved, with gross funds totalling R43.4 billion having been paid out since 1 September 2024. More recently, in June, SARS Commissioner Edward Kieswetter further communicated that Two-Pot withdrawals had increased to R57 billion.

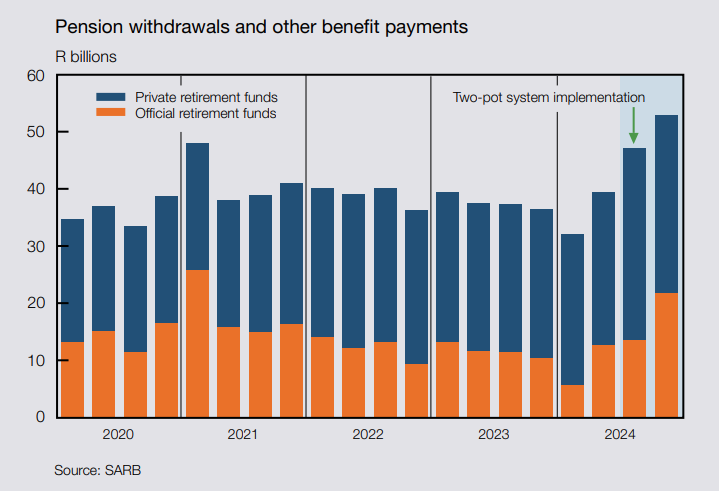

The impact of the Two-Pot withdrawals on the total number of retirement fund withdrawals can be seen in the South African Reserve Bank’s (SARB) June 2025 Quarterly Bulletin. The statistics show a 19.4% increase in total withdrawals across the retirement fund industry from the second quarter of 2024 to the third quarter of 2024 when the Two-Pot legislation came into effect, followed by a further 12.5% increase in the fourth quarter of 2024.

Fake news: the biggest challenge

Some of these withdrawals prior to 1 September 2024, can be pinned on the fear factor in anticipation of the implementation last year. Prior to 1 September many rumours (based on misinformation causing confusion) alleged that fund members’ savings were being confiscated in some manner on the implementation date. People believed that all their previous rights to access were being taken away. These rumours became urban legends that led to an influx of withdrawals in general. This accounts for the increase between quarters one and two and certainly for some of the increase between quarters two and three.

The rest post 1 September 2024 should be a combination of the norm of previous years and the actual savings withdrawal benefits (SWB) from the savings component, that became available when Two-Pot was implemented. Some people believed that if they do not take the SWB of R30 000 (the maximum for any given fund member), they would forfeit access to the new savings component permanently.

In the SARB picture above, private retirement funds are those that are registered, regulated and supervised in terms of the Pension Funds Act whilst official retirement funds are mostly public sector funds such as the Government Employees Pension Fund, amongst others.

Repeat withdrawals

Although the Glacier retirement funds only received 3 178 Two-Pot withdrawal requests in the last year, equalling R63 256 061.25 in value, other fund administrators experienced larger volumes.

A trend that was reported amongst retirement fund administrators in the new tax year, starting on 1 March 2025, was the number of retirement fund members who took a second withdrawal from their emergency savings components.

In May 2025, Natasha Huggett-Henchie, consulting actuary and member of the Actuarial Society of South Africa (ASSA) Retirement Matters Committee, noted that about 75% of Two-Pot withdrawal applications received by the administrators represented on the committee in March and April 2025 were received from members who had already taken a withdrawal in the previous tax year. At the Sanlam Benchmark event in June 2025, Edward Kieswetter, Commissioner of SARS, said that 478 000 of the 4 million withdrawals since 1 September 2024, were repeat withdrawals. This means that just under 25% of fund members took a withdrawal from their savings component before 1 March 2025 and again another one after 1 March 2025.

This raises concerns, as the savings component should only be accessed in emergency cases. Taking annual withdrawals from the savings component reduces the members’ savings available at retirement. It also holds the danger that these members will not have any funds to access when unforeseen emergencies occur in the future.

Boost in tax revenue and tax debt collections

The withdrawals from the savings component are taxed at the member’s marginal tax rate. The marginal tax rate is the percentage of tax applied to your income for each tax bracket in which you qualify. This tax is withheld by the retirement fund and paid over to SARS. In the first six months of implementation, the Two-Pot withdrawals from retirement funds led to an additional R12.9 billion in tax revenue being raised by the end of the fiscal year (March 2025), which far exceeded SARS’ original projections and alone boosted the growth in personal income tax (PIT) collections by two percentage points. In June this year, SARS communicated that the tax revenue from two-pot withdrawals had grown to around R15 billion.

Along with tax collections, the two-pot retirement system also enabled SARS to recover R1 billion in outstanding tax debt via stop orders (IT88L) that were automatically deducted before any two-pot withdrawals were paid out.

Where did the money go?

Despite the increased liquidity to households from the Two-Pot withdrawals, household consumption expenditure and disposable income were relatively muted, with year-on-year increases of only 5.4% and 4.6% respectively, in between the third and fourth quarters of 2024. This indicates, as supported by a study completed by the Bureau of Market Research (BMR) Personal Finance Research Division, that in addition to funding living expenses, members also used the money from their Two-Pot withdrawals for:

1. One-time debt settlement

A decline in overdue debt balances for clothing retail accounts, cellular phone contracts and education loans was observed in September 2024, whilst overdue debt balances for general retail and furniture store accounts declined in October 2024. The overdue balances for cellular phone contracts and education loans that initially declined in September 2024 later rose again.

2. Acquiring assets

Even though the lower interest rates would have also played a role, a surge in used car sales was observed from September to December, with October 2024 marking the highest monthly registration figures since 2012.

The BMR analysis of bank deposits also indicated that there were no significant changes in historical savings trends, suggesting that the proceeds from two-pot withdrawals were not primarily allocated to household savings.

These numbers and deductions are a sad truth, for a moment we thought the drop in overdue retail debt might just be a silver lining for credit behaviour but alas, we pivoted back to extreme indebted consumerism.

Continued need for financial education and guidance

Although the 2025 Sanlam Benchmark Survey showed improved awareness of the Two-Pot Retirement System among consumers surveyed (59% in 2024 to 92% in 2025), the findings also highlighted that many members still express concern and confusion. We also should not forget that the months before implementation highlighted how little fund members understood of the previous big retirement reform i.e. annuitisation in 2021, despite having three years to come to grips with it.

Furthermore, despite 77% of consumers indicating that they understood the tax implications of the Two-pot withdrawals and a large number of these consumers reporting additional income streams and additional savings, 36% of these consumers confirmed that they had made a two-pot withdrawal and a further 12% confirmed that they might have if they were eligible or had sufficient savings.

The Two-Pot Retirement System offers retirement fund members more flexibility and options. However, without any safeguards from permissible access to the savings component, members will require adequate financial education and guidance to navigate the complex long-term consequences and tax implications of their options. Members are encouraged to engage with a financial intermediary for personalised advice that will take their specific circumstances and concerns into account, and help them to make informed, confident decisions regarding their retirement planning.

ENDS