Marcus Rautenbach, Principal Investment Consultant at Simeka

The economy

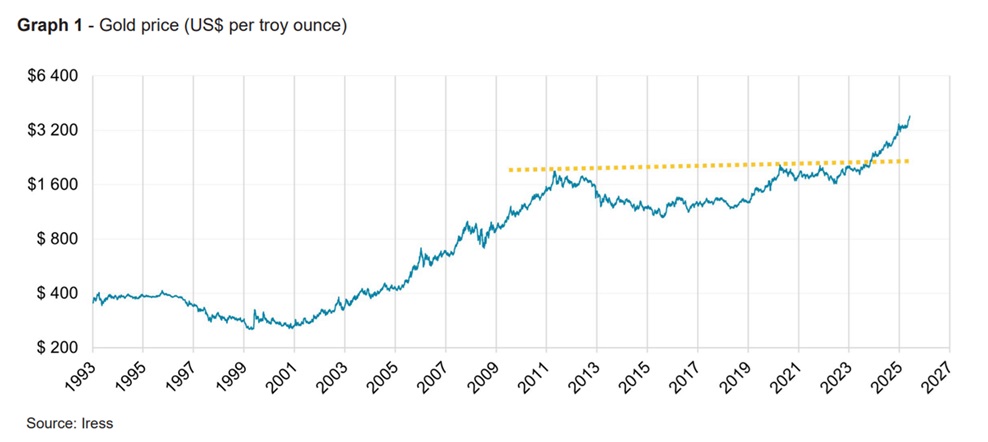

Developments in the economy and financial markets were mostly positive in Q3 2025. The prices of precious metals increased (gold, as illustrated in graph 1, silver and platinum) while shares and domestic bonds posted strong returns, and the rand strengthened to R17.27 against the US dollar.

After contracting by 0.6% in Q1 2025, the US posted better than expected growth of 3.8% in Q2 2025. Inflation increased moderately in Q3 2025, and the US Federal Reserve cut the federal funds rate by 0.25% in September 2025. Events in the political and social environment in the US are more animated than usual, but financial markets are largely unaffected.

China’s growth for Q2 2025 was better than expected at 1.1% and India’s economy expanded by 1.7% for the quarter. Growth in the Euro area was more modest at 0.1% over this period, despite a 0.5% contraction in Germany.

Domestic economic growth for Q2 2025 (released on 9 September 2025) was better than anticipated at 0.8% (quarter on quarter). Real GDP measured by production showed that the mining industry grew 3.7%, manufacturing increased by 1.8% and trading activities improved by 1.7%. The transport industry (including telecommunications) decreased by 0.8%. Measured by expenditure, household consumption improved by 0.8%, contributing 0.6% of the 0.8% overall growth for the quarter. Gross fixed capital formation remained negative at -1.4 for the quarter.

The Reserve Bank’s Monetary Policy Committee cut the repurchase rate by 0.25% in July 2025 but kept it stable at its meeting in September 2025. Inflation increased to 3.5% in July before softening to 3.3% in August 2025.

Unemployment remains the most serious challenge facing our economy. For Q2 2025, the unemployment rate was 33.2% rising to 41.3% when including discouraged job seekers. The number of unemployed persons and discouraged job seekers came to 11.812 million people for Q2 2025, compared to 11.578 million people at the same point in 2024 and 11.103 million people for Q2 2023.

The US 30% reciprocal tariff on imports from South Africa became effective on 7 August 2025. The reciprocal tariff overrides the universal tariff of 10% that was implemented on 5 April 2025. Section 232 tariffs are levied on motor vehicles and automotive products (25%) and steel, aluminium and derivates (50%). The African Growth and Opportunity Act of 2002 (AGOA) was up for renewal by the US Congress on 30 September 2025 – no progress yet.

Financial markets

Investors have benefited from strong investment returns thus far in 2025.

Offshore shares produced attractive returns when measured in US dollar terms. Share prices increased by 18.9% for the nine months to September 2025, as measured by the MSCI All Country World Index. In rands, the return is 9.0% year to date (YTD). For the calendar year to September 2025, the S&P 500 Composite is up 13.7% in US dollars and 4.2% in rands. “Magnificent 7” stock prices mostly continued to perform well for the nine months to September 2025: NVIDIA is up 39.0% YTD, Alphabet (Google) 28.3% YTD, Meta Platforms (Facebook, Instagram, WhatsApp) 25.7% YTD, and Microsoft 23.6% YTD. Tesla is up 10.1% YTD, but Apple is up only 2% YTD while Amazon is at 0% YTD.

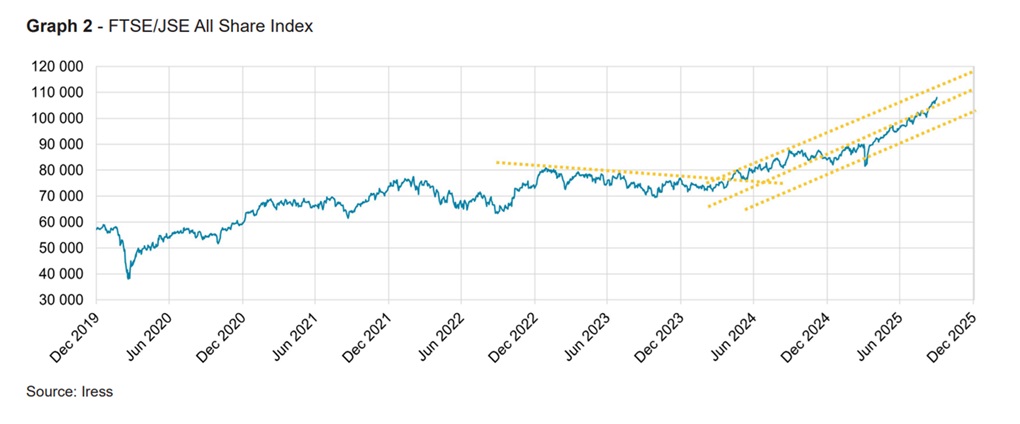

The FTSE/JSE All Share Index TR increased by 23.6% for the calendar year to September 2025 (graph 2), the FTSE/JSE All Bond Index posted a return of 14.0% and listed property improved by 12.3% over this period. The rand strengthened by 9.1% and the contribution made in rand terms by offshore shares, for the calendar year to date, is 9.0% while offshore bonds contributed -1.2%. The value added to a representative Regulation 28 compliant composite index for the calendar year to September 2025 is 17.6%.

A review of investable domestic shares shows that it is mostly gold, platinum, telecom and selected large industrial shares that have performed well in 2025. Banks, insurance companies and retailers posted indifferent or disappointing results. Sector as well as security selection has played a key role in investment results for 2025 up to now. The results produced by fund managers who did not include enough exposure to gold and platinum shares in their portfolios were average, while those with enough exposure to gold and platinum shares produced more exciting results.

The top performing domestic investable shares (shares with a market capitalisation of more than R30 billion) are Sibanye Stillwater (+229% YTD), Gold Fields (+195.1% YTD), DRD Gold (191.2% YTD), Northam Platinum (+188.5% YTD) and AngloGold Ashanti (+188.2% YTD). Naspers and Prosus share prices are up 49.9% YTD and 57.6% YTD respectively (Tencent is up 59.0% YTD in Hong Kong). The worst performing shares are The Foschini Group (-35.1% YTD), Mr Price (-31.9% YTD) and Nedbank Group (-24.2% YTD).

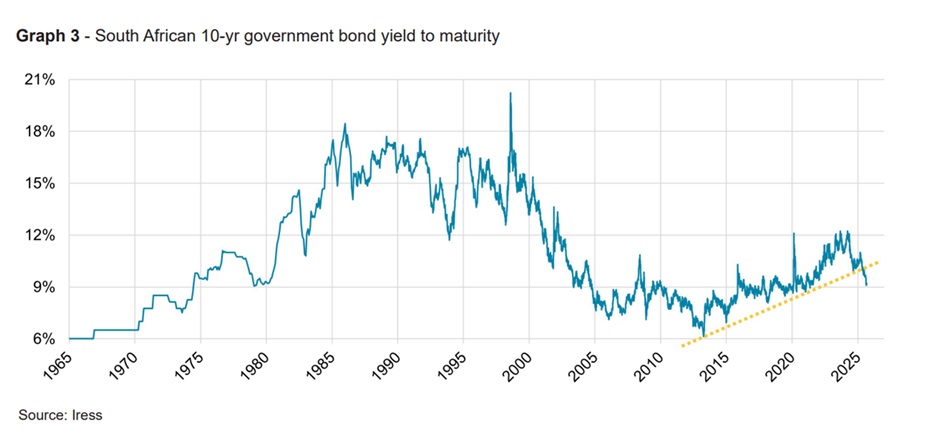

The domestic bond market posted pleasing returns. The 10-year South African bond yield to maturity closed the quarter at 9.20% (graph 3). Bonds in the 7- to 12-year maturity bucket achieved the best returns (+16.2% YTD). Non-resident investors, while still reducing exposure to South African shares, are increasing exposure to South African bonds. This forms part of a larger global risk-on investment strategy to enhance the yields earned by these investors.

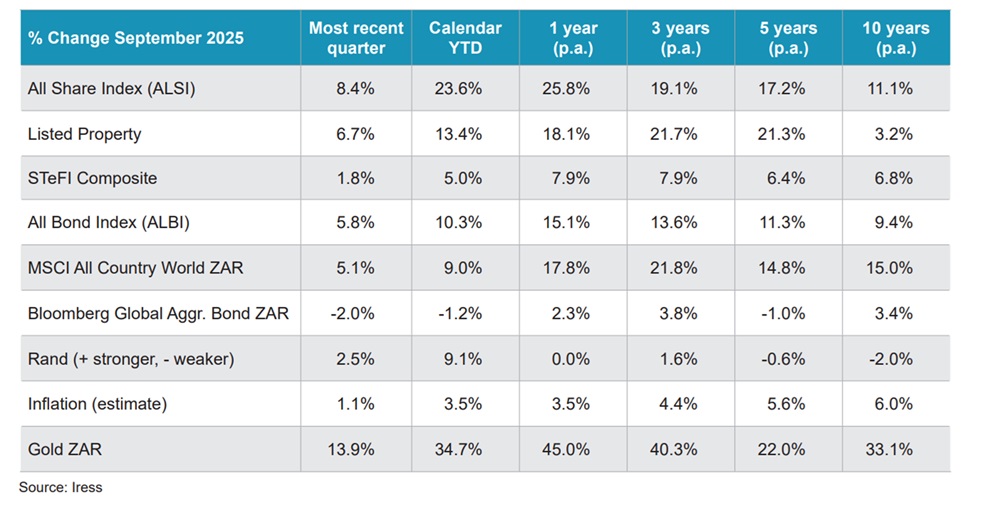

The table below shows the investment returns for the large asset classes available to South African investors and the values for the rand, inflation and the rand gold price.

The results produced by financial markets are mostly pleasing and this trend could continue in the near future.

ENDS